Acasti Pharmaceuticals – market begins to wake up to the explosive upside on offer should CaPre Phase 3 trials prove successful

By Richard Jennings

It has been a slow burn for followers of us into Nasdaq listed Acasti Pharmaceuticals (ACST) as per our original article per HERE but we believe that the stock is now primed to move decisively ahead as the company moves up the most important stage of the pharma sector“value proving” curve – completion of the make or break Phase 3 trialling of their key CaPre product.

Acasti Pharma is one of just a few companies pioneering a less controversial and hopefully less harmful approach to the treatment of severe hypertriglyceridemia (“HTG”) relative to statins through the use of super concentrated Omega 3 fatty acids derived from the oil of deep ocean krill crustaceans. In effect, Cap Pre (Acasti’s product) looks to lower the harmful production of high cholesterol by a patients liver.

We have a cracking track record in the US deep value pharma sector as evidenced HERE with our calling the bottom – literally to the day – in Endo Pharma, TEVA & Valeant. We believe, as we will reiterate below, that the upside on offer here will dwarf the returns seen from following this last call of ours on the 3 generic drug stocks.

There has been a lot of damning commentary from various medical bodies in recent years with regards to the side effects of statins and should CaPre even take a sliver of this market which is worth near $20bn (see HERE) the upside for ACST could be explosive given the current market cap of just $47.3m, in particular when set against an estimated current cash position of circa $20m (based on publicly disclosed information).

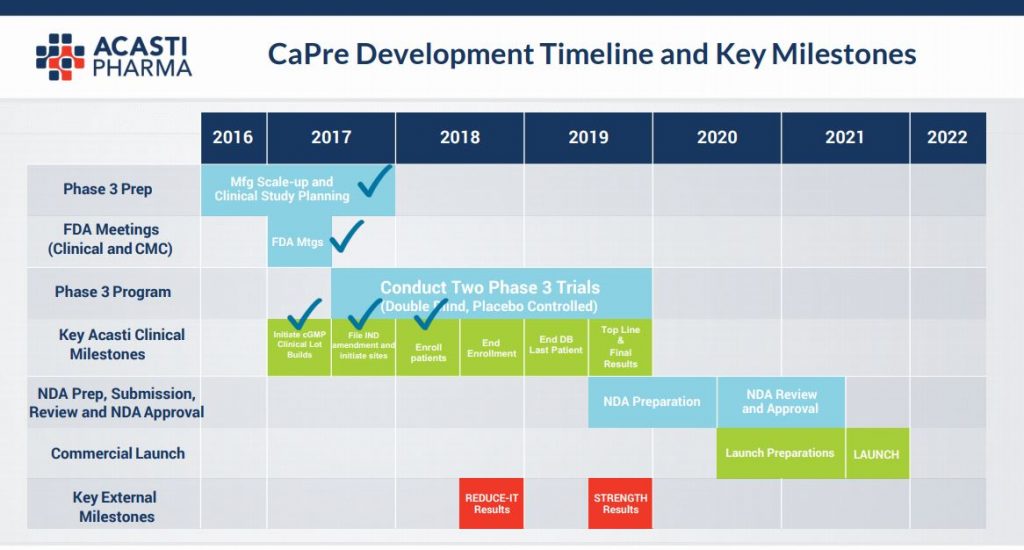

Below is the company’s stated clinical trials key milestone dates:-

You can see that we are now at the closing stages of the key Phase (3) trialling – the last hurdle in the US for FDA approval to bring a product to market and, when taken with the key comment from CEO Jan D’Alvise per below (our highlights) on the 18th Sep this year, together with the appointment of Jean-Francois Bolly as VP of Finance (& who comes with an exemplary pedigree in the pharma industry), this seems to have catalysed renewed interest in the stock in the last couple of weeks and on strong volume:-

“Our two TRILOGY Phase 3 studies remain on track to complete enrollment this year. Importantly, as of August 10, 2018 we have reached almost 60% enrollment, with 770 patients enrolled, and 110 patients randomized at 126 clinical sites across the U.S., Canada, and Mexico. We continue to project that we will complete these studies on schedule in mid-2019, and expect to report topline results before the end of 2019.”

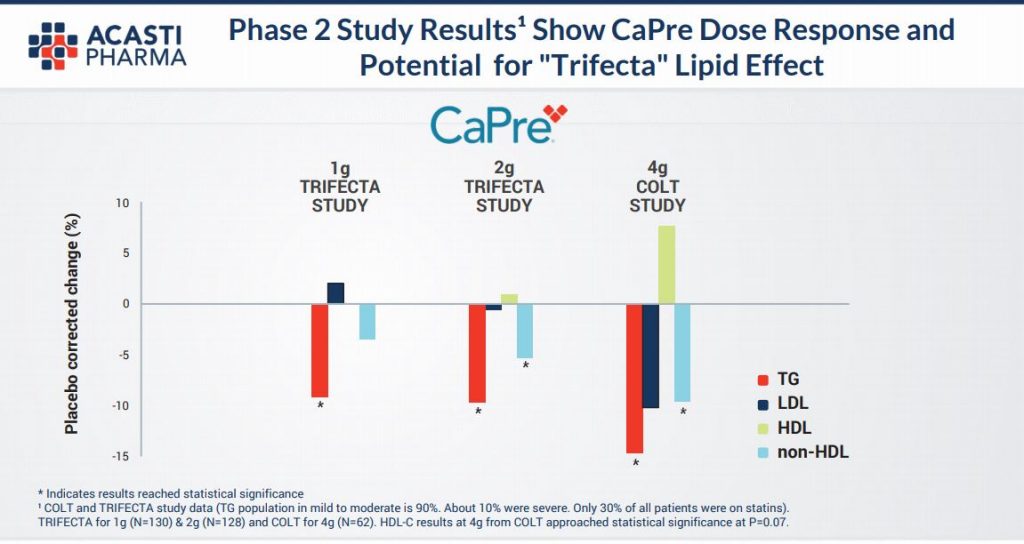

Seasoned investors in the pharma industry will know that it is precisely at this point in a drug’s development journey that excitement can build with regards to hoped for results from Phase 3 trials. As the diagram above illustrates, in approx only a year the results will be know and if the pre clinical trials are anything to go by then the efficacy of the product (as illustrated in the diagram below) is likely to be firmed up & we are highly optimistic in regards to the likely end data points and ultimate commercialisation. This slide below relays that at all gram dosages there is a material reduction in harmful Triglycerides and a non deleterious effect on so called “good” cholesterol – HDL.

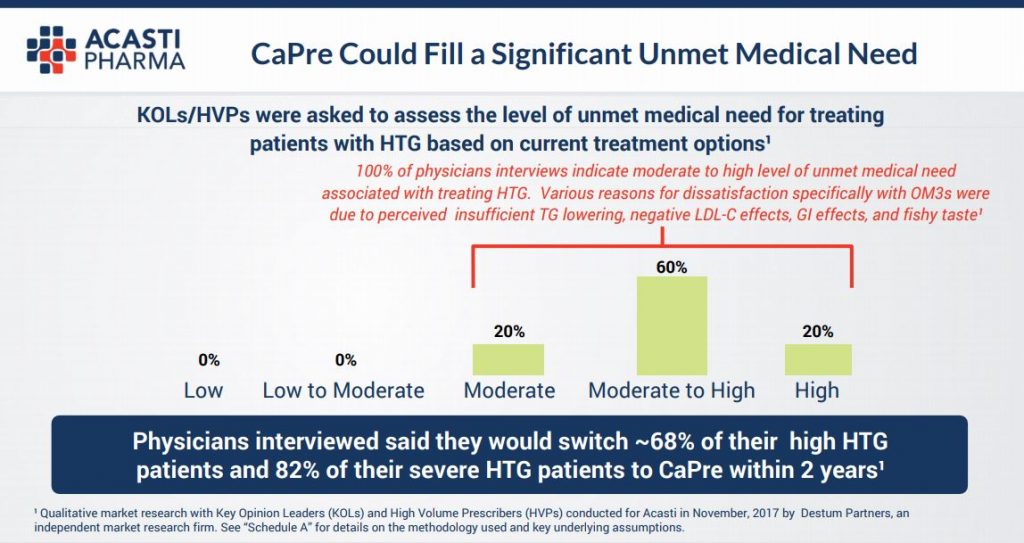

We also highlight they key slide to us from the company’s own presentation this month to investors and industry participants (see HERE for full presentation).

What this tells us is that for sufferers of High Triglycerides (HTG) there is a significant current unmet need for a product that actually lowers these materially and that, from a US physician’s perspective, a very large majority of these would prescribe CaPre. In effect a ready made and willing market place is now waiting.

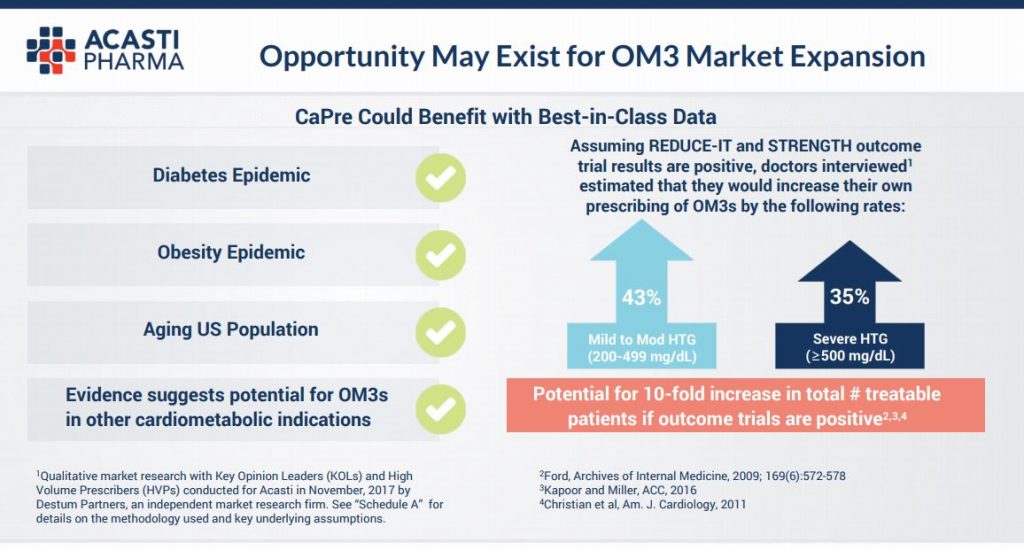

The story does not end here for investors in Acasti though. See the slide below from the same presentation. You can see that the company believes there to be a 10 fold increase in potentially treatable patients for a variety of other entrenched health markets including the diabetes and obesity epidemics. Should Acasti penetrate these markets, the upside for stockholders is truly “blue sky”.

Notwithstanding the current robust cash reserves there is the potential for perhaps one more capital raise as we see it before the Phase 3 results are completed but we believe this will not be as damaging to the stock price as previous ones for the following reasons. Firstly, there are a number of warrants outstanding that are now “in the money” and so the requirement to carry out a large placing of stock at a discount is much reduced. Secondly, as we move into 2019 and expectations and investor speculation likely builds with regards to the trial results, the market cap will, we believe, increase and so the dilutory element to existing shareholders be much diminished. Indeed, we will probably add to our position in the event of a raising if the market cap remains sub $100m.

Our position in Acasti Pharma is one of the largest in our portfolio such is our conviction in the upside on offer at these levels and we have short term target price of $2.50 which would put the company on a market cap of still only $100m and at this level probably begin to attract some institutional interest Stateside.

The bigger stock prize of course is post the Phase 3 trial results. If these are decisive in terms of the efficacy of CaPre we believe that it is almost inconceivable that the company would not be bought out by one of the larger pharma players with statin products as a defrayment exercise of potentially lost sales. Even if this is not the case then Acasti will be in an exceptionally strong position to enter into licensing deals given the robust patent portfolio they have been putting in place in regards to CaPre. One fund manager is on record in stating that they believe the company could attract a price of upto 1 billion dollars (see HERE). This is not outlandish to us and we remind readers that the stock was, at its peak 5 years ago valued at $42 – in fact at circa $1bn – when the company had not even come through Phase 2 trials – a pertinent example of just how “the market” can meaningfully misprice companies. Clearly the $1bn value 5 years ago was wrong but we believe the current sub $50m is equally wrong on the other side of the value spectrum. Accordingly, at the current stock price of $1.29c we believe the upside to be between 10-20 times the present price on an 18-24 months timescale should CaPre come through Phase 3 trials successfully. Buy.

RISK WARNING & DISCLAIMER

A director of Align Research own shares in Acasti Pharma. Full details of our Company & Personal Account Dealing Policy can be found on our website http://www.alignresearch.co.uk/legal/

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.