Endo Pharmaceuticals Flash Buy Call @ $5.88c – Fundamental value disconnect

By Richard Jennings

Another one of what we view as an asymmetric risk/reward opportunity has presented itself in the form of Irish and US based generic pharma play Endo Pharmaceuticals. It is fair to say that in recent weeks shareholders in this company and indeed the wider US pharma arena have experienced a world of pain. What with the Trump administration’s continued rhetoric over the price of drugs in the States and the debt restructuring of Canadian drug company Concordia together with the news that e-retailing behemoth Amazon is looking to make a move into the pharmacy dispensing industry, these stories have veritably put the cat amongst the pigeons causing investors to sell first and ask questions later.

The chart below of Endo illustrates just what a haircut the equity has taken during the last 3 months. Indeed, from a chart perspective the stock is about as oversold as it has ever been. Consider that this has occurred in the face of the wider US stock market continuing to probe new highs and it is clear just how decimated sentiment is. A final observation in the chart below is the volume in the stock this last week – very heavy, particularly yesterday when the stock collapsed over 10% on frankly no real catalyst. This type of action is usual evidence of a final capitulation washout event. Even the most bearish analyst Goldman Sachs has a price target that is in excess of the current stock price (target $7).

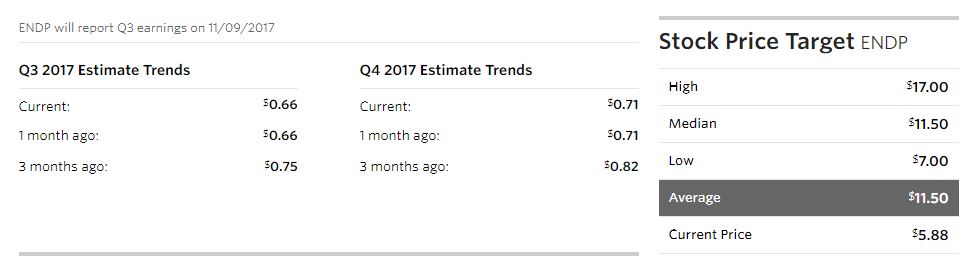

Below are tables reflecting both the consensus stance by Wall Street firms on the stock together with the pro forma EPS forecasts for the next two quarters and the consensus analyst price targets of which $11.50 is the median. The preponderance of Hold recommendations is in fact symptomatic of many analysts being afraid to go out on a limb and make a call either way. The fundamentals certainly warrant a meaningfully higher stock price yet the price action sows doubt into one’s mind such that safety in the herd becomes the preferred position. This type of groupthink presents opportunity.

At Align we are different. We look for these situations: where the underlying business worth diverges materially beyond the stock price being presently set by the market.

Below we set out out our fundamental reasoning as to why we believe that the current stock price of $5.88c does not come remotely close to reflecting the business reality at Endo and why we are outright buyers at this level.

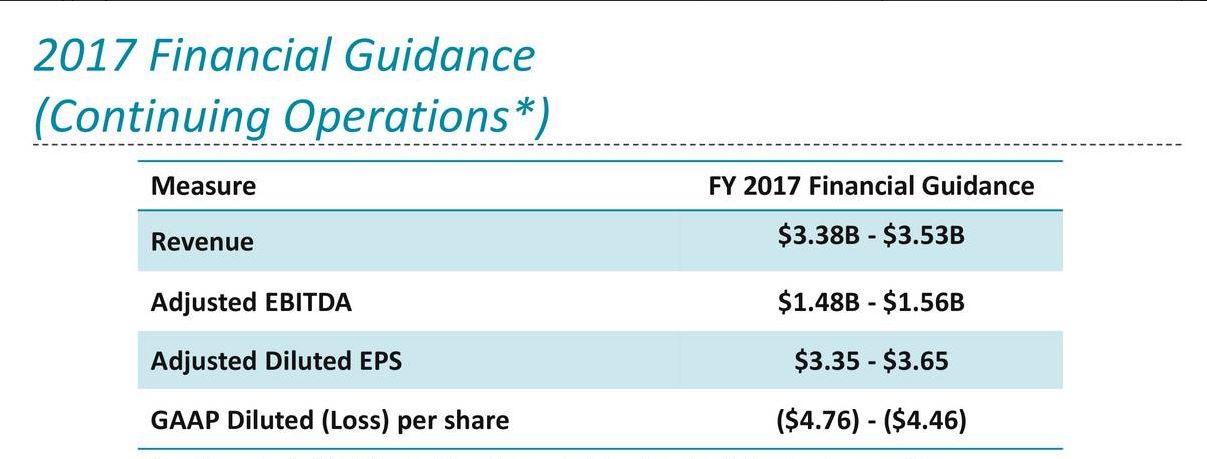

The most glaring reasoning behind our flash buy stance is the underlying fundamentals of the stock. Consider the following facts – the stock is slated to produce (GAAP adjusted) EPS of $3.50 for this year (see slide below) and just over $3 for 2018 (there is a wide range of between $2.46 – $3.76 for FY18 and we would lean towards the upper end). At a price per share of $5.88, the current year and pro-forma PE multiples are less than 2. That’s right less than 2. These type of valuation metrics are extremely rare and typically only presented when there is either (a) a real risk of imminent bankruptcy, (b) a discounted equity raising that has not been announced yet to the market or (c) there is completely irrational sentiment and fear at play.

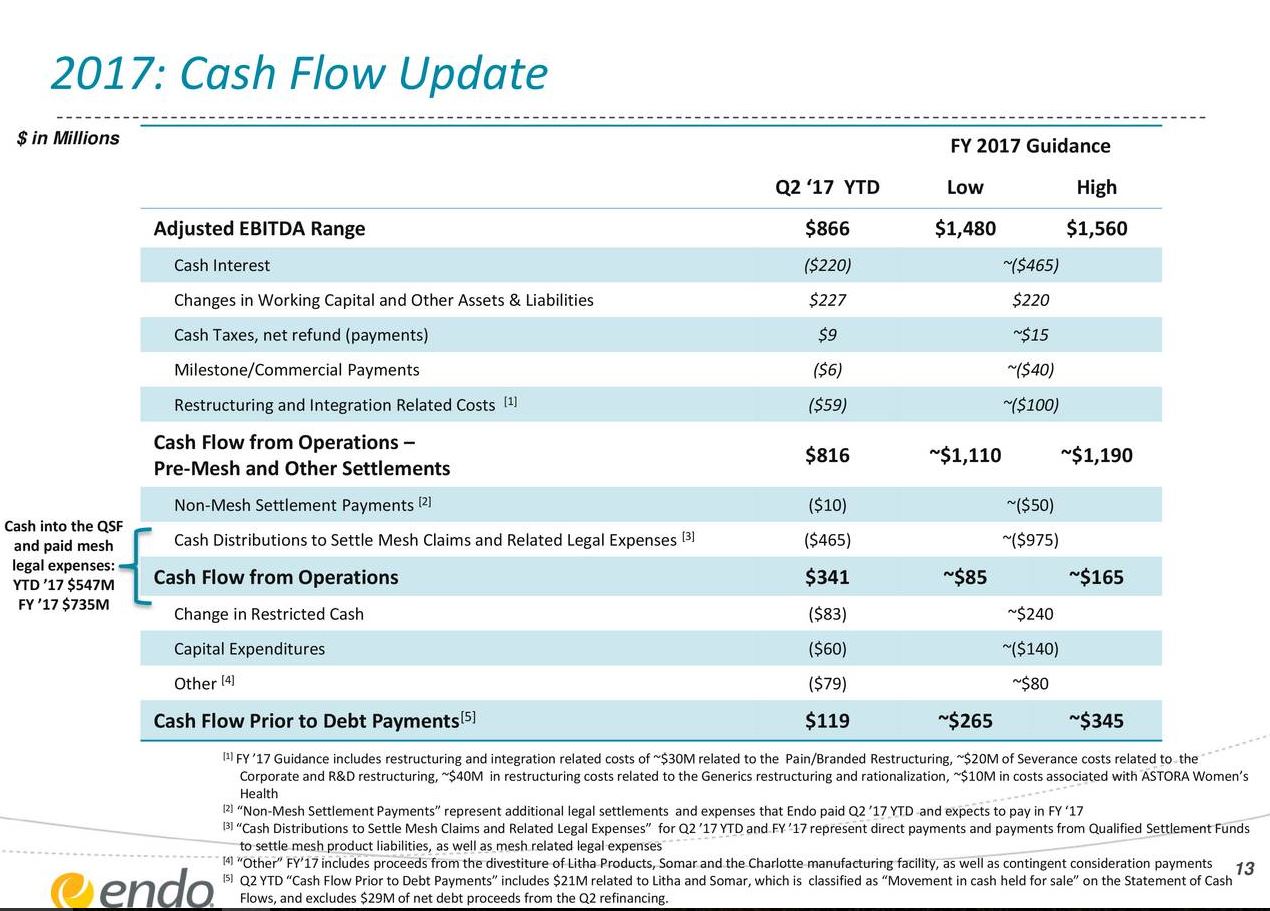

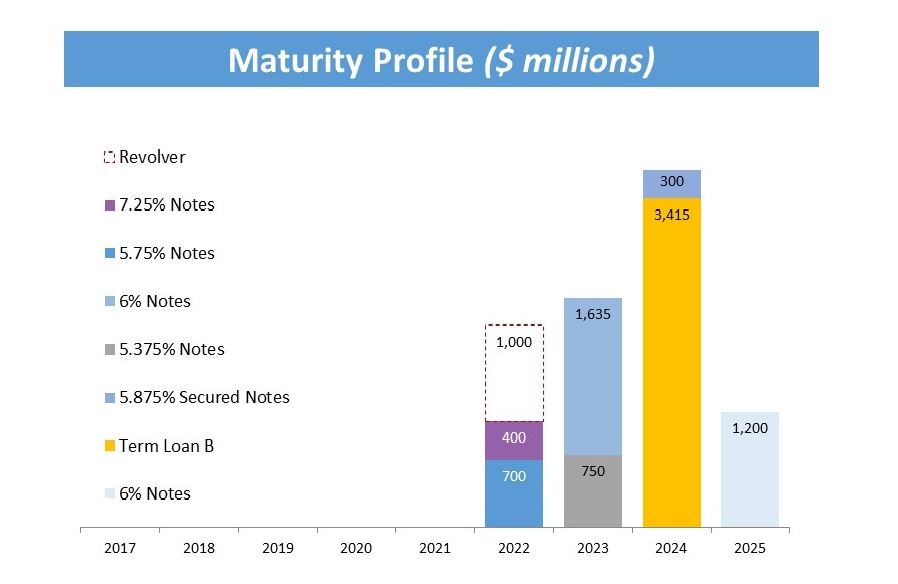

Addressing each of the above, the slide below lays out Endo’s debt profile over the next 6 years together with the most recent EBITDA guidance from the company. Given that the first bond repayment is due in 2022 and the company has guided for a surplus of between $265 & $345m before debt repayments for 2017 even after the large Mesh liability payments, unless earnings have fallen off a cliff the last 3 months then bankruptcy talk is both misplaced and for those propagating it, extremely irresponsible.

With respect to the potential for a discounted equity raising, we again point to the free cash surplus projection of $265 – $345m as provided by the company. We would in fact, subject to not breaching the EBITDA:Debt gross covenants, be urging the company to do the reverse and actually buy stock here with these surplus funds. We are not insiders and aside from management, no analyst or investor can ever know the full story but, based upon all we have to go on, namely publicly disclosed facts and figures, we highly, highly doubt that an equity raising is likely due to happen too.

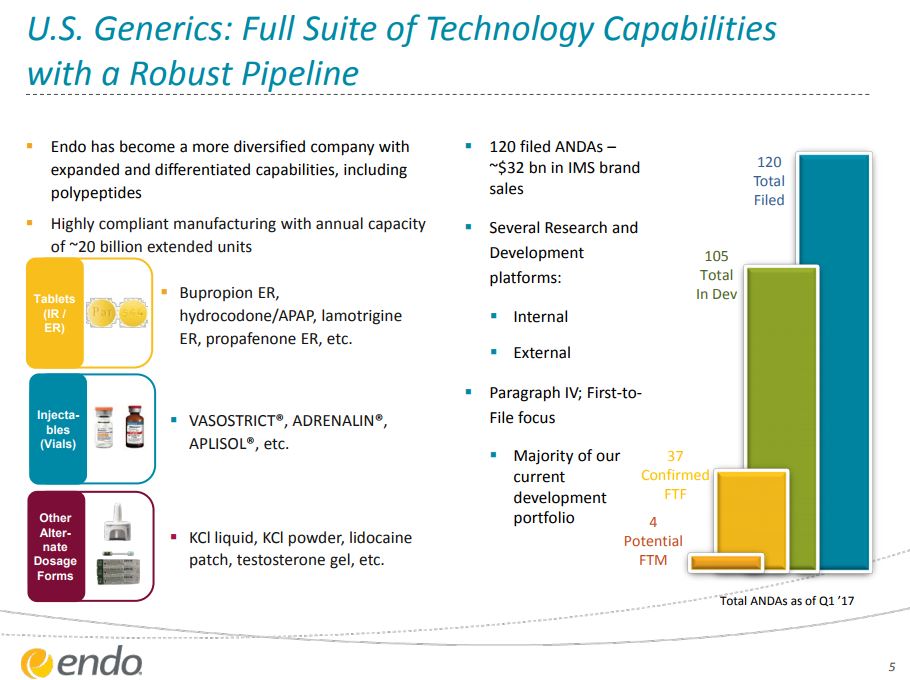

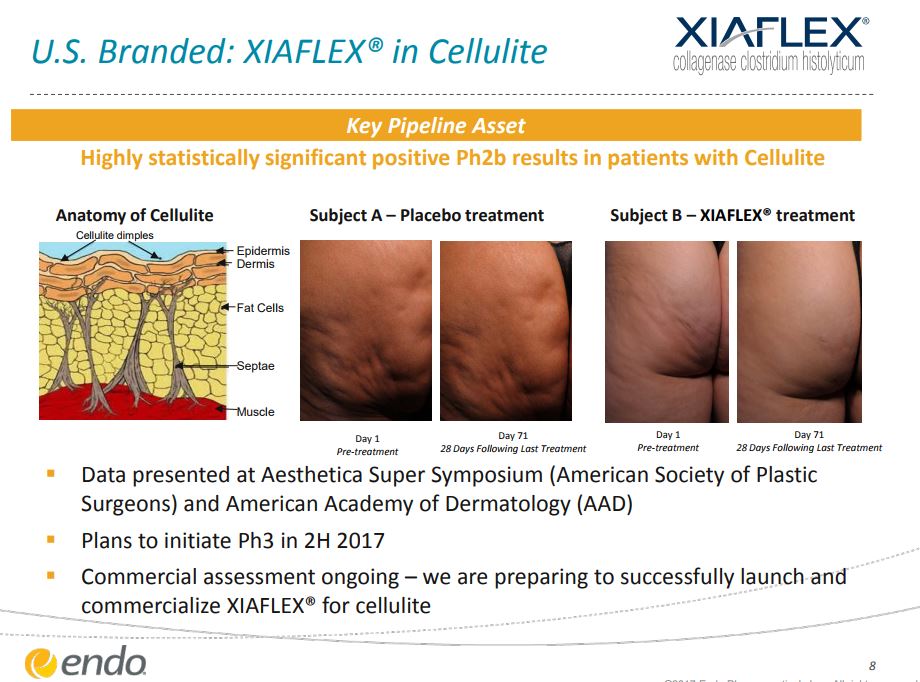

So that leaves the third option of complete irrationality which investors are wont to succumb to on many, many occasions. Reflecting upon the company’s pipeline of products in the chart below it is apparent that this is not a dying business but one in which there are real growth prospects at the top line over the next few years, in particular in the cellulite arena with their XIAFLEX product and which is expected to be marketed specifically for cellulite treatment as it comes through Phase 3 late next year. The cellulite treatment market is a $10bn opportunity. See here the potential importance of this product to the company and slide below with further details

The CEO has also stated that he expects to release circa 20 new products to the market each year – a pipeline that make no mistake will be attractive to some of Endo’s larger peers. Indeed in 2015 Perrigo approached Endo to buy out the entire company but the deal fell apart due the perceived value by Endo management. With the stock trading at a fraction of its then value and much much less relative to Perrigo it once again highlights just what a “sitting duck” Endo currently is…

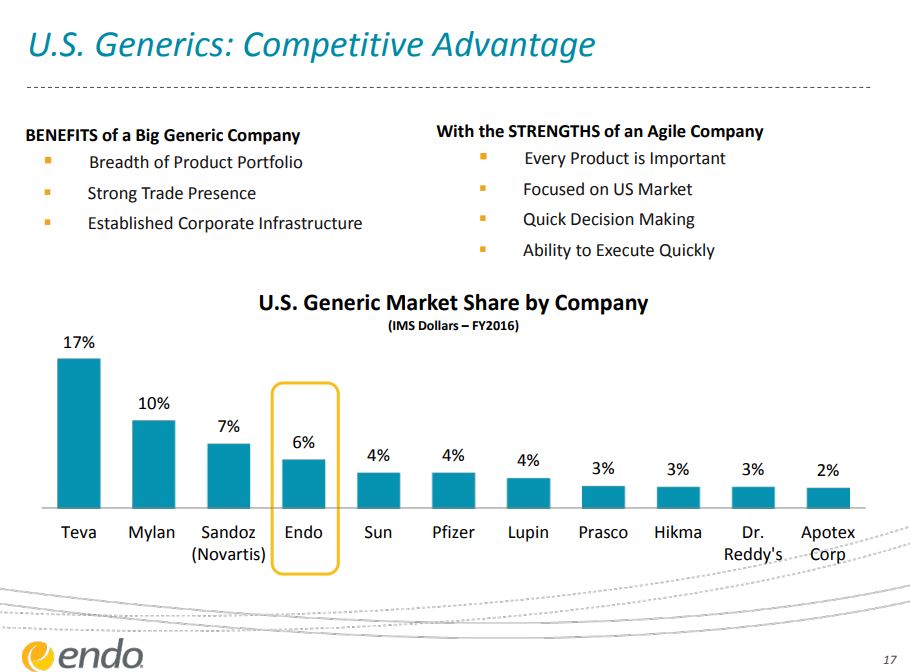

We can also see in the slide below from the company just where they are positioned in terms of market share in the US Generics arena. The slide tells me that Endo are no minnow and that their market share would be a complementary and coveted addition to the likes of Novartis or Pfizer and where the equity acquisition cost is a mere morsel.

Further, in trying to square the current woeful equity valuation with reality, a good place to start is the bond market in looking at the price of the company’s publicly traded debt. Surprisingly we see no additional stress indicators here in their debt prices over the last 3 months, certainly not to the degree that has produced a 50% haircut to the stock price with the company’s 7.25% bonds due in 2022 continuing to trade in the early/mid 90’s range. If the market really did expect a default was looming these would be much, much lower.

Although not massive, it is worth pointing out that both the CEO and the COO bought stock during the last 3 months, with a gross purchase value of just over $200,000.

We also highlight that private equity house TPG remains the biggest shareholder in Endo and at the current stock price we would be highly surprised if they are also not considering their options regarding taking the company private again whilst the mesh liabilities are repaid over the next 18 months and new drugs come through the pipeline with a view to an industry sale or refloat post these catalysts and the assessment of equity worth by other players is much different.

Another factor which we believe will add fuel to the stock price as rationality returns is the heavy short position. The last disclosed figures were on the 13th October with the new disclosures due Monday next wk. We suspect it will be back towards the record high of 24m shares (near 15% of the equity base but much less as a percentage of the freefloat) seen in late March this year – just before a rally of near 30%. At this level, it will take close to 5 days volume to cover. Coupling this with the extremely negative sentiment, the very oversold status of the stock and the forthcoming 3Q report, any short worth their salt holding out here is playing a very dangerous game of chicken.

To conclude, we currently have a stock that has near halved over the last three months resulting in an extremely oversold situation in which investors are falling hostage to “anchoring” – that is the projecting of recent price action forward in the near term. Coupled with 3Q earnings due out on the 9th November and sharp falls post the previous few quarters figures, investors are running for the exit irrespective of price on fears of yet more pain coming down the pipe.

Set against this background we have an almost mathematical impossibility of near term bankruptcy, a free cash flow yield in excess of almost 30% for this year and over 60% for 2018 based on management’s projections for the Mesh liability payments. Those metrics will not have escaped both large shareholder TPG’s notice as we have already relayed nor indeed a whole multitude of other industry and potential financial buyers. The equity is almost being given away and yet the pipeline of products the company has coming through various phases of commercialisation is extremely attractive. In short we have a compelling disconnect between reality and perception.

We believe that the fear going into the 3Q results on November 9th now provides a real buying opportunity and that management’s guidance for 2018 and the dispelling of any financial distress stories likely to come out of these results will see the stock price trade back towards $10 rather than $5. This is the swing buy opportunity we see today whilst we also believe that the valuation metrics really do present a cycle nadir opportunity for larger players like Novartis to acquire Endo. In fact at the current price it would be almost unthinkable if such a deal is not being pitched by Wall Street bankers as I write.

We are not alone in our view with legendary value investor Bill Miller commenting at a price near twice the present one – “Endo was the worst performer in the S&P 500 last year and would be the second worst this year if it weren’t removed from the index in January. That level of underperformance is often associated with a washout stock price with little downside and significant upside should things improve.

New management at Endo is highly regarded. Their top priority is paying down some debt. We think they could sell some assets to accomplish this more quickly than the market expects. This would make the company a more attractive acquisition target. Endo’s largest shareholder is private equity firm TPG. We think ENDP could be sold in a few years, or earlier if the price is right. While we are not counting on it being taken out, it is yet another way to win. Either way, we easily get values for Endo that are at least double the current market price.”

At $5.88 we are resolute buyers of Endo Pharmaceuticals expecting both short and medium term meaningful upside. EDIT – Post re-iteration of 17 guidance on 30th Oct we place a short term price target of $10.

DISCLOSURE & RISK WARNING

A Director of Align Research Ltd holds a personal position in Endo Pharmaceuticals and is bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.