Acasti Pharma – pivotal Phase (3) results moment is upon us

We have covered Acasti Pharmaceuticals extensively per HERE this last 2 years and the vast majority of that coverage has been focused around the key Phase (3) so called Trilogy 1 & 2 trial results for the company’s cholesterol lowering drug – Capre – and that are due out, in the former’s case, any day now with the latter following in early January 2020.

Full background on this opportunity can be found on the Acasti tab link above and we will not regurgitate the company’s operations here but look to provide those parties who have followed us from sub $1 with the observations we have made over the last few weeks from a technical perspective.

With a current share count of just over 95m shares, the market cap is still de minimis IF, repeat IF the Trilogy patient trials meet their primary endpoint which is the reduction of Tryglicerides in comparison with a placebo after a period of 12 weeks.

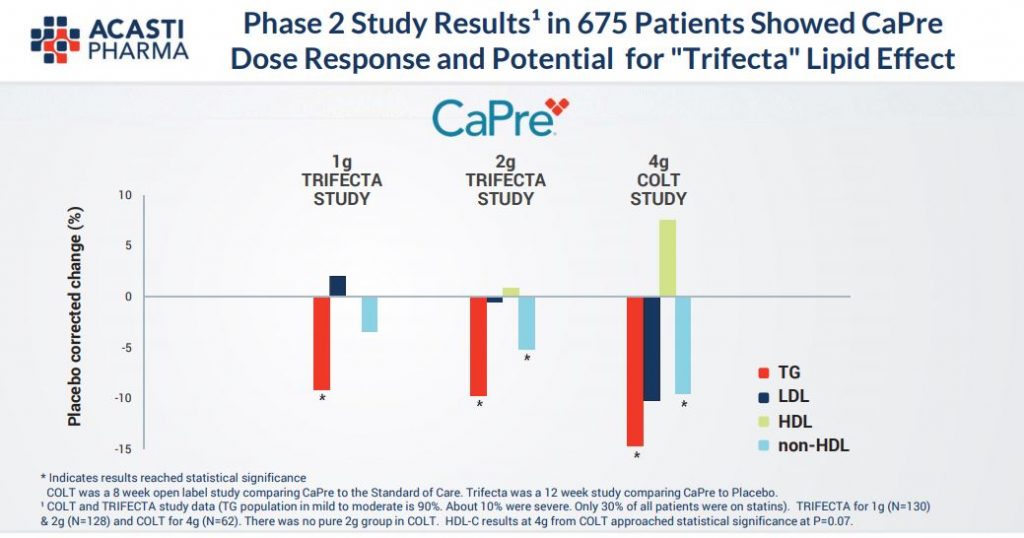

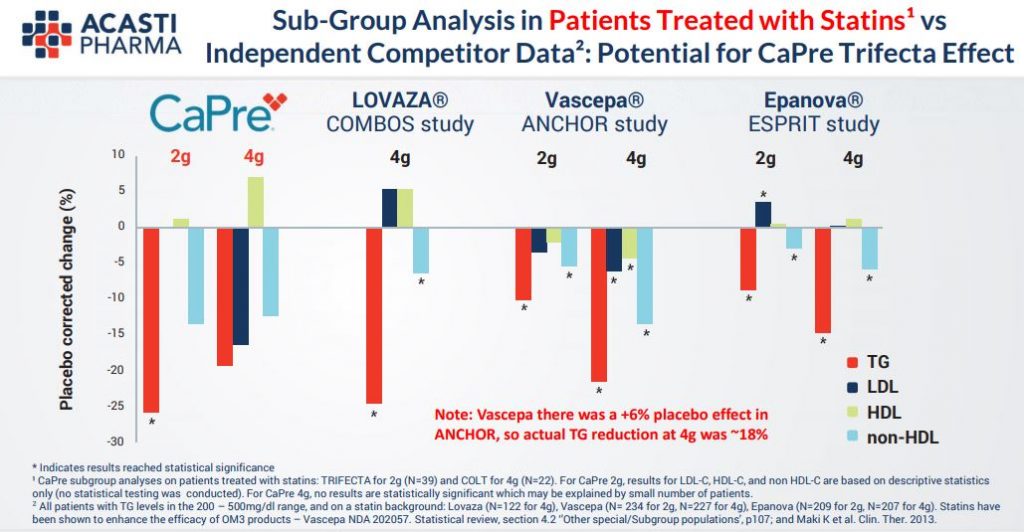

As we can see in the tables below and also given recent commentary by COO Pierre Lemieux it looks to be highly probably that this end point will be met given the high Triglycerides readings in excess of 500mg/dL for all trial patients and the combination of treatment with statins too. It does seem from the Phase (2) results that Capre really does present the profile of being “best in class”, in particular through raising HDL unlike its peers and which is the so called “good” cholesterol.

In effect, the current trial seems to fit perfectly Acasti’s endpoint requirements. Trilogy 2 results due in January will provide a further dataset designed to show additional topline results including CaPre’s impact on several important secondary endpoints such as LDL, VLDL and HDL cholesterol and non-HDL cholesterol, as well as HbA1c, an exploratory endpoint which is an important biomarker of glucose control for diabetic patients. Indeed, management believe that Capre could indeed be a complementary potential treatment for diabetes too.

There are a number of HNW specialists sitting on the register with large holdings including George Weaver Haywood & that should give comfort to holders as the company enters what looks to be a very exciting 2020. Further catalysts aside from Trilogy 2 are the release of secondary and exploratory endpoints in March, presentation of the full dataset at “important” scientific meetings and, most importantly, the filing of an NDA to obtain FDA approval for release into the key US market. The company has stated that it intends to work with partners overseas with regards to the licensing/distribution of Capre with Asia in particular being seen as a key market.

In short, IF the efficacy of Capre is proved in Phase (3) there is likely to be literally life changing returns not just for Capre patients but also investors in the stock. Amarin Pharma’s market cap sits at near $8bn and if Capre proves to be, as many industry and specialist analysts expect to be – “best in class” there is every likelihood of a meaningful closing of this valuation gap during 2020 and more likely a buyout, possibly by Amarin. Our own expectation is that if Trilogy 1 & 2 meet expectations that the market cap will be sitting closer to $1bn implying a stock price of around $10. We would not expect the company to remain independent going into 2021.

From a technical perspective we can see in the chart below that as the company re-rated during the summer, moving from sub $1 to near $3 given new coverage of the stock by a number of other analysts, that the shares have essentially spent the balance of the year consolidating these gains. The major part of November into early Dec seems to have been classic market maker manipulation to wring out the weak hands with a controlled decline to the $1.70 level. So far so smart. However, as we are all aware, markets are “leaky” and during the last 2 weeks nearly 50% of the float has turned over with a 50% rise in the stock price. This type of price action is usually a“tell” and should not be ignored.

We have noticed in the last 3 days in particular block purchases that almost certainly are not speculative retail buying but either “informed” purchases or institutional additions. This type of price action, whilst not infallible (anything can happen in the markets we have learnt over the years) does generally point to “parties in the know” accumulating.

We can see also in the chart that the RSI is not in the overbought 80 region but has risen from the key 50 line, almost text book like in fact and so indicates to us that should the Trilogy results be positive, that there is quite some way to run. From an immediate target viewpoint, the breaking of $2.50 implies a move to $4.50 (the wedge height) and we note going back to Sep 2014 a gap just below the $10 level and which would fit with our fundamental overview. Gaps don’t always get filled but when a stock price gets close it it then it generally acts as a magnet.

We are now in for free on the stock having traded out some of our original block in the summer spike and thus wish all longs the best of luck as the clock literally clicks down the last minutes on this pivotal results moment for Acasti shareholders.

RISK WARNING & DISCLAIMER

Align Research & a director of Align Research own shares in Acasti Pharma. Full details of our Company & Personal Account Dealing Policy can be found on our website http://www.alignresearch.co.uk/legal/

Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.