Align Research Top 10 Conviction calls for 2022

And so another yet year turns… A little older and hopefully a little wiser, although observing the utter, utter madness that is the world today and many of those going along with the Covid hysteria and narrative I am not so sure about the wiser part… There is a saying in the stock market, that is the backdrop at any one point in time is either “feast or famine” – well the early part of ’21 came in like a lion enjoying a veritable “feast” but as the spring gave way to summer and many of the crazy covid restrictions were lifted it seems the world went on holiday and with it demand for UK shares. So began the current “famine” in UK Plc and small caps in particular which experienced a material de-rating.

Inflation will be the key driver this year in our opinion and there is ONE primary place to be in this scenario – commodity focused equities. We make no apologies for the fact that our list below is packed with these save for a couple of deep value plays. The current “official” RPI of 5-6% is quite simply untrue. Real world inflation is likely running around 11-12% and with interest rates in the UK & US still effectively zero, I am not so sure many people understand the impact of such massive negative real interest rates on their net wealth – put simply it robs you of this – you are getting, literally, poorer by the day. Over just 5 years, if the current real (not the manufactured one that has no relation to real energy & food prices, council tax increases etc) inflation rate continues and you keep your money in the bank then you will have lost over 50% of its spending power. Sobering thought indeed. This is why equities and real world assets – gold in particular are, in our view, the place to park your money – particularly with bargain valuations still abounding.

We have observed again this year that in the small cap arena management is EVERYTHING. Sadly, quality high calibre management is very, very, very rare, particularly where they are also aligned with shareholders. That is the stand out lesson of our foray into this arena over the last 6 years. Ultimate delivery of plans just does not happen in almost all cases. Look at the debacle that is ADM Energy – what differentiates us from almost every other known research house however is that when we get it wrong (invariably through management non delivery and in certain instances outright lies to us) then we hurt just like our followers. That is rare and I believe many people forget this. Vice versa, when we get it right – Argo Blockchain, Xtract Resources, ITM Power, Gaming Realms, Powerhouse Energy, Rainbow Rare Earths, Eqtec, Silence Therapeutics etc etc.. the returns can be life changing. Patience is however required to ride this turn in sentiment and fellow investor realisation of what is going on in a company. With that in mind, we are aware that some of the inclusions below have been disappointing this year and were included last year. We have thus only included those companies where we expect continued execution of corporate plans by management that have proved themselves and hence their inclusion once again this year.

So, in no particular order here are our top 10 picks for 2022.

KAZERA GLOBAL INVESTMENTS – Current price 1.1p

Kazera is in the midst of a complete transformation from the moribund years under old CEO Larry Johnson. As the largest shareholder here we push management to ensure that cash flow is paramount. Recent RNS’s have made clear that profits from its South African diamond operation are about to be eclipsed as its HMS and tantalum projects move into production.

A lot has been going on at Kazera this last 12 months, the southern African focused mining investor with a large high-grade tantalum & lithium project in Namibia. Commercial mine production of tantalum is now just around the corner with a new Chinese off-taker and recent plant upgrades. A transformative deal in June 2020 that we introduced took Kazera into diamonds and now imminently into the extremely lucrative heavy mineral sands (HMS) with the intent of this funding providing the cash runway to fully develop the tantalum opportunity. The company is now on the cusp of this.

A new strategy is being spearheaded to bring the tantalum mine back into production using borehole water and, benefiting from improved water retention techniques, is now set to produce decent cash flow literally within week. Work has been ongoing using the natural mountainous landscape to create tiered tailings dams which will be gravity fed.

Whilst on care and maintenance, the mine superintendent and the geologist have still been employed. This has allowed work to continue on the ground and included the running of a lot of water pipes, with more boreholes brought on stream as well as the cleaning of boreholes. Following very heavy rains there is now some 65 foot of water in the boreholes, which is considered sufficient to support a reasonable level of production. It should be noted that without the water problem, this tantalum mine could make several million dollars a year as it stands with very minimal upgrades to the plant and an addition of an already government approved tailings dam.

Recently, there was very good news on the Tantalite Valley Mine where the return to mining and tantalum production is now in process as the first shipment to the company’s off-take partner is expected by the end of December 2021, with a steady increase in production during 2022.

Diamonds have decent profit potential

Diamond and diamond processing are set to generate healthy profits, to be followed by HMS, at which stage funding sources for the tantalum become internally generated (or it could come by way of a bank loan). So, cash flows from the diamonds and HMS will also further exploration of both the tantalum and lithium potential – a really hot area in the battery metals space.

Processing alluvial material at Alexkor. Source: Alexkor

In September 2021, Kazera, with its joint venture partner MV5 took over the operation of the Muisvlak alluivial diamond processing plant, a move which will allow the team to remedy production blockages at the alluvial diamond operation of the past. The target is to lift the throughput at the plant six-fold to 35,000 tons of gravel per month, significantly increasing the amount of gravel Kazera can process from its activities at Alexander Bay. With control of the processing plant at Alexander Bay, Kazera can now make the operational improvements necessary to boost diamond production and profits. A December 2021 announcement highlighted what looks like a 300% increase in diamond production over the last production cycle.

First production from HMS expected within months

The company now expects its Mining Permit for the HMS to be granted in the first few weeks of 2022 allowing production to begin from this 72,000tpa high-grade HMS project. Initially, unprocessed material will be sold and Kazera has well-developed plans to be generating additional profits of some US$300,0000 per month within 6 months of receiving the Mining Permit. It gets better than that however as waiting in the wings are international players seeking to get the chance to build a separation plant, allowing KZG’s production to be sold at a price uplift of around 600% more.

At the moment, Kazera’s subsidiary WHM is waiting for the final grant of a Mining Permit over a 5-hectare beach sand deposit at Walviskop which has a JORC Indicated Mineral Resource of 3.11Mt of Valuable Heavy Minerals at a grade of 61.2%. Apparently, the predominant Valuable Heavy Minerals are garnet (30.29% of Run of Mine (ROM)) and ilmenite (27.54% of ROM). Also present are zircon and rutile, which haven’t been included in the economic modelling. The NPV has been determined at around £150 million based on a 20% discount rate and prevailing FX rates.

Mining HMS at Alexkor. Source: Company

That big NPV(20) valuation is just for Walviskop and there is one hell of a lot more here than simply Walviskop. Truth is that WHM is also in the process of applying for a Prospecting Right over an adjacent beach which apparently bears all the hallmarks of having similar characteristics to Walviskop – but is reckoned to be 34 times larger. To save you reaching for your calculators, and being highly illustrative, 34 x £150 million = £5.1 billion.

If that wasn’t enough, as a by-product of the HMS operation, Deep Blue Minerals is expected to generate around 300 carats per month of additional diamond production from the HMS operation. Importantly, beach diamonds tend to be bigger and better quality than those found inland and so we are talking about higher prices being paid at auctions. Whilst inland diamonds typically attract prices around US$250 per carat, Kazera are fairly confident that they can sell these diamonds for more than US$750 per carat.

There is no doubt that rapid progress is being made right across each and every one of Kazera’s operations. With a current market cap of just under £8m, and management telegraphing the imminent HMS licence award, the profits thereof from here, the tantalum and lithium potential that is frankly massive and the steady cash flow generation profile of the diamonds, the current stock price frankly defies belief. We are hard pressed to find many minnows on the cusp of immediate cash and profit generation with aligned management. This is the one position that we expect to generate multi-fold returns in 2022.

IRONVELD – Current price 1p

Ironveld is blessed with having a world-class high purity iron, vanadium and titanium project which is located on the Northern Limb of the Bushveld Complex in Limpopo Province in South Africa. There have been a number of false dawns in the long-drawn-out process of bagging a financing deal to unlock the tremendous value here. However, November 2021 brought the news that Grosvenor Resources Pty Ltd was to invest £5.6 million at 1p a share. This large sum of money at a substantial premium is set to do wonders for the fortunes of Ironveld.

In addition, in late-December 2021, the company was able to report an additional transaction with Grosvenor which will see them taking a 51% stake in one of Ironveld’s subsidiaries called Luge Prospecting and Mining Company for around £2.4 million. This means that in the end Grosvenor will be investing a total of £8.0 million in Ironveld. On receipt of these funds, Ironveld will be fully funded to begin mining, operating and ore processing before the end of 2022.

Ironveld initially joined AIM in 2012 with Prospecting Rights over a vast 165km² area in the Bushveld, South Africa, with plans to mine magnetite iron ore as feedstock for its own pig iron plant. Since then, there has been a large JORC-resource delineated (2013), a cracking DFS (2014), mining licences secured, environmental approval gained, plus confirmation of power supply from Eskom – major milestones on the road to putting this project into production. All great news but in recent years Ironveld has been treading water ahead of the arrival on the scene of Grosvenor Resources.

Huge potential to be unlocked

The company’s unique project is a hugely exciting asset which has a JORC-compliant resource of 56.3Mt grading at 68.6% Fe2O3, 14.7% TiO2 and 1.12% V2O5. When in operation, the project should attract a lot of attention as it would be first project in South Africa that is capable of producing high purity iron (HPI), vanadium and titanium. There is huge potential that is beginning to finally be unlocked by new investment and Grosvenor’s access to further finance.

HPI, vanadium & titanium mineralisation outcropping at IRON’s Bushveld project. Source: Company

As a result of the November 2021 financing Grosvenor are set to take a 29.9% stake in the company and will be able to nominate two NEDs. Grosvenor is a newly formed South African private company formed by young black entrepreneurs with high profile political connections who are looking to expand their investments and mining operations in South Africa.

Grosvenor’s shareholders have a background in the mining and selling of bulk commodities in South Africa and are no strangers to negotiating offtake agreements and financing relationships with significant international mining and trading companies. Grosvenor’s CEO is Thembinkosi Ndlovu, who started his career in media and telecoms and is also a Director of privately owned South African company called Susanoo Holdings, which is involved in coal, manganese and iron ore mining projects. This is no passive investment for Grosvenor as it really wants to get involved.

The company will be looking to use Grosvenor’s expertise and connections in order to finance the start of mining and the building of a smelter on site that will be required to bring the company’s project into development. Importantly, both Ironveld and Grosvenor are committed to ensuring the company can commence mining and processing of its magnetite ore in the near term, so it looks like they won’t be hanging around.

Production could commence in 12 months

The £8 million will fund the mine and small on-site smelter. These are expected to be in production by year-end 2022 and so there is the real prospect of revenue and early cash flow. From that stage there will be plenty of opportunity to scale up the operation.

Further expansion simply requires further capital to build a bigger plant as there is certainly no shortage of ore. Its crying out for a far larger project that really does justice to the serious potential that exists here. Reading between the lines, Grosvenor looks to be the perfect partner as it has access to the sort of finance and offtake agreements that big international trading companies which can provide.

There is no doubt that Ironveld has a tremendous competitive advantage when it comes down to HPI production, which is used in 3D printing. There are only a handful of major HPI producers, and most do not have their own mines but instead use scrap stainless steel which accounts for up to 70% of production costs.

HPI is used in Powder Metallurgy allowing for the manufacture of very complex shaped components. Source: Company

The company’s big advantage is that not only is it cheaper to mine rather than grinding up stainless steel but also Ironveld’s HPI does not have the impurities that exists in stainless steel as it has not processed. The compelling combination of having its own mine together with by-product credits represents a huge competitive advantage. All of this firmly places Ironveld in the lowest quartile of the HPI cost curve globally. It has to be said that when you consider by-product credits the company may well be the world’s lowest cost producer.

Align initiated coverage on Ironveld in January 2021 when the stock was trading at 0.685p with a Conviction Buy recommendation and a target price of 3.26p. Given the potential here plus the newsflow, we have no hesitation whatsoever in reconfirming our stance at the current price of 1p.

EQTEC – Current price 1.2p

The high profile climate conference COP26 earlier this year once again highlighted the potential opportunities for green energy companies. As we write, more than 130 countries have now set, or are considering, a target of reducing carbon emissions to net zero by mid-century. At COP26, world leaders committed to a range of new emissions reducing strategies and also flagged that technology will be critical for meeting these ambitious plans.

This bodes well for EQTEC, whose Advanced Gasification Technology uses a variety of waste feedstocks to produce a pure high-quality synthesis gas (syngas), capable of being used for applications including generating green electricity, heat, biofuels and hydrogen. The company works with and co-ordinates multiple parties for its projects, including developers, waste owners, EPCs and contractors and funders with a view to ultimately providing its gasification technology, associated engineering & design services and O&M services.

Some significant operational progress was made in 2021, and while this has not yet been reflected in the financial results, it looks like the coming years are set for some hockey stick style growth. The major financial event of the year was May’s oversubscribed equity placing which raised £16 million at 1.5p per share. The funds were raised to accelerate and to take full advantage of a number of near-term opportunities, to be deployed as development capital and to prepare for long-term growth. At the half year end in June cash stood at €15.34 million, with EQTEC now being debt free following a debt for equity swap.

EQTEC has also made significant progress across its development pipeline and active development projects. At the end of September the company had 17 projects under construction or development, up from 10 at the end of March and 13 at the end of June. Some highlights include the acquisition and planned recommissioning of a biomass-to-energy project in Tuscany and the formation of two go-to-market joint-ventures in Greece and Croatia.

Meanwhile, in the UK further progress was made at the flagship Billingham Project, a 25 MWe waste gasification plant built around EQTEC technology which is set to transform 200,000+ tonnes per year of refused-derived fuel (RDF) from municipal solid waste into electricity, thermal energy and/or a range of other chemicals and fuels. Also in the UK, the Deeside Project seeks to create a complete, local waste-to-energy solution with a material recovery facility, a 2 MW anaerobic digestion facility and a 9.9 MWe gasification facility built around EQTEC technology to transform c.182,000 tonnes per year of municipal, commercial and industrial waste into green electricity and other energy.

In mid-December EQTEC updated on the two UK projects, stating that they are currently under review by a range of large-scale infrastructure investors and owner-operators for potential funding, commercial operation or both, along with local, industrial offtake customers. EQTEC anticipates these discussions will progress to exclusivity and due diligence in early 2022 but due to these developments financial close for both Billingham and Deeside has been deferred until 2022. As a result, total revenues for 2021 are now expected to be between €8 – 10 million, up from €2.2 million in 2020. An EBITDA loss of €2.5 – 3.5 million is also expected prior to closing additional projects that might fall into the current financial year.

While these minor delays might be disappointing we do not believe that they deter from the medium/long-term investment case here. Combined with investment into engineering capability and capacity, the vast project pipeline sets the stage for significant growth in the years ahead, with the company’s proven technology being at the forefront of solving some of the world’s most pressing environmental and economic issues.

We are currently reviewing our forecasts for the company in light of recent news but do not expect to make too much of a downward revision to our current expectations for c.€27 million (£22.7 million) of net income in FY2023. With a current market cap of £103 million it is easy to see that the shares look very cheap should our expectations be met over the next two years. Ahead of an update note in the new year we are happy to retain our stance of Conviction Buy.

CORCEL – Current price 1.2p

Corcel offer a highly attractive mix of blue-sky battery metals exploration and flexible grid solutions (FGS) which are a compelling play on the decarbonisation of the global economy. It is the old Regency Mines, best known for its vast Papua New Guinean nickel laterite Mambare Project which was once valued at £40 million.

It has been a bit quiet over recent years as the company has gone through a substantial restructuring since the previous Chairman was booted out by shareholders. The decks have now been cleared and a period of substantial growth has begun. With James Parsons now at the helm and the 12 month “legacy clean up” behind them, investors are now witnessing the creation of a highly relevant vehicle.

Corcel is very neatly positioned to benefit from an expected price hike in battery metals. Transition to a low carbon world needs storage for renewable energy to be a viable and stable source of energy hence the growing clamour for batteries and battery metals where a supply crunch is expected in the mid-2020s onwards with big structural price hikes.

Tring Road Gas Peaker plant. Source: Company

Providing critical service to the UK grid

There is no doubt that there are big opportunities available as the UK switches to flexible power generation. Corcel is investing in energy storage/renewable projects to provide critical services to the UK grid as it transitions from coal/nuclear generated power to renewables.

Burwell substation, location of one of Corcel’s FGS projects. Source: Company

Already, the team has a growing list of well-advanced projects, strongly backed by a major pipeline of projects that are under review. It does look like the pieces are all neatly slotting into place and developments seem to be progressing well at both the Tring Road 50MW and Avonmouth 50MW Gas Peaker Projects.

In November 2021, Corcel updated investors on its UK based transitional energy project portfolio. At the Tring Road 50MW and Avonmouth 50MW Gas Peaker Projects, Corcel was able to confirm that the management team is now in advanced discussions with select investors for these two projects. After a comprehensive marketing programme, these projects certainly seem to have attracted significant interest. It’s not hard to see why as such projects are critical to the UK’s transitional energy strategy as they provide flexible energy supply which is necessary in order to support the volatility that lies in the UK renewables supply especially wind and solar.

DSO nickel supply to China is envisaged

Currently, the nickel price continues to fly high at US$19,750 a tonne which is good news as the company now has two impressive nickel cobalt projects in Papua New Guinea – Mambare and Wo Wo Gap. Mambare is actually being positioned to become a Direct Shipping Ore (DSO) nickel supplier to China.

Recent GPR work at Mambare was designed to determine the location for the DSO operation for the Mining Lease. This development is likely to require US$25 – 30 million of capex and at that stage, Corcel would either be looking to bring in larger players for a JV or consider a complete disposal. Currently, the company owns 41% of the project, but given a perceived inability of its partner BMA to fund the asset through to production, it would seem logical that the entire asset is vended into Corcel to allow for meaningful development. Chinese investor Sinom has been happy to accept Corcel’s paper, as demonstrated by the 2020 debt deal, and has now emerged as a highly supportive 12% plus shareholder. In our view, such backing speaks volumes for being a potential source of both offtake agreements and future funding.

Going forward, a good case could probably be made for Wo Wo Gap being worth roughly the same as Mambare, so if not the full £40 million valuation Mambare had in 2011-12, then at least some reasonable discount to that. With nickel prices strong and Chinese producers looking to have diverse sources of ore (outside Philippines and Indonesia), Corcel looks mighty well-placed moving ahead.

Plans at Wo Wo Gap are likely to involve updating the JORC to 2012 standard, then progressing towards a mining lease with all the hard lessons that the team has learnt from Mambare taken into account. It is now on the cards that the Mining Lease at Mambare could be awarded in the coming months allowing a DSO operation, funded by a JV partner. Together with Wo Wo Gap, this could nicely set the scene for some real valuation creation and M&A action.

By any yardstick, Corcel is highly undervalued in our view. We initiated coverage on the company in July 2021 with a Conviction Buy stance when the shares were trading at 1.625p and have since upped our target price a touch to 20.03p. At the current price of 1.20p, our recommendation is unchanged with an eye watering disconnect between the stock price and underlying value in our opinion.

BLUEBIRD MERCHANT VENTURES – Current price 2.7p

Bluebird Merchant Ventures is a South Korea-focused resources company which is bringing old gold mines back to life. There are big benefits to gain from bringing old gold mines back to life. Not only is it far quicker but also a lot cheaper to rehabilitate old gold mines than fund exploration. These old gold mines at Gubong and Kochang ceased production a couple of decades ago due to a low gold price – when it was under US$140/oz.

Old photograph of Gubong. Source: Company

All things Covid have rather delayed developments, but Bluebird expects to commence gold production quite swiftly once South East Asia has eased travel and other restrictions relating to the pandemic. Planning and preparation work has been taking place for the adit refurbishment at Kochang, but as investors learned in October 2021 the work has yet to begin. More normal circumstances should allow this process to begin with a swift trajectory to 100,000oz pa within a five-year period. At attractively low operating costs of US$576/oz, this could be a big money spinner, in a country which has a highly pro-mining government.

We think Colin Patterson (CEO) and Charles Barclay (COO) have developed a cracking business model. In 2010, the Apex Mine (Philippines) was acquired for US$7 million, reinvigorated by the team and 2 years later received an offer for US$180 million from a major. In our mind, Bluebird bears all the hallmarks of being Apex Mark II.

COO Charles Barclay underground at one of BMV’s Korean gold projects. Source: Company

Bluebird now owns 100% of the Gubong and Kochang gold mines

There was big news in June 2021, when BMV was able to announce that it has gained 100% ownership of Gubong and Kochang gold mines. This has happened by BMV acquiring the 50% remaining stake from its from ex-joint venture partner Southern Gold (SAU).

For this 50% stake, the company issued SAU with just over 200 million BMV shares at 3.6p per share. We understand that SAU has a great understanding and knowledge of the assets’ potential and are restricted for 12 months from selling the shares.

The outlook for BMV does seem to be looking brighter and brighter. The funding hurdle for getting into gold production has already been resolved as the company has negotiated a gold loan for a minimum of US$5 million up to a maximum of US$20 million from a Korean crypto finance firm. Bluebird will repay this debt in gold out of production with the lenders getting a 20% discount to the gold price based on the gold price at the time of delivery. Already, BMV has received funding from this crypto backed gold loan, enabling progress on the ground in South Korea which should allow the team to move ahead with construction.

This level of funding should get Gubong and Kochang into production in the short term as well as allow BMV to meet its goal of increasing production to 100,000 ounces of gold per annum within 2 years. Even better, there is no timescale for debt repayment – we did check that with the company. Investors can breathe a sigh of relief as this funding should allow Bluebird to achieve gold production without needing an equity placing to fund the construction phase.

Highly compelling gold play

Bluebird offers a highly compelling gold play with a commitment to provide a decent pipeline of news to keep investors fully informed. Management has extensive experience of bringing old mines back on stream and there are powerful economics due to the attractively lower costs of refurbishing an old mine compared with building a new one. At the same time, no amount of advanced exploration and drilling can ever provide the level of knowledge and comfort that the data from the historic mining of a deposit does.

In June 2021, we revisited our target price for the stock. Using a flat gold price of US$1,775 per ounce, we have determined a Net Present Value using a 12% discount rate of US$302.56 million. To be more conservative to allow for project execution risk, we have discounted this NPV by 50%, resulting in a figure of US$151.28 million. This equates to 23.28p per share based on the number of shares in issue (467,482,119). Based on the number of shares on a fully diluted basis (650,901,578 where we have included all of SAU’s 200 million shares) gives a figure of 16.72p which have adopted as our new target price. Covid-related delays had whittled down the price over the last 12 months from the 4.20p level to 1.70p but in recent weeks the stock has come alive again. We are happy to reconfirm our Conviction Buy stance at the current price of 2.70p.

AMARIN – Current price $3.43c

Nasdaq listed Amarin Corporation is a pharmaceutical company whose lead commercial product is Vascepa. This is an FDA approved drug used as a supplement to reduce triglyceride levels in adult patients with severe hypertriglyceridemia – triglycerides are fatty molecules that in high levels can make an individual predisposed to heart disease. Vascepa contains the omega-3 acid commonly known as EPA, derived from fish through a process designed to eliminate impurities and isolate and protect the single molecule active ingredient.

Amarin shares surged in September 2018 after the company announced that top line results from a global study of 8,179 statin-treated adults with elevated cardio-vascular (CV) risk demonstrated an approximately 25% relative risk reduction in major adverse CV events with use of Vascepa 4 grams/day as compared to placebo. In December 2019, the FDA then approved a new indication and related label expansion based on the results of the trial. That helped Amarin’s revenues rise by 43% to $614.1 million in 2020 and net losses fall from $22.6 million to $18 million.

However, the shares slumped back to Earth in early 2020 after the Nevada Court ruled in favour of two generics companies in a patent litigation case related to abbreviated new drug applications that sought FDA approval for sale of generic versions of Vascepa. Later that year the two companies, Hikma Pharmaceutical USA Inc. and Dr. Reddy’s Laboratories, received approval to market their generic versions for the original indication of Vascepa. In November 2020, Hikma then launched their generic version on a limited scale, with two now on the market. While Amarin has fought back, the US Court of Appeals for the Federal Circuit have shut the door on a possible reversal by upholding the Nevada Court decision.

So the market’s main concern here is that Amarin will experience significant pressure on US sales of Vascepa to the generic competition. However, the share price fall seems overdone to us for several reasons.

For starters, the generic approvals only relate to the original indication of Vascepa which amounts to only a small proportion of the company’s business. On that matter CEO John Thero recently said “…the generic that’s in the market and no one that’s talking about potentially launching soon, have a label that is limited to, the original label for VASCEPA…..And that was about $40 million of our business last year…. but that’s not a growing sector of our business.”

And the company is still the clear market leader in the US, with recent Q3 results stating that Amarin retained approximately 83% and 87% of the market in the three and nine months ended September 2021 respectively – that’s after around one year of generic competition. There are plans to further strengthen the brand compared to the generics via expanding healthcare professional reach and engagement through a new digital omni-channel platform, driving further enhancements in managed care access and optimising Vascepa prescriptions for cardiovascular (CV) risk reduction.

Alongside this, Amarin has huge opportunities for its lead drug outside of the US where it thinks there is potential for an additional $1 billion of annual revenues. In Europe, where the drug will be marketed as Vazkepa, the European Commission (EC) approved the marketing authorisation application in March this year. This made Vazkepa the first and only EC-approved therapy to reduce cardiovascular risk in high-risk statin-treated patients who have elevated triglycerides. A launch was seen in Germany in September 2021, with market access dossiers now submitted for reimbursement in ten major European countries. The marketing in Europe is supported by a c.150-person commercial field force in Germany and further Medical and Commercial teams in all major markets.

Elsewhere, Amarin has recently announced plans to initiate regulatory filing and review processes and obtain approvals in several additional countries in 2022 as part of its global growth strategy to reach the top 50 cardiometabolic markets in the world. The first wave will include Australia, New Zealand and Israel. There is also good news from the potentially huge Chinese market where in early 2021 the Chinese National Medical Products Administration (NMPA) accepted for review a New Drug Application (NDA) for Vascepa. Amarin’s marketing partner in China expects to receive a decision on the NDA in Mainland China and, separately, in Hong Kong near the end of 2021.

Finally, activist investor Sarissa Capital arrived on the register in the third quarter of 2021 and seem to have an average entry cost approaching $5 a share. They are not there to be passive and we suspect that they will be pushing for a serious value catalysation event likely to be an outright sale of the company – value upwards of $10 a share have been mooted by respected industry analysts.

Amarin shares currently trade at just $3.43 (for a market cap of $1.33 billion), down from just over $24 as recently as December 2019. We should note that there is good asset backing here with net assets of just over $1 billion as at 30th September 2021, $517.9 million of that in cash and investments and no debt. Fellow analysts at SVB Leerink reissued a “buy” stance and $12.00 target price on the shares in September, which implies upside potential of 250%. With the price being so cheap, we would not be surprised if takeover rumours surface once again, with Pfizer having been flagged as being interested in the past. Buy.

ECO (ATLANTIC) OIL & GAS – Current price 17.75p

Eco was in our New Year 2021 picks list and has not really done us proud yet. But, we have high hopes that in 2022 the value being built up in this business will become more widely recognised.

Eco is building an Atlantic margin focused business with offshore plays in Guyana and Namibia. Importantly, in both of these locations, the company has highly prospective licences which are being developed in partnership with majors, which really serves to reduce the risks.

The backstory here is that the company first started trading on the TSX-V in 2011 with Namibian oil interests. Progress was quite rapid and by 2016 the company teamed up with Tullow to acquire a licence in Guyana to explore similar basins in the margins on the other side of the Atlantic Ocean, ahead of becoming dual-listed in 2017. The shares climbed to 190p plus in 2019 following the drilling of two discovery wells in Guyana which confirmed the prospectivity of the upper and lower Tertiary fairways. News that the wells contained sour heavy oil disappointed the market and the share price plunged. Truth is that since that time the stock has remained a bit unloved.

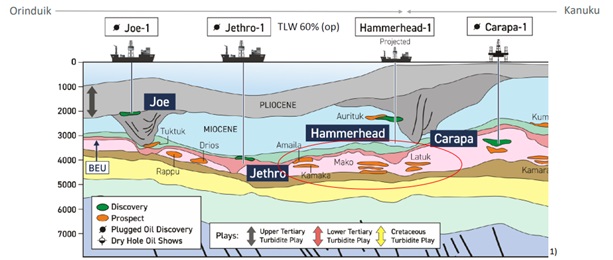

Eco’s Atlantic Margin Plays – Offshore Guyana and Namibia. Source; Company

Delineating drill targets in Guyana

The market seemed to quickly lose interest as the oil that Eco found was heavy, but it has to be pointed out that it is pretty similar to other commercial heavy crudes that are in production around the world. There are plenty of reasons to really believe in the considerable upside potential of the Orinduik licence, especially in the Cretaceous horizon which has shown to bear light sweet oil in the neighbouring Stabroek and Kanuku Blocks.

Orinduk block play diversity and multi-billion barrels perspectivity. Source: Company

On the Orinduik Block, Eco (15% WI) and its partners Tullow (operator, 60% WI) and TOQAP Guyana B.V. (25% WI) have been working to make sense of these discoveries in offshore Guyana, in relation to other discoveries which are close by in order to delineate drill targets which are expected to be established in the near-term. Given all this potential, Eco wants to resume drilling on Orinduik as soon as possible.

Also, Eco has recently taken a 6.4% stake (with warrants to take this holding to 10%) in JHI Associates Inc, which holds a 17.5% interest in the Canje Block offshore Guyana. Recent months have seen ExxonMobil successfully and safely drilling its Sapote-1 well in the Canje Block where hydrocarbon shows were recorded. This ought to provide some decent newsflow with Eco updating the market on technical results of the Sapote-1 well and updated drilling plans on the Canje Block.

Potential catalysts for wider regional success in Namibia

Eco has the second largest footprint after ExxonMobil in offshore Namibia. The company has been approved by the country’s Ministry of Mines and Energy to be the Operator of all four blocks, which total 28,593 km². Offshore Namibia oil exploration has become highly attractive for IOCs and oil majors over recent years. The arrival on the scene of proven oil finder like ExxonMobil, Total, Qatar Petroleum and Shell would suggest that more discoveries could now be on the cards. Eco looks very well-placed to benefit tremendously from any successes in the forthcoming drilling campaigns of Total, Shell, M&P, and ExxonMobil.

At the moment the company is continuing to monitor and assess opportunities, especially in light of the upcoming drilling activity in the region. Most notable are two high impact deepwater wells, Total Energies Venus-1 well and Shell Namibia’s Graff-1 well, which were both spudded in December 2021. Press reports have suggested that the Venus-1X is a world class, basin opening well and if successful could be transformative for Namibia and such a potential success of each or either well would be big potential catalysts for wider regional success.

Smart move into renewables

Last year kicked off with the company moving into renewables by taking a 70% stake in Solear (in partnership with 30% holder Nepcoe Capital Partners) which sources, acquires and develops an exclusive pipeline of potential high yield solar projects in southern Europe. Basically, this move will see Eco becoming a diversified, growth orientated energy company. The first move was acquisition of the Kozani Project in January 2021 and since then Solear continues to assess more projects seeking high turnover, early-stage opportunities.

Solear is seeking to take advantage of a changing energy market and subsequent attractive economics that are driving global solar photovoltaic (PV) energy demand growth. Eco is providing a shareholder loan of up to US$6 million for its 70% stake, which is expected to be repaid either when monetisation of the solar PV assets, or from third party investment into Solear, or project cash flows. At the end of the day Eco will get its US$6 million back and retain its 70% stake in Solear. What a tremendous deal and an excellent use of some of the company’s US$18 million cash pile as it waits to be involved in further oil & gas exploration action. Management is not sitting on its laurels and plans to be active in M&A activity in the industry, whilst at the same time continues to review various opportunities with a view to broadening the company’s asset inventory. So, prepare for some M&A action which could add further sparkle.

We initiated research coverage of Eco in October 2020 with a Conviction Buy stance and a target price of 123.54p. With the share price currently standing at 17.75p, we are very content to reiterate our view.

CORO ENERGY – Current price 0.28p

Coro is a highly compelling regional energy play focused on renewables and gas that is benefitting from the rapidly growing South East Asian economies. It is the old Saffron Energy, which joined AIM in February 2017 with onshore gas producing interests in Italy. Within 12 months a new management team had taken over, led by James Parsons as Chairman, bringing a brand-new strategy for expansion and transformational growth focused on South East Asia. Early 2019 saw Coro acquire a 15% interest in the Duyung PSC in a deal which involved helping to fund highly successful appraisal drilling which saw 2C resources grow by 79% to 495BCF (gross).

There is no doubt that the growth in electricity demand in SE Asia is amongst the fastest in the world due to the rapidly rising population, rising incomes, industrialisation and urbanisation. Coro sees enviable opportunities to supply this market with gas and renewable energy as coal generation still dominates.

Technically low risk large gas field

Duyung PSC is positioned to supply gas to Singapore where premium prices are paid. Certainly, Duyung PSC’s Mako Gas Field is one of the largest gas fields ever discovered in the West Natuna Basin, offshore Indonesia. It is a shallow single tank deposit that is technically low risk. Gas production could start as early as 2024.

There are many ways Coro could fund its share of the development of the Duyung PSC. Management have plenty of confidence in funding with their proven institutional connections. Operator Conrad Petroleum’s current 76.5% holding might be a larger stake than they would want to finance in the development of the project, which could well result in a farm out deal with another E&P company. In such a farm out Coro might well tag along and perhaps get a development carry if they liked the valuation. Or the company might raise fresh capital at that stage and perhaps restructure its debt. If there was a farm-out andCoro tagged along and if the development was project financed on a 40% equity and 60% debt basis, the sort of investment required by company would most likely be in the region of US$10 – 15 million and not US$20 – 40 million.

Successful appraisal drilling campaign on the Mako Gas Field in 2019. Source: Company

There has not been much news out of Duyung in 2021. However, the operator Conrad Petroleum is reported to be doing a good job on keeping it moving although COVID does stop face to face meetings. Conrad has been moving the project forward with its work updating the development plan. It looks as though 2022 will firmly see Duyung back on investors’ radar. Hopefully there will soon be news on the Gas Sales Agreement (GSA) which has been the subject of many rumours, already there is in place a Heads of Agreement with gas buyer in Singapore. This does need a better understanding of the volumes so the revised Plan of Development (PoD) needs to come first, as there may be some domestic production obligation and then the partners will have a proper understanding of the gas volumes that can be exported. With FID now most likely to happen in 2022 after a 2-year development, gas production could begin as early as 2024.

Rapidly rolling out 150MW of rooftop solar projects

The move away from coal towards electrification across South East Asia will require a significant investment in renewables. This in turn is set to increase demand for battery storage to support grid imbalances as well as the growth in renewables. 2021 saw Coro acquire Global Energy Partnership Limited (GEPL) and a 20% stake in ion Ventures, vehicles being used to further the company’s renewables strategy in this region.

The GEPL acquisition came with a portfolio of pre-development assets which its management team had been working on for something like four years. These assets consisted of a large portfolio (2GW) in the Philippines in onshore wind and solar along with a large portfolio in Vietnam. All these projects were at a very early stage but came into Coro where the management has a proven track record of raising the sorts of sums required to finance the development of such portfolios.

Rooftop solar PV scheme. Source: Company

The immediate action will be in Vietnam as the roll out of 150MW of roof top solar can progress quite quickly as the only permitting necessary is gaining fire certificates. In the Philippines, GEPL has large utility scale wind and solar projects which need extended permitting and lots of land. Wind projects need to also collect 12 months wind data, which will be undertaken in tandem with permitting but there is a longer lead time. Realistically, the first solar project in the Philippines could be expected in 2023 and a wind project probably the year after. But it has to be pointed out that the pandemic has hit travel and slowed the management team down.

Bullishly, management is talking about the initial bite sized 5MW project being planned to be in operation in Q1 2022. This will provide proof of concept to reassure management, investors and partners alike. The plan is that the initial 5MW project will act as a cookie cutter to roll out further multiple solar projects that make up the 150MW portfolio. All this might sound quite rapid, but we mentioned earlier on CEO Mark Hood and COO Michael Carrington had been working on these renewable projects in South East Asia for a number of years before they joined Coro. As far as funding the rollout is concerned, Coro has contracted the premier financial advisor in renewable energy projects, Green Giraffe, which is out in the market looking at multiple solutions for company.

Moving into 2022, it does look all to becoming together quite neatly at Coro. We initiated coverage on the company in December 2020 with a Conviction Buy stance when the shares were trading at 0.275p with a target price of 1.50p. At the current price of 0.28p, we have full confidence in reconfirming our stance.

TED BAKER – Current price 104p

Global lifestyle brand Ted Baker (TED) has had a pretty bad time over the past six years or so, with the shares down from highs of £35 to just over £1 as we write. A string of profit warnings have hit the firm hard, as did a misconduct scandal which claimed the head of then CEO & founder Ray Kelvin, with staff alleging that he had implemented “forced hugs”. Then along came the pandemic, forcing most of the company’s physical stores to shut for most of 2020. But following a refreshment of the management team and wholesale review of the business, things now look to be getting back on track.

To understand the current investment case we need to go back to June last year when the company completed a £105 million fundraise, sold its head office for £77.8 million and announced a three year transformational strategy known as “Ted’s Growth Formula”. Along with the balance sheet strengthening, the strategy is looking to drive revenue growth and improve operational efficiency. Some financial targets set out at the time of the plan included medium-term revenue growth of c.5%, an EBITDA margin of 7% to 10% in FY 2023 and free cash flow generation, after capex, of at least £30 million by FY 2023.

At the same time, results for the year to 25th January 2020 (before the effects of the pandemic hit) showed revenues only down by 1.4% at £630.5 million but a reported loss of £70.4 million as new management did a kitchen sink job, booking in £84.6 million of non-underlying expenses, mainly comprising total charges of £45.8 million related to inventory write offs. The pandemic ravaged 2021 numbers meanwhile revealed revenues down by 44% at £352 million and an underlying loss of £59.2 million.

There was brighter news in the most recent results, with revenues returning to growth in the 28 weeks to 14th August this year, up by 17.6% at £199.3 million. A focus on re-establishing the brand’s premium position, combined with the efficiency drive, helped to boost margins, with losses cut by 71% to £25.2 million. Net cash was £12.7 million at the period end, ahead of expectations, and a target to achieve a net cash position was moved forward by one year.

Moving into the second half and things are still looking good with total revenues up by 18% and further margin increases being seen. The transformation plan delivery was said to be on track, with the company in line with or ahead of plan on six of the current financial year’s operational KPIs. Encouragingly, at the time, limited negative impact was being seen from the global supply chain disruptions or rising inflation.

Back in 2018 Ted Baker made a record net profit of £52.7 million and paid dividends of just over £27 million. The current market cap is £187 million, which means that if the company can get back to just half of the 2018 profit figures than the shares would be on a multiple of just over 7.1 times earnings. Half of 2018’s dividend would equate to a yield of 7.2%. We see material value here, as do analysts at Liberum who have a 225p target on the shares, 122% above current levels.

RIVERFORT GLOBAL OPPORTUNITIES – Current price 1.35p

RiverFort Global Opportunities (RGO) is an AIM listed investment company which invests via venture debt instruments in small cap companies across a range of sectors and stock exchanges. Returns are generated for shareholders via a mix of interest and fee income on venture debt instruments, along with equity upside from direct equity investments, warrants and conversion rights. More recently, RGO has been looking for further upside potential by investing in high impact growth companies, at the pre-IPO stage, with a particular bias towards the technology sector.

Riverfort recently announced results for the six months to June 2021, which showed another strong period of progress. These showed a profit of £1.4 million for the half after the investment income continued to flow in and a £1.12 million gain was recorded on changes in the value of the investment portfolio. That helped NAV per share rise to 1.57p, 19% above the current share price.

Recognising the high valuation multiples currently being achieved, RGO has been increasingly making investments in companies operating in fast growing industries, such as technology, at the pre-IPO stage of their development. This is to benefit from valuation increases associated with subsequent sales or IPOs.

During H1 2021, two such investments were made, the first in Pluto Digital Assets. Pluto is a technology development, advisory and specialist operator in digital assets. The company provides exposure to a diversified portfolio of well-established cryptocurrencies such as Bitcoin, Ethereum and Polkadot and new high growth decentralised technologies and projects based around the Web 3.0 infrastructure including Ethereum and Polkadot ecosystems, with a particular focus on decentralized finance (DeFi). In February 2021 RGO invested £300,000 for a 7.5% shareholding, then in March a further £700,000 was invested as part of an additional $40 million (c.£29 million oversubscribed fundraise at 6p per share), giving it a post raise direct stake of 4.2% in Pluto.

The second investment was made in May, with €1.4 million invested in Artificial Intelligence (AI) cyber-security cloud business Smarttech247, as part of a €2.5 million convertible loan which is convertible upon an IPO of the company and pays a coupon of 5%. At the same time, RGO raised £1.64 million for itself via a placing at 1.7p, with the funds being used for the Smarttech247 investment and other opportunities. Smarttech247 is a multi-award-winning MDR (Managed Detection & Response) business and a market leader in security operations, helping its global client base to proactively defend themselves against cybercrime as they migrate to cloud based technology operations.

There is the potential for a near-term valuation uplift here as in August last year Smarttech247 announced it would seek a listing by way of a reverse takeover of AIM listed Conduity Capital, at a valuation, “…significantly higher than the valuation at which RGO invested at earlier in the year”. The deal is currently ongoing.

Alongside the potential valuation uplift from IPOs of these companies, we believe there is further significant upside across the RGO portfolio. A key part of the upside potential from RGO’s investments comes in the form of the warrants it actively seeks out and receives as part of agreed investment packages. To give one example of the returns potential here, in Q2 2020, the company exercised warrants it held in EQTEC with the shares received then being sold at a price 92% higher than the exercise price.

Current warrant holdings include in the likes of Kodal Minerals, Pires Investments, Canadian Overseas Petroleum, and Invinity Energy Systems. Classified as a Level 3 asset under fair value accounting rules, the company’s warrants are valued using the Black-Scholes option pricing model. The resulting figure is then discounted by 75% to reflect the warrants being untraded derivatives and the underlying equity securities being traded on junior markets. As such, returns are only realised when the respective warrants are exercised and resulting shares sold.

Alongside the current discount to NAV and valuation uplift potential, RGO also offers income attractions. A dividend of 0.06p per share was paid for the most recent year following significant cash generation. That implies a yield of 4.44% at the current price.

RISK WARNING & DISCLOSURE – Align Research Limited & a Director of Align Research hold interests in all the companies mentioned in this piece with disclosable interests in Kazera Global, Corcel & Ascent Resources Plc. All companies apart from Ted Baker and Amarin & ECO Oil & Gas are research clients of Align Research. The Director is bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited