Anglo African Oil & Gas – Revision to price target post recent newsflow

If Xmas had not just passed, the phrase “it’s beginning to look a lot like Xmas…! would spring to mind ref news out of Anglo African Oil & Gas (AAOG) in recent weeks. This morning there was the news that Societe Nationale des Petroles du Congo (SNPC) which owns a 44% stake in the Tilapia field is now going to begin reimbursing costs. For some time now AAOG has been funding SNPC’s share of costs and the amount owed was in excess of US$10 million. The company had been hoping to write-off this debt in exchange for an increased stake in the project. This morning’s RNS makes clear that SNPC also see the potential upside in this field.

OK, it might be that at this time AAOG don’t get a bigger stake in the project, but this move provides a good third-party validation of the economic potential at Tilapia. Already the company has received US$663,000 from SNPC. In addition, SNPC plans to imminently propose a short-term payment plan to meet the remining debt of around US$9.5 million.

This news comes rapidly after AAOG outlined the production plan for TLP-103C last week.

The plan is that TLP-103C will produce from the upper reservoirs and basically co-mingle production from R2 and the Mengo, following a double completion and a one-off frack of the Mengo. For the first 14 to 18 months, an initial aggregate flowrate of more than 1,500 bopd is expected just from TLP-103C alone.

Experts have estimated the level of initial production to be approximately 1,200 bopd from the R2 based on first production at TLP-101 and results from SNPC’s two other wells in the R2. In fact, TLP-103C has a thicker oil column than the TLP-101 which is likely to slow the decline. Wells in the Mengo tend to produce between 600 – 800 bopd and a figure of 400 bopd figure has been selected. That actually all adds up to 1600 bopd, so it does seem that the board is being somewhat conservative to us.

At 1,500 bopd, the projected financials apparently suggest around US$1 million of net free cash flow generated per month and a breakeven oil price of just under US$20 per barrel. The timelines run like this: Schlumberger’s fracking equipment is due to arrive in the Congo at the beginning of April 2019 with plans to bring the well into production immediately following the frack. So, the company is suggesting that first production is targeted for late-April 2019.

The message that is coming out loud and clear is that AAOG does not need to raise any money for existing operations. Firstly, it seems that company will now finally receive the US$10 million owed from SNPC plus there will be the strong cash flow from TLP-103C expected within a couple of months. This all looks enough to fund well TLP-104 (Djeno & Vandji) which is likely to cost around £7-8 million and looks to be on the cards to be spudded in August 2019.

The ramifications of the last few announcements allow us to revisit our target price.

The TLP-103C well has been a big success story, intersecting the targeted Djeno horizon where hydrocarbons have been discovered. Wireline logging has confirmed a 12m oil column in the Djeno, proving a functioning reservoir in this formation. The Djeno success came on top of the confirmed combined 44 metres of oil columns across multiple horizons at the TLP-103C well.

A recent presentation unveiled a little more about the drilling of the Djeno. We realise that the next well TLP-104 will be a pure Djeno well and there is apparently an interesting zone 100m below where TLP-103C stopped drilling. The data collected from this well will allow AAOG to optimise the location for the drilling of the TLP-104 well to allow production from the Djeno reservoir at optimal levels.

Neighbouring fields are producing from the Djeno at something like 5,000 bopd per well and we have viewed a successful discovery in the Djeno as being potentially able to deliver a transformational increase in production. TLP-104 is planned to be drilled using a more powerful rig. Not only will this well be targeted at bringing the Djeno into production, but also test the deeper potential reservoirs in the Djeno and the Vandji.

The company will also need to invest further in upgrading the existing topside facilities to cope with the possible level of production that can be expected from Djeno. This is likely to involve the team investigating options for a direct pipeline running 17km to the export terminal at Pointe Noire.

Just going back to the licence renewal, AAOG announced that they have received a letter of intent confirming the intention of the Government to award the company with a new licence over the Tilapia field and which will extend through to 2040. Negotiations over the terms of this new licence are currently in progress and which has already encouraged the company to plan for a full field development programme at Tilapia. We believe that the existing PSA terms could be improved measurably.

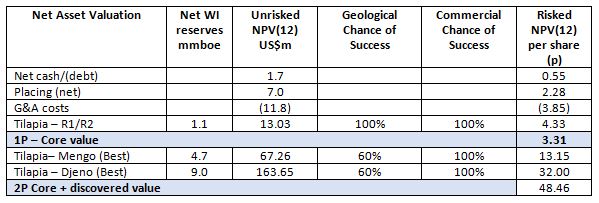

Below we present our revised NAV breakdown with key assumptions:

Net Asset Valuation using a 12% discount factor based on 237.9 million shares on a fully diluted basis and a constant oil price of $65 Brent equivalent. Source: Align Research and current USD/GBP FX rate.

We initiated coverage on AAOG with a Conviction buy stance and a target price of 28.23p. Following the Djeno discovery we have taken the time to look again at our model and the risked Net Asset Valuation. We might be jumping the gun ahead of the forthcoming publication of the CPR, but we have sought to revise our target price based on assuming that the chance of success at Djeno has improved from 25% to say 60%, following the drilling of the TLP-103C well. Based on that assumption, our risked NAV derived using a 12% discount factor, 237.9 million shares on a fully diluted basis and current FX rate, would provide a higher target price of 48.46p. We are thus happy to reconfirm our Conviction Buy stance with an increased target price of 48.46p. At the current price of 10p per share we believe AAOG equity is woefully mispriced.

RISK WARNING & DISCLAIMER

Anglo African Oil & Gas is a research client of Align Research. Align Research & a Director of Align Research own shares in Anglo African Oil & Gas and are bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.