Dryships (US) – another monster short squeeze set up looks to be in place

By Richard Jennings, CFA

In a small departure from our usual approach in highlighting value within largely the UK marketplace, we present what we believe is a very interesting situation in a controversial and obscure shipping stock listed in the US – Dryships.

The chart of the stock over the last 3 months at the bottom of this piece tells the tale. From one of the largest 3 day run ups in history (2000%) the stock has subsequently lost nearly 99.9% of its value over the ensuing period to Friday’s close (27th January). Why? It all revolves around what appears to be a fiendishly complicated financing package with an entity called Kalani Investments Ltd and that essentially provides the company with an equity financing line of $200m. The details can be found here – http://dryships.irwebpage.com/press/dryspr122716.pdf

For those that cannot be bothered to read the minutiae, the financing requires Kalani to buy stock at a discount to any particular days VWAP – the discount being 6%. This gives them a clear incentive to short the stock (and short they most certainly have as they have not appeared above the 5% threshold that would have required a filing with the SEC) once receiving a notice of drawdown from the company at which point they receive the shares from the company to cover their short.

As at the writing date it was disclosed that the company had issued 73.8m shares in relation to this facility in exchange for aggregate gross proceeds of $130.5m. There is thus $69.5m of further drawdown capability remaining and which can be utilised anytime between now and December 2018 (the facility is for 24 months).

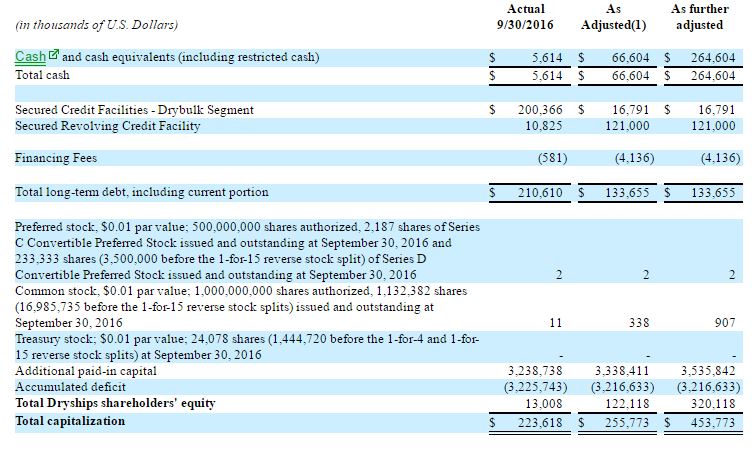

We estimate that current shareholder equity is now approx $383.5m using the prospectus which the company filed on the 27th December (see excerpt below). This is the crux of our belief (in unison with the technical position we shall layout below) in a material upside opportunity at the current price of $1.99c. Following a reverse split on terms of 8:1 on the 23rd Jan 16 there are now approximately 13.5m shares in issue. The market cap is therefore just $27m – a discount to book value (and the ships are hard assets) of over 90%.

Pro-forma balance sheet make up assuming full $200 million Kalani line used

On the 15th December 2016 the company reported net debt (debt minus cash) of approx $90-95m but since then the Kalani equity facility has delivered to DRYS some $130.5m in cash and thus would, based on management’s disclosures, put the company in a current net cash position of @ $35 – 40m – this is more than the current market cap! Management did however announce the purchase of one VLGC for $83.5m that is due in June of this year and the company also has the option to acquire a further 3 VLGC’s for $250.5m. Aswell as the Kalani facility, the company also states undrawn credit facilities of $79m which will be needed if the additional VLGC’s are purchased.

I am drawn to the following statements from management in recent weeks:

“We believe that given where we are in the cycle in both the tanker and dry bulk markets, we are faced with a unique entry point to acquire vessels in these sectors at historic low prices.” And – “This acquisition allows us to deploy the Company’s available liquidity immediately and will be highly accretive to earnings and cash flow. This marks the first acquisition of the Company since the restructuring of its balance sheet and our first investment in the gas carrier segment which we believe has very positive long-term fundamentals.” There is some considerable merit in the purchase of the new VLGC’s too as they are all booked under long term charters with good quality customers and so would appear to back up the recent management statements.

Where it gets really interesting for a trader however is that aside from the now miniscule market cap relative to the restructured balance sheet (supported largely by 19 existing vessels and the new VLGC ordered), the stock has been shorted in extremis in recent days and weeks in the expectation of the final $69.5m drawdown by the company of the Kalani equity line. As the stock price falls then of course the number of shares to be issued increases. Given that there is no immediate pressing need for liquidity as we illustrated above, there is a very good argument for the company to actually delay the drawdown and thus engineer another monster short squeeze. Indeed if they act with any rationality this is precisely what they should do with the shares having a limited free float and so minimise dilution to their stockholders. With the stock running up 2000% on the last short squeeze in early November it becomes apparent just what picture could be being set up here…

In the alternate, and the company does press ahead with the final drawdown (or has been in process this last week) then the share count is likely to rise by around another 15-20m shares (using the last 5 days VWAP). To me this is a still a moot point however as the balance sheet receives the cash and recent scaremongering talk of bankruptcy by misinformed bears becomes even more ridiculous and also, importantly, kills the basis for further shorting anticipating this very event. Net effect? Another short closing episode could be set in motion of which the effects could be dramatic on the upside.

Below is a chart illustrating the almost unprecedented measure of oversold-ness. Indeed I am hard pressed to recall another stock in recent times with such lowly technical measures. When the bounce comes it will likely be something to behold and I wonder whether the market has set itself up for another November 16 type episode. Bear in mind also that 4Q 2016 earnings are due in the next couple of weeks too at which point we will be able to see a snapshot of the current balance sheet with real clarity post the recent financing activities. I suspect this may also be another potential catalyst for a short squeeze.

We can see in the chart below the magnitude of volume turned over in the stock this past week and that the shares have actually fallen every day during January. With over twice the share count traded last Friday and the stock falling to the days lows at the close, if ever there was an illustration of what you could call a selling climax then I would post that this is it! I would guess a good proportion of the shorting carried out in the last few days is of the outright “naked” variety. If so, these will need to be covered before settlement date (3 days in the US). An absence of further selling could cause another mad scramble for the stock along with natural buyers and we can see HERE the most recent short position in DRYS and which shows near 5m shares now short – almost 1/3 of the entire disclosed stock float. Factor in the likely naked position of which my suspicion is it is currently multiples of this however and their is more tinder being laid for a spark to ignite the stock.

On pure fundamentals, and adjusting the carrying value of their existing ships (excluding the new VLGC order) by a blended discount rate of 60% (to be ultra conservative) – using the last disclosed current share count of approx 13.5m – we believe the book value of DRYS is approx $15/16 a share. By any measure, based on publicly disclosed information and the current technical position highlighted here, the closing stock price of Friday 27 Jan of $1.99 presents (albeit high risk) another phenomenal asymmetric risk/reward opportunity to us here at Align and one we have positioned ourselves long for.

CLEAR DISCLOSURE – The author, who is a Director of Align Research Ltd, holds a personal position in DRYS and is bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).