Eco (Atlantic) Oil & Gas – Transformational acquisition adds to offshore Guyana potential

By Dr. Michael Green

This morning Eco announced a real transformational deal that positions the company as the obvious go to small cap play for investors seeking exposure to high-impact drilling programs in three of the world’s most exciting hydrocarbon provinces – Guyana, Namibia and South Africa. The latest news is that Eco has signed a Commercially Binding Term Sheet to acquire 100% of JHI Associates Inc., which includes JHI’s 17.5% WI in the Canje Block offshore Guyana.

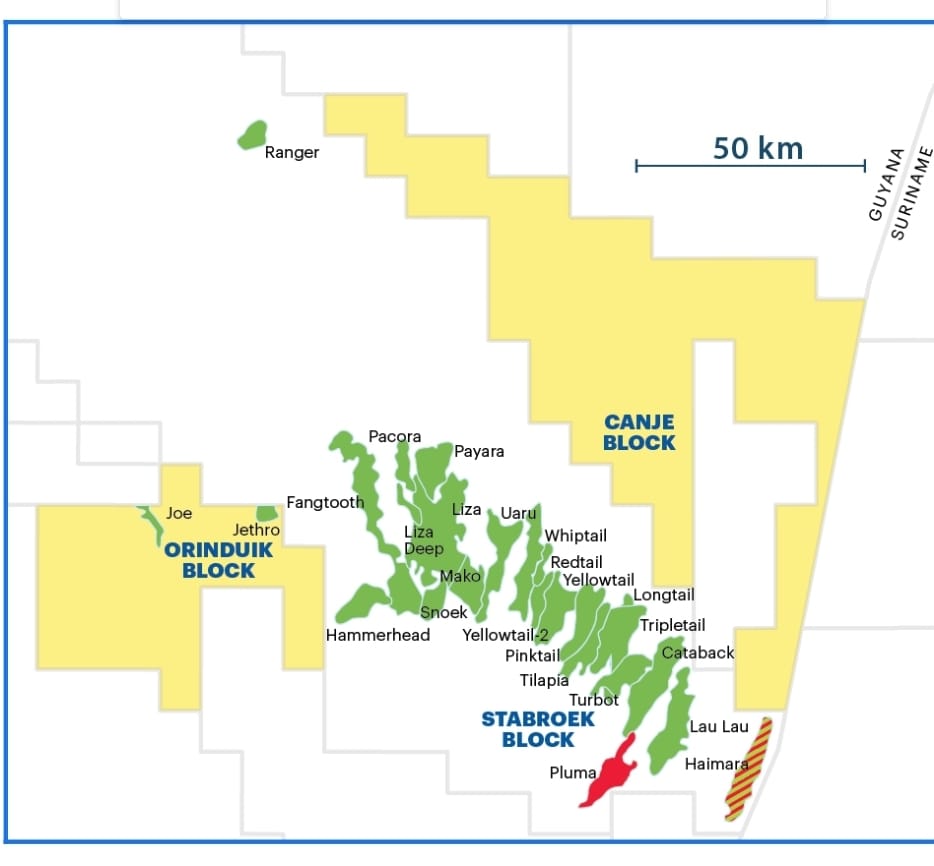

This cracking acquisition is a c.US$52 million all paper deal at Eco’s current share price, which brings into the company not only JHI’s 17.5% WI in the Canje Block, but also its US$15 million cash balance – very handy. It is hard not to get over-excited by this deal as the Canje Block, offshore Guyana, lies directly adjacent to the prolific Stabroek Block where ExxonMobil has a long series of discoveries, finding over 10 billion barrels of oil.

JHI’s shareholders will be issued with new common shares based on an exchange ratio of 1.1994 new Eco common shares and convertible securities. The end result is that JHI shareholders will hold roughly 34% of the enlarged company. JHI will be able to appoint two NEDs to Eco’s eight-member board, which will bring more invaluable high-level exploration expertise into the boardroom.

The deal is expected to close in Q2 2022 but does depend on the signing of an Arrangement Agreement and satisfactory DD being completed by Eco and naturally any required approval from the Government of Guyana, Canje Block partners, as well as the stock exchange.

June 2021 saw Eco take an initial small stake in JHI, which is a private Canadian company. Since that time, the company has obviously gained a really good understanding of the Canje Block and a real appreciation of the expertise of the JHI management team. So much so to cement such a deal. This deal actually gives Eco a 17.5% PI in the Canje Block, operated by Esso Exploration & Production Guyana Limited (35%), a subsidiary of ExxonMobil. The other partners are TotalEnergies E&P Guyana B.V. (35%) and Mid-Atlantic Oil & Gas Inc. (12.5%).

The 4,800km² Canje Block lies roughly 180 – 300km offshore Guyana in depths of water ranging between 1,700m and 3,000m. This is a large block and a highly significant licence area which captures the lower slope and base of slope play fairways, channels and fans outboard of multiple ExxonMobil discoveries in the adjacent Stabroek Block which is lies just up-dip of Canje.

More than 6,100km² of 3D seismic over the Canje Block has resulted in the identification more than three dozen prospects in four proven plays in the Lower Tertiary and Upper Cretaceous confined channels and Lower Cretaceous Carbonate structures. If that wasn’t enough the recent drilling of the Sapote-1 well, coupled with all those Stabroek discoveries, has now firmly shown that there is also the opportunity of yet deeper horizons. The enviable potential at the Canje Block seems truly awe inspiring.

Canje block. Source : Company

At the time, Gil Holzman, Co-Founder and CEO of Eco Atlantic was quick to point out that “This transaction adds to Eco’s strategic acreage position in Guyana and ensures that there will be a number of drilling catalysts over the next couple of years on Eco’s eight offshore blocks. In addition, the enlarged Group will benefit from JHI’s current cash position, adding US$15million to Eco’s balance sheet, further strengthening the Company’s liquidity position. Given Eco’s strategic investor base and proven access to the public capital markets, the anticipated addition of JHI’s interest in the Canje Block and its working capital, will further augment the enlarged Group cash position for its share of all near term exploration programs on its current blocks including: 2B in South Africa where drilling preparations for a late Q3 spud are underway and the Eco Orinduik Block offshore Guyana to follow, Block 3B/4B in Orange basin South Africa and elsewhere in the current and future portfolio of the enlarged entity.”

Crucially, Gil also mentioned that “Ahead of our planned drilling campaign on Block 2B offshore South Africa in late Q3 2022, we are also looking to finalise drilling targets in Eco’s Orinduik Block, offshore Guyana. Demonstrating that, as ever, the Eco team are head down and focused on delivering value for shareholders. We look forward to providing further corporate updates as appropriate.”

We tipped Eco as one of our picked for 2022. But we didn’t foresee such an explosive start to the year with such impressive M&A action which is rapidly expanding the scale of the company and the number of size of its opportunities. This acquisition builds on the Azinam acquisition which Eco was able to announce earlier on this year. All this and now investors are poised for some drilling in highly prospective areas.

Ownership of Azinam has allowed Eco to enter into the frontier region of South Africa as the deal added interests in two Orange Basin blocks. Block 3B/4B is directly correlated to the Graff 1 prospect and Block 2B which is a shallow water block with a previous light oil discovery. That was seen as tremendous news for Eco with its strong licence position in Namibia where it’s for blocks in northern Namibia have more than 2bnbbl of P50 unrisked prospective resources. There had been plenty of interest from the leading international oil companies ahead of these discoveries, which could now generate a veritable feeding frenzy to farm into Eco’s acreage.

There is no doubt that Eco is exploring for oil and gas in some of global hotspots in todays’ hydrocarbon world – offshore Namibia and offshore South Africa, along with offshore Guyana. We recently updated our research coverage on Eco with a Conviction Buy stance and a target price of 114.65p. In recent weeks the stock has been 10p higher than the current 28.50p, we reckon there is a lot more to come and are more than happy to confirm our stance.

RISK WARNING & DISCLAIMER

Eco (Atlantic) Oil & Gas is a research client of Align Research. Align Research holds an interest in the shares of Eco. Full details of our Company & Personal Account Dealing Policy can be found on our website http://www.alignresearch.co.uk/legal/

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor. Align Research is bound to the company’s dealing policy, ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited