Align Research demonstrates its “eat your own cooking” capability

By Richard Jennings, CFA

When we set out to create a new type of research house, one that addressed the issues posed by what is known as Mifid 2 – the separation of research payments from trading commissions – we had in mind an offering to the marketplace that also cut a swathe through the many conflicts of interests inherent in this business.

Almost without exception where there is a research note produced there is some type of potential conflict. Either the research provider is the broker/nomad to the company or is touting for the brokerage/nomadship (in which case the coverage will almost universally be positive) or a note is created (per the Mifid 2 directives to address this) to generate commissions from the fund manager recipients. Additionally, almost all research these days is produced with institutional investors in mind and is usually held behind a firewall. That being said, two relatively new start ups – Research Tree and Research Pool are democratising this access through allowing so called “retail” investors to view the reports and I recommend them wholeheartedly. But still, many of these reports cost the reader hard dollars.

Align’s purpose is simple – to research companies we feel are (a) undervalued and (b) either devoid of coverage whereby the message is not getting out there to the wider market or we have spotted a new angle that is under appreciated by investors. By its very nature this typically leads us towards companies that could be described as small or micro cap and, since our inception, as a consequence of the savage bear market that ended at the start of 2016 – to concentrate on the resources sector.

Uniquely however, our remuneration does not come from receiving the brokership to a company or from the generation of commissions. It does not even come from the requesting of subscription proceeds as multitude “tipsters” offer. Our remuneration comes from approaching only those companies that we believe in and our offering to “get under the hood” of the company in question with capable and well qualified analysts in exchange for equity compensation. Importantly therefore, we are completely aligned with existing investors, management and any new investors that acts upon our research. Our position is openly disclosed in our notes and blogs too and we believe this is the most unconflicted approach out there. Additionally, the company is locked in for a minimum of 6 months in relation to the equity holdings. The cost to our readers of this research? Zip, nada, not a cent aside from their time in reading our reports. Indeed, in all probability the note is also one that most likely would otherwise not have been produced had we not taken up coverage.

What the above approach does of course is concentrate our minds to ensure, as far as possible, that we are correct in our analysis and also that the re-rating potential stands the test of a minimum of 6 months, i.e. there is longevity to the basis of investment. If we are correct then we make money. If we are wrong, we lose money. There is no cleaner or clearer scorecard.

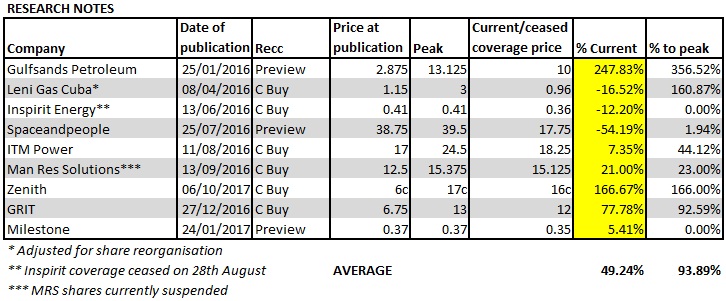

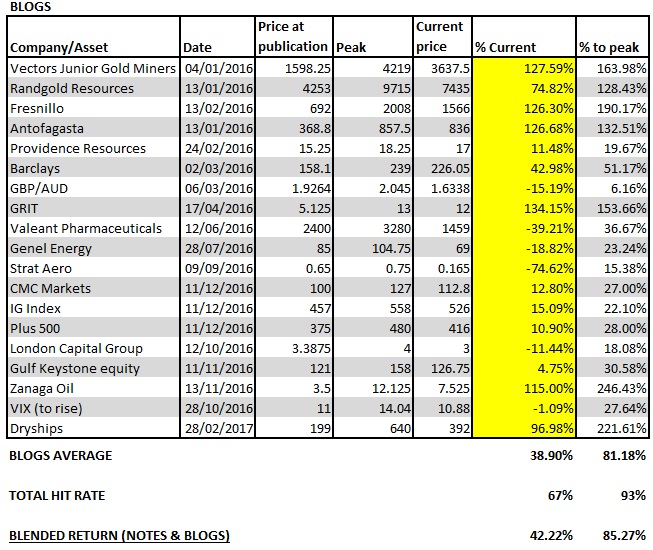

And so, as we complete our first year of operation, we present below the tally of our recommendations and can safely say that we have enjoyed our cooking this last year!

Blended rate returns reflect a simple equal weighted arithmetic average assuming each position was incepted with the same capital amount.