Pricing Gulf Keystone Petroleum equity in a bid scenario

By Richard Jennings CFA

Following on from our post restructuring GKP blog HERE in which we attempted to establish fair value for the restructured GKP equity, it did not come as a surprise to us to see the news on Tuesday that China’s SINOPEC was mulling a takeover bid for the entire equity of Gulf Keystone.

With the shares trading at just 125p prior to the announcement, the stock was some way off even our own conservative base case valuation, most likely as a consequence of the frankly laughable low ball bid tabled by DNO of just over a pound a share (in the post consolidated form) and that many market participators had anchored their valuation expectations to. What must be remembered for any observer of GKP’s equity however is that the DNO bid was very opportunistic – they were appealing directly to the bond holders who received over 80% of the restructured entity’s equity value and DNO pitched the offer at a price that they believed would appeal to the Senior note holders in making this investor class whole (and some). Rather like the situation of a bank or debt originated owner of a house that simply wants his money back following a repossession and is largely indifferent to the true value. This assumption looks like an error on DNO’s part at this point.

The GKP Board made clear in late summer that they would not engage with DNO until the balance sheet restructuring had been completed and so it is, in our opinion, testimony to others perceived value in GKP’s assets that new players have emerged now (the news reports of last week pointed to other potential bidders). SINOPEC of course already have a strong existing interest in the Kurdistan and Iraq & Syria regions of the Middle East through the prior acquisition of Addax Petroleum and so the swallowing of GKP by SINOPEC makes a lot of commercial sense for them given their experience in the region. It looks to us like they see a renewed upswing in the oil price cycle (as we do and as we flagged HERE over 2 months ago ahead of a 20% rally) and that those companies whose stock prices trade at lowly EV/2P values are now fair game for predators.

With the above in mind, and in the almost complete absence of any recent analyst commentary, we attempt to establish what the final takeout price of GKP may be should a bid proceed.

We make the tempering point that any expected bid price is likely to be very different to what the company is really worth. Remember that any bidder would only pay a price that they also see upside from once under their control. We believe the base case value to be 200p per share as our last piece on GKP laid out but that does not mean that the equity will be bid for at a price in excess of this. In fact, given the post restructure shareholder list does still comprise a meaningful portion of former bondholders, sadly for legacy shareholders this will, in all probability, act as brake on price expectations. Additionally, management do not hold large stakes and so this typically acts as a dampener on takeout prices as they do not have such an aligned and vested interest.

On the plus side however we have a company now with a relatively solid balance sheet, a supportive background of rising oil prices, dwindling supply of new oil stocks globally over the 2018-22 period given the almost complete shutdown of development in the last 2 years by the industry, more regular payments from the KRG to GKP recently and now 2 confirmed parties with an interest in acquiring the company and thus setting up for a potential auction. Of course, should a 3rd or 4th bidder emerge then the latter point would add even more fuel to the upside in the equity value.

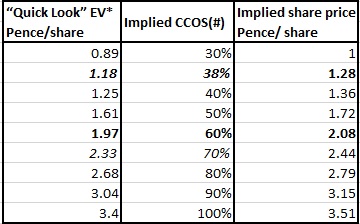

We originally ascribed a 60% CCOS (“chance of commercial success”) to the company’s reserves of 360mb net WI (2P) even though the CCOS estimate should really be higher in deriving our see through price (pre the 100 for 1 consolidation) of 2.08p per share (see table below):

Put another way, at the current stock price, the current Enterprise Value is a shade over £300m (the disclosed last cash figure of $104m pretty much cancels the outstanding debt of $100m and we assume no drawdown on the $45m senior facility that was put in place by management recently). With 360mb of net 2P reserves then we can see that the market is currently valuing these at effectively 83p or just $1.08c per share (based on current FX rate). By any stretch this is a very low figure. DNO trades around $2 a barrel and their Tawke, Dohuk and Erbil fields are in the same region. To apply a near 75% “management” discount to GKP is very heavy indeed and illustrative of precisely why GKP have found themselves on the receiving end of a second bid approach.

What the above means re the disparity between DNO in particular and GKP is that DNO can offer meaningfully more for GKP if their own paper is used and it would be balance sheet enhancing for DNO. For SINOPEC, they have paid much more than this for reserves (albeit under a different oil price environment) and if we assume a typical 25-30% bid premium to the average price of 125p over the last 3 months we arrive at circa 160p. With 2 bidders in the frame, one with extremely deep pockets and the other with premium paper, our best guess is a final takeout price, should a bid succeed, of around 180p per share.

Accordingly, at the current stock price of 134p we see no equity downside on a valuation basis here at Align (assuming oil prices do not return to the $20+ region of course) but the potential for circa 50p upside in the event of a bid being tabled and put to shareholders in the New Year.

CLEAR DISCLOSURE – A Director of Align Research Ltd holds a personal interest in both Gulfsands Petroleum & Gulf Keystone equity and is bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).