Kazera Global – Blue-sky potential of a world-class tantalum mine perfectly positioned for the new “green” economic revolution

By Dr. Michael Green

Over recent months the Kazera story has been really coming together, with all the pieces now seemingly in place for the obvious generation of substantial value going forward. The commencement of diamond production is set to provide the cash flow to facilitate production of heavy mineral sands (HMS) with licence news hopefully imminent and of course further development of the company’s cracking tantalum project.

The potential of Kazera’s world-class tantalum asset seems to be poorly understood by the market, which is why the stock had been trading at a shell company style valuation, just because it needed cash to progress. As per the last RNS (see HERE) this could be about to change dramatically. Quoting Director Dennis Edmonds – “Further to progress being achieved in South Africa, discussions at the most senior levels with future investors in Namibia continue to progress positively, with multiple investors now having visited the site and completed due diligence to support the building of the water pipeline from the Orange River. This is a very valuable process for Kazera, and we look forward to further engagement with these investors”.

Tantalum is ever so important for the electronics industry, where it is required for high performance applications such as capacitors, superalloys and other uses; as well as having critical uses in aerospace and defence and, as a way to play the “green” revolution, a key component of the all important batteries to be increasingly used in electric vehicles in the future.

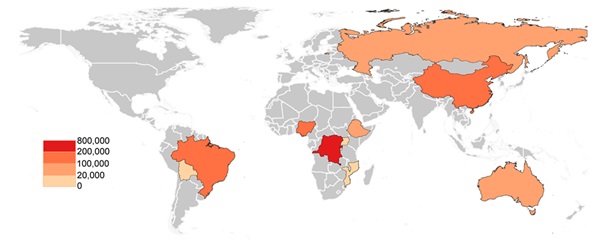

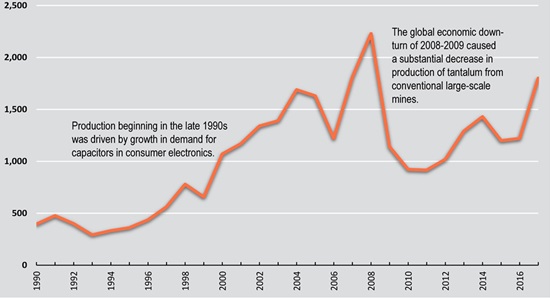

World tantalum production is pretty small and comes from just a few regions and producers. There are big changes going on in the regional supply of this critical material which seems to underline Kazera’s potentially important role in the industry moving ahead. The tantalum market has been affected by rapid changes in the balance of supply-demand, which has resulted in plenty of price volatility.

World production of tantalum concentrates 2017 (Kilograms of tantalum content).

Source: American Geosciences Institute

World production of tantalum concentrates 2017 (metric tons of tantalum content).

Source: American Geosciences Institute

|

Country |

Mine production |

Reserves |

||||

|

2015A |

2016A |

2017A |

2018A |

2019E |

||

|

Congo (Kinshasa) |

350 |

370 |

760 |

740 |

740 |

n/a |

|

Rwanda |

410 |

350 |

441 |

500 |

370 |

n/a |

|

Nigeria |

na |

192 |

153 |

200 |

210 |

n/a |

|

China |

60 |

94 |

110 |

90 |

100 |

n/a |

|

Brazil |

115 |

103 |

110 |

250 |

250 |

34,000 |

|

Australia |

na |

na |

83 |

23 |

20 |

55,000¹ |

|

Ethiopia |

na |

63 |

65 |

70 |

40 |

n/a |

|

US |

– |

– |

– |

– |

– |

n/a² |

|

Other |

117 |

45 |

83 |

101 |

109 |

n/a |

|

World total |

1,100 |

1,220 |

1,810 |

1,890 |

1,800 |

>90,000 |

¹ – JORC compliant reserves of 14,000 tons.

²- The US has about 55,000 tons of tantalum resources in identified deposits, most of which were considered uneconomic at 2019 prices.

World mined tantalum production and reserves (tons).

Source: US Geological Survey, Mineral Summaries Annual Reviews

Over recent years, the economics of traditional tantalum mining in Africa has been undermined by low-cost Australian production of tantalum which resulted as a by-product of lithium mining. Production from down under has been growing swiftly and accounted for 5% of world production in 2018. Despite a wobble in the lithium market in 2019, Australian production grew to 17% last year and the country’s share of the global tantalum market is expected to account for more than 20% of global production in 2020.

Demand growth of 4.6% CAGR until 2029

Leading commodity markets researcher Roskill, in its outlook to 2029 for tantalum, sees the need for this important material rising 4.6% per year from 2019 to 2029. High performance capacitors are expected to continue to represent the largest application, which accounted for something like 36% of tantalum’s estimated demand of 2,000t in 2019. However, the biggest growth in demand is expected to come from chemical applications and tantalum mill products.

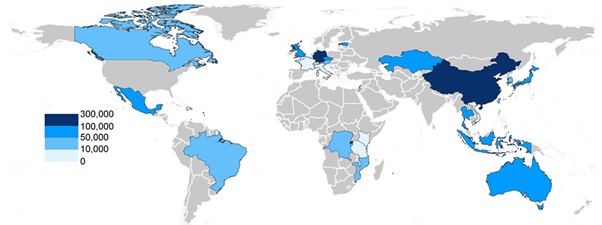

US imports of tantalum 2017 (Kilograms of tantalum content).

Source: American Geosciences Institute

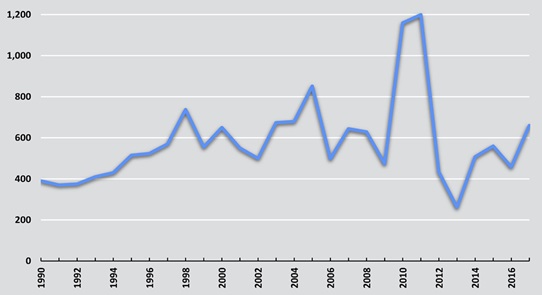

US apparent consumption of tantalum (metric tons of tantalum content).

Source: American Geosciences Institute

Roskill seems to be in no doubt that tantalum is set to be a big beneficiary in the wholescale move towards the electrification of our homes and vehicles. They believe that increasingly tantalum is seen to have an important role to play in a wide range of future products ranging from ensuring performance of the next generation of electrical devices and communications technology right through to making sure that self-driving EVs get around safely.

Increasing supply chain transparency

African tantalum production largely comes from the Democratic Republic of Congo (DRC) and Rwanda, where its mining has courted controversy as it has been deemed to have helped finance conflict. In 2012, the US Securities and Exchange Commission adopted a rule mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act which required companies reporting to the SEC to publicly disclose the origins of the tantalum they buy in order to restrict the use of conflict minerals that originated in the DRC and adjoining countries.

This legislation is being aped by the EU which next year brings in its Conflict Minerals regulation which means that more and more emphasis is being placed globally by governments and industry on the transparency of the tantalum supply chain. Given Namibia’s stable status this is music to Kazera shareholders ears.

Tantalum prices have been historically quite volatile given the changing complexion of this small market. The material had been merrily trading at around US$100/lb in mid-2018 based on 30% Ta2O5 concentrate cost, CIF (cost insurance and freight paid by seller) into China. As production ramped up from Australia, the price fell to the US$54/lb mark by Q3 2019. However, price recovery saw prices around the US$65-70/lb mark being reported ahead of the disruption caused in metal markets by the COVID-19 pandemic.

Tantalum is on the critical list

Recent years have seen investors flocking to rare earth stocks like moths to a flame, creating some bumper corporate valuations. Along with the rare earth elements on the list of critical metals are also manganese and tantalum.

This is all because tantalum has a high thermal conductivity. Around two-thirds of current production goes into electronic capacitors which are a vital component for today’s smart phones and all sorts of modern technology. Here we should mention that the US relies on tantalum to build basic circuitry in guidance control systems in smart bombs along with the on-board navigation system in drones. That is not to mention, tantalum is also needed for US anti-tank systems, robots and most of its weapon systems.

China has a stranglehold on rare earths and the US has been in the process of attempting to reduce its reliance on China for such critical metals. To this end, the US needs to rapidly establish alternative sources of supply from elsewhere in the world. For tantalum there are few places to go. So little tantalum is produced in the world that pure tantalum plays like Kazera are a fairly rare beast.

High-grade world-class tantalum project

Given the rapid growth expected for tantalum, Kazera’s project could well come onstream with impressive timing. It must be pointed out that the company’s Namibia Tantalite Mine really scores for a number of reasons. Firstly, the material is of an attractively high grade. Secondly, Kazera is operating in a really stable jurisdiction. Thirdly, the production from this operation is clearly conflict free. Last but no means least the tantalum has low radioactivity. To cap it all, there is also impressive lithium potential. Below we investigate these important factors.

The Tantalite Valley which is the home of Kazera’s project is so named due to the high-grade tantalite that occurs in various pegmatite ore bodies that outcrop in this mountainous area of southern Namibia. Tantalum minerals occur within carbonatite and alkaline rocks known as pegmatites, the most economically significant mineral being tantalite (Fe, Mn) Ta2O6 which is the primary source of the chemical element tantalum. Here tantalite is found in 5mm – 50mm coarse crystals.

Stable, investor friendly jurisdiction

There is no doubt that Namibia represents a stable jurisdiction. The country is a multi-party, presidential democracy which has now enjoyed 30 years of political stability and peace. It is a very good place to do business, as was highlighted in a recent Fraser Institute Mining Company Survey which ranked Namibia as the second most attractive African investment jurisdiction based on a combination of regulations, licencing, political stability, geological database, infrastructure, mining tax regime, among other factors.

Conflict free production

Users of tantalum are encouraged to demonstrate that their supply chain is transparent to ensure that conflict-free tantalum is procured. As African tantalum production increasingly comes under pressure from both global governments and industry for increased transparency of its supply chain, Kazera scores highly as its production is clearly being seen to be conflict free. The reporting method is through a rating carried out by ITSCI or a similar global conflict free system. Most of the African countries are either rated level lll or level ll, three being the highest risk with two being any country attached to those level lll countries. Kazera’s mine boasts the lowest risk rating of level I which is considered to be conflict free.

Low radioactivity

A highly important differentiator is that Kazera’s production has none of the problems of tantalum concentrate sourced from Mozambique which has high (Class 7) radioactivity levels. Production from there needs be mixed with silica to reduce the level of radioactivity to allow it to be shipped. On arrival, the silica has to be removed, which adds two additional processes and significant extra costs. In fact, there is scope to use Kazera’s concentrate to reduce the overall level of radioactivity in Mozambique tantalum as well as other class 7 producing areas in order to make it shippable.

Blessed with bonus lithium potential

In addition, this high-grade world-class tantalum project also has growing lithium potential. Lithium represents a huge bonus which Kazera almost gets for nothing as the tantalite mineralisation contains lithium and at the same time, impressive lithium grades also come with good levels of tantalum.

In 2018, licences over 1,500km² adjacent to the Tantalum Valley were acquired by Walkabout Resources (ASX:WKT) where more than 600 pegmatite bodies have been identified together with more additional pegmatite swarms. On this neighbouring property, structural control has led to the identification of Lithium-Caesium-Tantalum LCT-type enrichment pegmatites with grades as high as 1.6% Li2O5. Demand for lithium is rising dramatically for use as a battery metal where the World Bank in its recently updated “Minerals for Climate Change” forecast that demand for lithium, cobalt and graphite could climb by 400-500% by 2050 in a scenario where global warming is limited to 2°C.

Just add water

We have never had any doubts about the quality of the asset, which is a demonstrably high-grade tantalum project in Namibia. Ok, so far, commercial production has been elusive at the mine due to a lack of water. A 13km pipeline from the Orange River would solve this problem, coupled with some plant upgrades, and cost US$3-5 million. Now investors can begin to see that the plan to utilise the potential cash flows from diamonds and HMS to provide the funding runway to fully develop this large-scale world class tantalum opportunity is beginning to be successfully unfurled.

The impressive progress on the ground in South Africa seems to be matched with developments in Namibia. Matters seem to be hotting up at this world-class tantalum play with compelling news as regards the financing for the Orange River Pipeline. Already, potential investors have been on site and successfully completed their due diligence investigations. It does seem that events could be moving rapidly ahead here as Kazera is now in advanced negotiations with no less than three major Namibians investor for a substantial equity investment into the company.

Final terms of such investment remain under negotiation and are the subject of regulatory clearances in Namibia. As with all these things, while the board remains optimistic, there can be no guarantee that such negotiations will be successful or what sort of terms might be demand. This Namibian investor cannot afford to hang around as waiting in the wings are two other groups which have both completed DD and are thought to be in the midst of preparing investment proposals. As the largest shareholders in the Company we would certainly not be supportive of any investment that is at the current material undervaluation and which we have made clear to the company.

We initiated coverage on Kazera with a Conviction Buy stance in early August 20202 at 0.70p with a target price of 2.50p. We believe this is a unique proposition in the small cap minerals resource space and that we are on the cusp of a transformative period. At 0.975p, we are more than happy to reconfirm our highly positive recommendation.

RISK WARNING & DISCLAIMER

Kazera Global is a research client of Align Research. Align Research & a director of Align Research own shares in Kazera Global and are its largest shareholder who are bound to the company’s dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited