Kazera Global – transformative investment at over 100% premium to current stock price – 2.7p. Buy!

Well, the eagle most certainly has landed (the Eagle being Kazera’s logo). Over the past four months or so, the board has made no secret of the fact that a succession of potential investors has been taking a good look at Kazera with the aim of providing the cash to put the company’s world-class tantalum mine in Namibia back into operation.

It has certainly been worth the wait as this morning astute investors have truly received manna from heaven. Kazera will shortly (all that is now required is for the Namibian receiving bank to process the funds) be on the receiving end of €9.13 million at a price of €0.03142 per share, which is 2.70p to you and me. This price is well in excess of the current share price to state the bleeding obvious; but this isn’t the only good news.

The issue has been priced at this sort of level to reflect the company’s net asset value when taking account of developments and prospects in the diamond and HMS operations – although the statement this morning stopped short of saying as much. In mathematical terms, the £7.87m in sterling sum will result in the investors owning just shy of the all-important 30% of Kazera which would have triggered a bid.

The money is coming in two tranches. First will be a combined €6.64 million which will consist of €2.49 million of straight equity and €4.15 million of convertible loan which is convertible at Kazera’s instigation subject to the company meeting certain progress criteria. Tranche number 2 is a €2.49 million convertible loan which Kazera will be able to drawdown on or before 30 June 2021. The subscription price and the price upon which the loan will be converted is €0.03142 per share (2.7p per share).

The first payment only needs the approval from the Namibian receiving banks. Here we should mention that this investment into Kazera by the Namibian investment partners is a part of a much larger group of strategic investments which is expected to be completed at the same time, and because of the amounts involved, extensive DD has been required by the Namibian Central Bank, the participating commercial banks and the EU-based sending bank. Thankfully that process is now in the closing stages.

At the time, Larry Johnson, CEO, was quick to point out that – “The proposed investment will be transformational in allowing us to build the water pipeline, construct the tailings dam that will enable us to recover water whilst facilitating waste storage in an environmentally sound manner, and to bring the processing plant back online. It will also allow us to continue to explore the vast property with a third phase core drilling program, so adding further valuable resource to our world class tantalum and lithium assets. We will also be able to continue exploring other opportunities available to us and to accelerate progress on our recent investments in South Africa. …” This comment by CEO Mr Johnson clearly hints at material increases in the company’s current JORC main resource estimate.

The other good news concerns diamond production where 242 carats were recovered in February 2021 (noting however that the company still has material amounts of diamond bearing gravels to process) which, assuming a highly conservative sale price of $200 per carat, means that the South African diamond division should now be covering its overheads. Better than that, the operation looks to be on the verge of decent profitability. Due to the higher grades expected from the new block combined with receipts from the joint venture (which were both mentioned in a recent announcement) this has the prospect of making the diamond operations a major cash generator for Kazera in the near future.

As if that was not enough, the HMS operation acquisition deal looks like it will imminently be given the OK by the DME in SA. The route of the problem is that there have been big delays in processing mining rights applications in South Africa. These matters have recently been raised in the South African Parliament and the local feeling is that a number of pending cases will now be dealt with reasonably quickly. Vendor Tectonic Gold has done the decent thing and continued to show their support for the HMS project by agreeing to an extension to 30 June 2021.

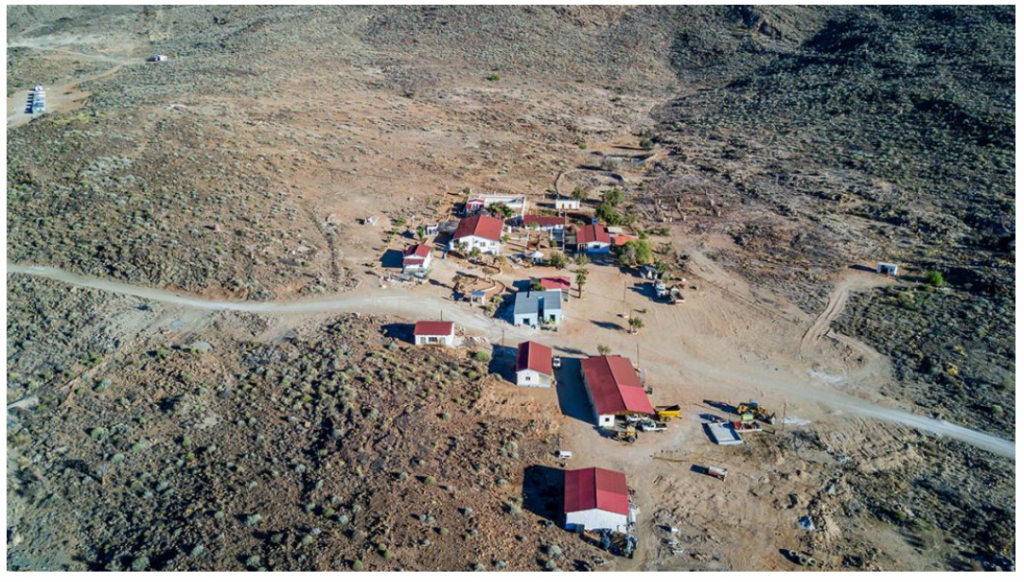

We have never had any doubts about the quality of the company’s flagship Tantalite Valley Mine asset which is a demonstrably high-grade tantalum project in Namibia – indeed with its low radioactivity one of the most attractive deposits globally. So far, commercial production has been elusive at the mine due to a lack of water. A 13km pipeline from the Orange River neatly solves this problem, coupled with some plant upgrades which are all now going to get funded. In short, this investment totally transforms the landscape for shareholders and which as largest shareholder we are delighted with!

We initiated coverage on Kazera with a Conviction Buy stance in early August 2020 at 0.70p as per HERE with a first target price of 2.50p. Given the magnitude of this investment and the use of these funds means that we will doing a full update note shortly. Readers of our initial note will be aware that the target price was heavily discounted. Our unrisked NPV (and still at a heavy 12% discount rate) equated to $36.85m. With a likely resource upgrade, the lithium being brought into play and the HMS side also to be heavily unrisked upon licence approval we are likely looking at a £40-50m market cap, cash funded and cash generative company before the year is out. Based on the enlarged share count this would give us a new target of between 4-5p.

Buy now if you can at a discount to the material investment by the new investors while you can.

RISK WARNING & DISCLAIMER

Kazera Global is a research client of Align Research. Align Research & a director of Align Research own shares in Kazera Global and are its largest shareholder who are bound to the company’s dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited