Kore Potash – Updated PFS at DX project shows attractive financial returns

By Dr. Michael Green

This morning Kore Potash brought investors good news on the updated PFS for the company’s number two potash project, DX. In our view, this demonstrated that very attractive financial returns could be achieved from modest capex.

Kore Potash is a large fertiliser play that has been developing the Sintoukola potash basin in the Republic of the Congo (RoC) since 2010. Kore has a district scale development with 6 billion tonnes of potash, just 15km from the coast where way more than US$230 million must have now been spent. The flagship 2.2Mtpa Kola project came through the DFS with flying colours and as attracted the attention of the Summit Consortium, which is seeking to fund the project into production.

At the moment, contractual terms are being negotiated prior to accepting the Engineering, Procurement and Construction (EPC) proposal for the construction of Kola being provided by SEPCO Electric Power Construction Corporation (SEPCO), the engineering partner of the consortium. An agreement on the EPC terms is expected to lead on to Kore being presented with the financing proposal for the full construction cost of Kola by SEPCO. But enough of that for now, today we are focusing on Kola’s little brother – and as we all know younger brothers can be smarter than their older brethren.

In the shadow of the company’s flagship Kola project, the smaller Dougou Extension (DX) Sylvinite Project is being moved ahead. The DX Prospect lies immediately to the west of Dougou Deposit and is located within Kore’s Dougou Mining Licence, covering an area of some 10km by 15km. DX also lies southwest of Kola, which will be a separate development. The board was seeking to design a project that could be brought rapidly on stream with capital costs of under US$300 million which made it financially possible for a greenfield operation in RoC. The DX Sylvinite Project was conceived with these twin objectives in mind and is being developed as a scalable solution mine.

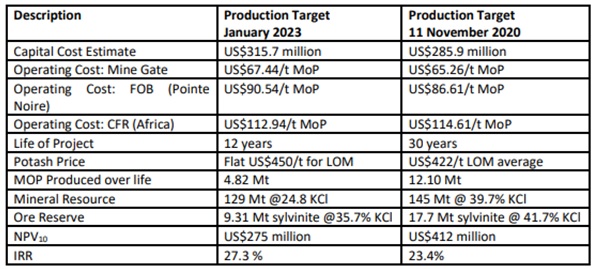

Today’s announcement focuses on update of the JORC (2012) compliant Mineral Resource, Ore Reserve, Pre-Feasibility Study (PFS) information and Production Target at the DX Project. First thing to realise is that more drilling plus impressive interpretation of the geophysical data has given the management team a smaller, better delineated and better understood sylvinite deposit but still with substantial ore reserves. The PFS results in a nutshell are shown in the table below.

DX – summary of production target economic evaluation. Source: Company

The production target of 15.5Mt sylvinite at a grade of 30.63 % KCl demonstrates an initial project life of 12 years at a production rate of 400,000 tpa Muriate of Potash (MOP). The production target is based on the mining of the proven and probable ore reserves and just 13% of the Inferred Mineral Resources that represents 30% of the life of project MOP production.

As mentioned from the outset, these numbers serve to really highlight that the DX project could offer very attractive financial returns from a modest capex. The NPV 10 (real) comes out at US$275 million with a 27% IRR on a real post tax basis at life based on a project average granular MOP price of US$450/t. The payback period is less than 3 years from first production. We see this as an attractive smaller scale MOP project that could generate very interesting amounts of cash.

The MOP price for the life of the project averaging US$450/t has got to be seen as being highly conservative given what is going on in the wider potash world. At higher potash prices the DX project could make enormous amounts of cash. It is important to realise that the DX project creates additional optionality for Kore on top of its larger Kola project.

At the time, Kore’s CEO Brad Sampson was quick to point out that “We are pleased to be able to update shareholders on the value of the DX project. The most recent drilling and geophysical data has further improved confidence in the DX Deposit and the economic attractiveness of the DX Project. The updated resource further confirms this Project to be a low operating cost potash operation that can produce approximately 400,000 tonnes per annum of MOP. What makes DX unique is its low capex and shallow deposit containing high grade potassium chloride, qualities which are very rare in the potash industry.”

There does seem historically to be very little slack capacity in the supply and demand of potash. Sanctions against Belarus in 2020-21 took out a large chunk of the world’s potash supply. The war in Ukraine and Russian sanctions have also taken out another large chunk of potash supply. Depending on who you talk to, six months ago between 10-20% of potash was unavailable and effectively off the market. So, as long as sanctions continue against Russia, high potash prices look like they are going to prevail.

These global events have highlighted the need to develop more potash projects but both Kola and DX are unique because of their location on the coast and being extremely close to the Brazilian and African markets. Interestingly enough, last heard Brazil was still getting potash from Russia (although erratic), so the country is desperately searching for new sources to significantly reduce this dependency.

The potash market looks to be playing into Kore’s hands as the company is positioned to replace potash supply from the northern hemisphere. Not only are the company’s production costs enviably low, but Kore is also blessed with having the shortest shipping route to the giant Brazilian market and the fast-growing African market. We believe all the pieces are now almost in place to allow Kore to commence a dramatic growth trajectory.

In May 2021, we updated our analysis on Kore Potash with a conservative price target of 11.2p and a Conviction Buy stance when the stock was trading at 1.175p, and since then it has been as high as 1.8p. So with the shares now standing at 0.775p, we see a chance of a second bite of the cherry and are more than happy to reiterate our Conviction Buy stance.

RISK WARNING & DISCLAIMER

Kore Potash (KP2) is a research client of Align Research. Align Research holds a position in Kore Potash and cannot be seen to be impartial in relation to the share price outcome. All employees and analysts are bound to the company’s dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk. You should also assume, given that the majority of Align’s fees are received in stock, that for general corporate cash management purposes including taxation, that divestments of investments held will take place as and when, in Align’s sole discretion, it is deemed appropriate.

This financial promotion has been approved by Align Research Limited