Cuba: Block (9) read through to MEO Australia & Leni Gas Cuba

By Mark Parfitt and Richard Gill, CFA

The technology start-up world is replete with tales of the all important “timing” being the key for successful companies. Indeed, whole ‘TED talks’ are devoted to the very subject.

Investors however are more often than not to be found fretting about day to day commodity price movements rather than actively seeking out long-term value creation. Then the funniest thing happens: key news events for the very natural resource players they purport to follow assiduously are overlooked or just plain neglected, which is odd when a well-executed strategic entry into an underdeveloped fairway can potentially generate exceptional shareholder value extremely rapidly. So much for efficient markets…

Now, obviously this does not happen all that often but when it does, it has the potential to change not just the valuations of the respective companies involved but, on rare occasions, the whole way an area, a country or even linked national economies function. We think just such a (dare we say seismic) event may now be emergent in Cuba and that its ramifications will be manifest.

Last week a teaser was released by ASX listed MEO Australia which gave the first update on the company’s key Block 9 Cuban onshore acreage. The ASX release is a technical assessment detailing one of three onshore plays identified, focusing crucially not on shallow heavy oil belt prospects but on a deeper lighter oil play:

– Lower Sheet Play (approx. 2,000-3,500m in depth) details released

– Upper Sheet Play (approx. 800-3,000m in depth) still to be released

– Shallow Tertiary Play (approx. 400-1,200m in depth) still to be release

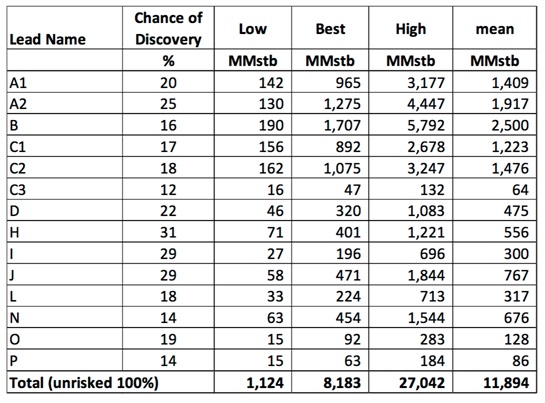

The ‘Lower Sheet Play’ at a depth of between 2,000-3,500m is the only play specifically detailed in the ASX release. Described as a conventional fractured carbonate play with strong similarities to existing producing fields in Cuba, 15 prospects are identified with details on volumetric potentials for 14 of these. Notably, this first release only describes the partial potential of west and centre of the block indicating the need for future seismic works. Yet what is described is already appraised to hold an aggregate potential of 8.2 billion barrels of initial oil-in-place.

Read that again.

Yes. That did say 8.2 billion barrels of oil-in-place, it was not a typo. Further additional seismic will be required to delineate initial assessment also to the east of the block and it is worth reiterating that this release only covers one of three identified plays.

The prospective recoverable resources estimated from these targets are of course but a fraction of the headline values, yet they are significantly material to investors in the two micro-cap listed companies involved:- ASX listed MEO Australia and Leni Gas Cuba (which is to conclude the reverse into Knowlton Capital and relist in Canada on 12th July 2016). Leni Gas Cuba currently holds a circa 15.8% stake in MEO.

Unrisked, aggregate gross prospective resources total 395 million barrels gross (best net estimate & 276mmstb net) but the company is talking about potentially high quality light oil here, not a biodegraded low value shallow oil and that is from just a part of the first of the three plays from within the 25 year licence which is held – one of only a few available to non Cuban entities. Significantly, more value bearing details are yet to come on a low cost onshore PSC with a number of prior oil discoveries including the Montebo Filed that sits in the middle of Block 9 and which was the first commercial oil field in Cuba with historic production of circa 6 million barrels at 60 API oil. This reduces exploration risk, all of which is flagged by the very nature of the release.

First an overview…

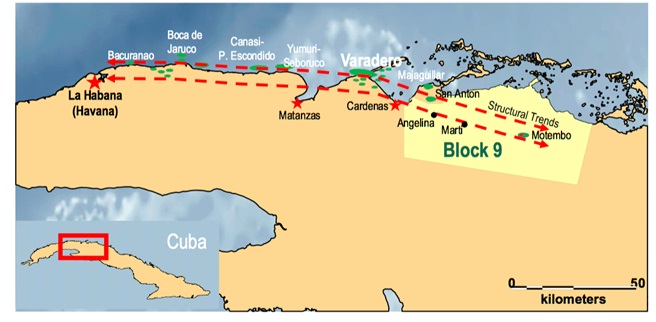

Take a glance at the overview orientation map below:-

Wide scale overview map of Cuba illustrating the location of the block, the wider regional trend associated with the geology and some of the on-trend fields already discovered. Source MEO Australia.

We can see Block 9 PSC in more detail. Aerially, it covers some 2,380km2 mostly onshore along the north coast of Cuba being situated to the East of Cardenas and is, importantly, located within a proven hydrocarbon system with multiple proximal shallow heavy oil producing fields, close to existing, if modest pipeline infrastructure.

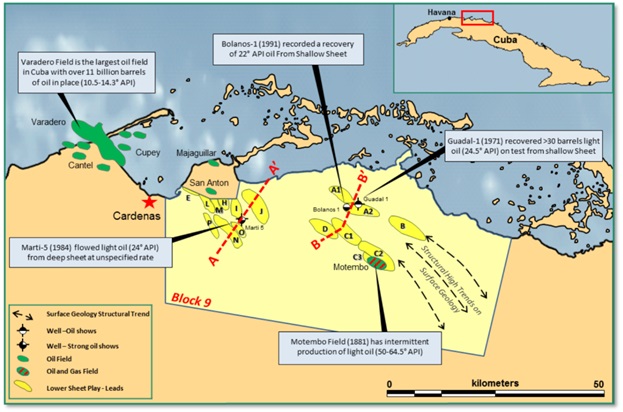

Figure 1. Block 9 location map showing Lower Sheet Play prospect outlines, adjacent fields and including some oil test and production details. Source: MEO Australia.

Local fields include the Majaguillar and San Anton fields which lie immediately adjacent to Block 9 and the on-trend multi-billion barrel Varadero oil field operated by the Canadian company Sherritt, which ostensibly relinquished Block 9 in the early 2000s to develop the field. Block 9 also surrounds the Motembo field, the first oil field discovered in Cuba.

Fifteen prospects are (14 detailed volumetrically) within the ASX release but MEO considers that some of these leads can potentially be matured into early drilling opportunities, particularly those with nearby or shallow oil recoveries from old wells – the A2 being an early target. This, along with characterising the potential of the other two play-types, will be a focus of the company’s work in the coming months.

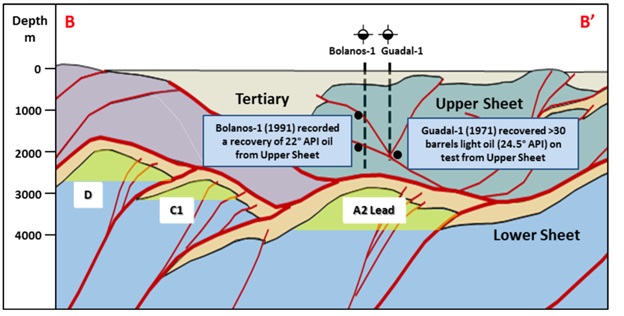

A cross-section along the B-B’ section as marked, illustrated in the Block 9 PSC map illustrating the A2 Lead. Source MEO Australia.

At a company level, MEO is prequalified as an onshore and shallow water operator in Cuba and was awarded a 100% interest in the Block 9 PSC on 3rd September 2015. Subsequently, this interest has become subject to a conditional 40% back-in option, held by private Australian company Petro Australis Limited, to be exercised no later than September 2017, (but more of that later).

A short potted history of Cuba

There have (so far) really been three phases to Cuban petroleum exploration, the extended period of pre-revolutionary exploration work going right back to the 1880s, then the revolutionary period with all that entailed bringing in not just Russian influences but Russian-style exploration ideas and then the more recent post-Soviet phase.

Cuba Petróleo Union, known by its trade name CUPET, is the state-owned Cuban oil company responsible for the country’s oil and gas industry. CUPET jointly produces crude oil through agreements with Canadian firm Sherritt as well as a number of others. As of March 2016, CUPET signed contract agreements with ten countries for further oil exploration and development. Canada’s Sherritt International produced about 20,000 barrels of oil a day with total annual revenue of $269.2 million in 2014. Of a total of 59 available licensed blocks, almost half were contracted to companies from Australia, Brazil, Canada, China, India, Malaysia, Norway, Spain, Venezuela and Vietnam.

Current daily national aggregate production is about 80,000 bopd of heavy oil with several companies being active over the last 15 years making discoveries along the 80 mile stretch of coast in the provinces of Havana and Matanzas in the northwest of the island.

Embargoes and politics have however limited the application of modern methods and applications albeit with some exceptions

Positives over this time include the development of the giant Valadero where Sherrit, Zarubezhneft, Rosneft and CNPC have used long reach shallow angle wells to tap near-shore Tertiary fields all along the North West heavy oil belt from Havana to Villa Clara province (which includes Block 9 in the east).

However, after big national disappointment in the failure of the deep water exploration programme to the north west, where three deep wells came up dry, Cuba has shifted its focus away from offshore oil to concentrate on renewable energy and further improving the output from onshore wells. This is partly due to a lack of interest by foreign companies in deep-water exploration, according to industry sources.

With so much oil readily available around the world, oil companies, including those from allies China and Russia, have been reported as seeing little incentive in drilling while the ongoing U.S. trade embargo on Cuba has further complicated drilling plans.

This consequence of this has not just been an increasing reliance on production from these shallow Tertiary fields but on imports too. This has left Cuba vulnerable, with CUPET importing heavily via its cooperation agreement to import from Venezuelan government in exchange for Cuban doctors and for “missions”. Venezuela has until recently been providing Cuba with cheap oil.

Or at least it did… which is potentially a big problem and is of course where the raw politics comes in, which is also probably best discussed now before any raw capitalist valuations…… Euphemistically speaking, ‘ahem’ there are ‘problems’ with Venezuelan supply payments and with cargoes and intermediaries which have been getting commensurately worse since the spring.

Of course security of energy supply is paramount to any country. It always has been, and it always will (read your Yergin). Just look at the news last (Friday 8th Jul 2016) in which Raul Castro told Cubans to brace for, “tough times because the country must cut spending and energy supply as it deals with a cash crunch and reduced oil imports from ally Venezuela”. Link HERE.

MEO’s news last week that its Block (9) prospects may be accelerated to a drill ready status in the short-term directly taps into the politics of this embryonic situation.

Certainly MEO’s and by extension Leni Gas Cuba’s position in Cuba provides a strong early mover advantage ahead of ongoing strengthening of diplomatic relations between Cuba and the US. So the question becomes will this potentially open a new phase for Cuban oil or will politics intervene – I am 52/48 or 48/52 on this one – it is too close to call – a bit like the recent EU referendum!

The point to all this is that I would suggest that commercialisation risk after a discovery well is now effectively a moot point – if it works and flows then I believe it simply will be done (American readers here should possibly refer back to the history of the East Texas oil field when you need to understand the importance of secured national oil production).

Valuation implications

The two publicly listed companies set to be the beneficiaries of Thursday’s news are ASX listed MEO Australia and Leni Gas Cuba.

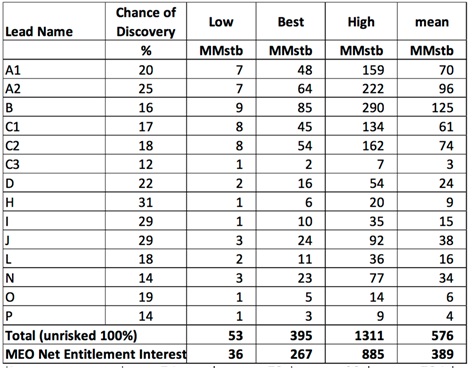

Looking at the data provided, 14 prospects are listed with volumetric and geological risk details. For simplicity’s sake we are choosing to use the ‘volumetric best estimate’ numbers as a base scenario and the arithmetic mean of ‘low, best, and high’ cases as our initial upside cases.

Block 9 PSC Oil-in-Place Summary for Lower Sheet Play:

Source MEO Australia

Block 9 PSC Prospective Resources Summary for Lower Sheet Play

Source MEO Australia

The 14 prospects are each risked individually geologically in the company’s data. Using these gives best and mean gross volumes for the released data on Block 9 of 78.62mmbo and 114.8mmbo respectively. With regards to “commercial risk” – we ascribe a 75% probability of commerciality given on the one hand the political situation and on the other the very low development and operating costs in the country.

The net entitlement interest from the PSC is a bit of thumb suck given that the cost recovery and tax pools are not yet know but illustratively we will use the 67.5% net that MEO are suggesting. We also assume a 50% farm out of the current gross holdings to fund exploration development. This gives a net entitlement interest to MEO of 19.9mmbbl – 29.07mmbbl on the two cases.

If we further assume $5/bbl in the ground (this is light, low development cost oil not 30% discounted heavy oil) this gives a net risked value post an assumed fund raising of USD$99.5m- $USD145.3m risked for Block 9 as currently illustrated with current data.

MEO implications

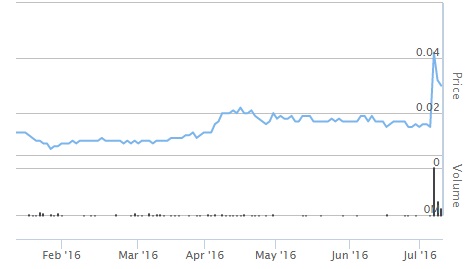

We fully anticipate Petro Australis can possibly secure their interests before the deadline so, ignoring any re-imbursement of costs that this generates, that reduces this current quick-look value to MEO to between $USD59.7m and USD$87.2m which is equivalent to $AUS75.6m – $114.74m at current exchange rates. Putting this into a share-price context, that is equivalent (on a fully diluted basis) to between 8.53AUSc/share and 12.46AUSc/ share excluding all other assets (Beehive), cash or commitments. The current share price is around 3AUSc/share.

MEO Australia 6 month share price

Leni Gas Cuba implications

Using the same case as for MEO, we can derive the theoretical carrying values for Leni Gas’s portion 40% Petro Australis stake (ignoring carry costs and assuming the option to move from 15% to 40% is exercised). We simply add this to the carrying value of the listed stake Leni Gas holds in MEO, to estimate a quick valuation for the Block 9 Cuba PSC on the same terms as the MEO calculation above. This gives a read through valuation of £11.7m – £17.1m or between 2.37 and 3.46 pence per Leni Gas Cuba share (at the time of writing) Again, as with MEO Australia, the Block 9 asset alone has a carried value of multiple times the current market price excluding all other assets cash and commitments.

The forthcoming data we suspect will significantly add to the potential Oil-in-Place and Resource base of Block 9. It also may very well be that wells are brought forward as early drilling targets and are further de-risked by targeting multiple stacked prospects. We shall look to keep abreast of the news. One thing is for certain, MEO Australia and Leni Gas Cuba investors are certainly in for an interesting ride in the months ahead.

CLEAR DISCLOSURE – Leni Gas Cuba is a research client of Align Research. Align Research owns shares in Leni Gas Cuba. A Director of Align Research holds a personal interest in Leni Gas Cuba and is bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details of our Company & Personal Account Dealing Policy can be found on our website http://www.alignresearch.co.uk/legal/