Oilex – Court stay now provides for binary outcome

News today of the granting of a Stay by the High court in Gujarat appears at face value to be bad news for Oilex shareholders in contrast to what the trading activity and price movement on Friday led many shareholders (including ourselves) to expect.

We proffer the following take on matters – namely that this is the last throw of the dice by GSPC in relation to their current default position on the key Cambay licence area. We expect that the stay will be overturned sooner rather than later and that the notice of the transfer of licence of the balance 55% presently held by GSPC will become a formality. We remind shareholders of the 2 facts: firstly, the statement by management on the 29th May re potential farm in interest per below:

“An increase in Oilex’s participating interest in Cambay from 45% to 100% would greatly assist the Company in strategic farm-in discussions with third parties. The Company has received several informal expressions of interest from parties to participate in the ongoing work programme and looks forward to updating the market when appropriate. “

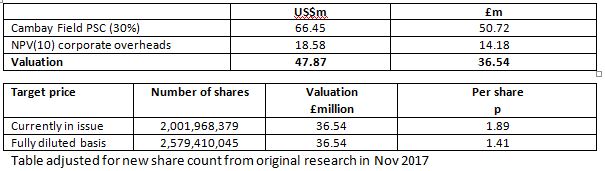

And secondly, our own analysis (in full HERE) that lays out our perceived value assuming that Oilex farms down to a 30% PSC in the Cambay fields:Table adjusted for new share count from original research in Nov 2017:

One can see that if management are able to finally receive back the full interest, quite aside from the outstanding circa $3m due from GSPC that the potential upside to shareholders is many multiples of the current stock price. Given the current market cap of just £2m, Oilex is now being valued as a shell with no value attributable to these very valuable assets. We believe this assessment of the legal position is wrong and liken the opportunity to that which we have highlighted at Pathfinder Minerals in recent months. Accordingly at 0.2p per share we are active and ongoing buyers.

DISCLAIMER & RISK WARNING

Align Research & a director of Align Research own shares in Oilex and are bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.