Kazera Global – on the cusp of complete transformation – current stock price provides a unique buying opportunity

Every night investors get on their knees and pray for the sort of announcement that Kazera put out yesterday. Neatly crafted into just a couple of pages was an update on the Namibian operation which just oozed value creation.

We have been fast to point out the blue-sky potential from the company’s world-class tantalum mine and over recent months the Kazera story has been really coming together with all the pieces now seemingly in place for the obvious generation of substantial value going forward. Also, diamond production is starting to provide the cash flow to facilitate production of heavy mineral sands (HMS) and further development of the company’s cracking tantalum project.

The latest announcement brought investors up to date on exploration results at Tantalum Valley Mine together with the prospect of further exploration and prospecting licences along as well as news on funding.

Exploration on just 30% of the ground at Tantalum Valley Mine has resulted in the company identifying three different minerals in commercial quantities. Across the areas explored, average tantalite grades has exceeded a whopping 25%, whilst average lithium grades were more than 4% which it believed could be increased to 6% by flotation.

Make no mistake, these are highly impressive grades, but probably the real surprise was feldspar which is another welcome positive surprise and where the average grade came in at above 12%. The feldspar resource could find its way into high quality ceramics and glass smelters. What the market seems to be missing is that all these minerals will basically be mined simultaneously creating the envious mining profile of attractively low combined production costs.

As concerns further exploration and prospecting licences (EPL), Kazera revealed that it has entered into a Memorandum of Understanding (MoU) with Manschaft Mining and Energy which holds five EPLs in central and north western sections of Namibia. This MoU looks as though it could pave the way to the company partnering with Manschaft to exploit the mineral potential of each of these EPLs.

These licence areas include more tanatalite and lithium plus the potential also for tin and niobium along with gold and copper projects in the well-known Kalahari Copper Belt. There is also a cobalt, copper and iron EPL on the Kaoko Copper Belt. Importantly, all these projects seem to have infrastructure nearby and some have been the site of current or past mining activity.

Last but by no means least was news on funding. Investors knew that the company has been in advanced discussions with a major Namibian investor for a substantial equity investment in Kazera from an RNS in early November. The front runner major investor has visited the Tantalum Valley Mine and carried out extensive DD in order to truly appreciate the scale of the opportunity which will be unlocked once the Orange River Pipeline goes in.

The hot news is that this potential investor seems to have far larger ambitions for the company moving ahead. This astute investor sees Kazera as being a consolidation vehicle to mop up further mineral licences not only across Namibia, but also on the other side of the border in South Africa – a veritable “match made in heaven” given the company’s operations acquired there in early summer. Indeed, within yesterday’s RNS was confirmation that Kazera is now moving into the final stages of the, in it’s own right, potentially company making HMS licence award on the coastal belt in Alexander Bay, SA.

Negotiations with the investor it seems are now approaching closure point for an initial equity investment at a price which will apparently be reflective of the company’s net asset value and which is more than its current share price – we estimate this to be between 1.5-2p per share. As mentioned before, there is interest from a number of investors however given the mix of Kazera’s assets and the current giveaway valuation.

At the time, Larry Johnson, CEO commented that: “The Company has made significant progress in 2020 by securing new assets, options over further licences and a potential significant investor. We anticipate a very exciting 2021. We are incredibly fortunate to be sitting on such rich sources of minerals as well as very adept technical teams in all our assets who are now cross-pollinating ideas and further opportunities. While financing discussions are progressing well we continue to work hard to bring the discussions to a conclusion that will put the Company on a sound financial footing.”

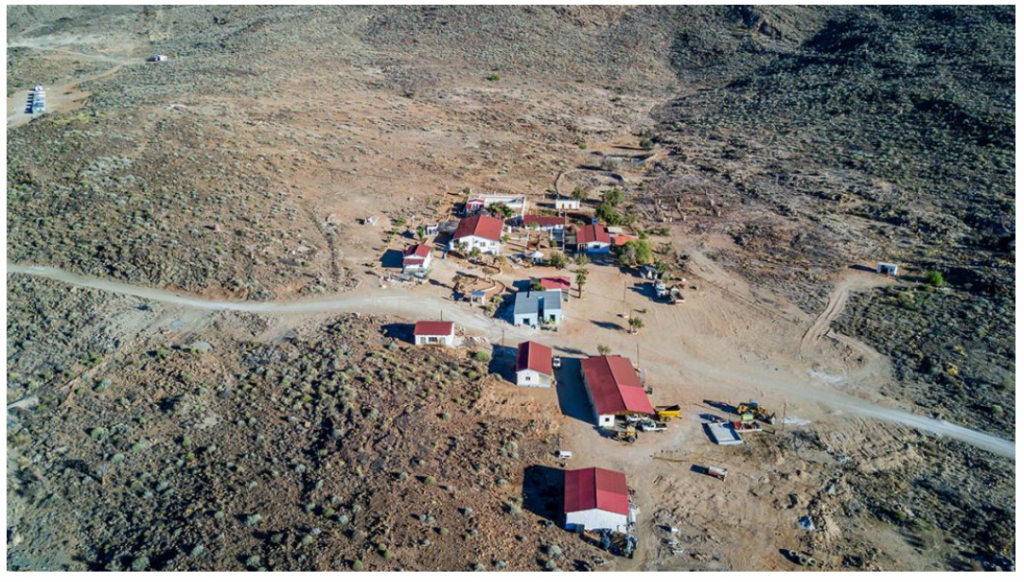

We have never had any doubts about the quality of the TVM asset which is a demonstrably high-grade tantalum project in Namibia. Ok, so far, commercial production has been elusive at the mine due to a lack of water. A 13km pipeline from the Orange River would solve this problem, coupled with some plant upgrades, and cost US$3-5 million. Now investors can all begin to see that the complete transformation of the company’s fortunes is just upon the horizon through the cash flow productivity in the SA diamond assets opening up the HMS avenue and now the imminent closure of a serious investment, at a premium to the current stock price, into the world class tantalum operations.

This news article out today illustrates just how much more attractive this opportunity gets from a global perspective by the day – https://www.asiatimesfinancial.com/china-enforces-new-export-controls-red-letter-day-for-rare-earths. Recent years have seen investors flocking to rare earth stocks like moths to a flame creating some bumper corporate valuations. Well along with the rare earth elements on the list of critical metals are also manganese and tantalum. Latest news is that China is now enforcing new export controls to further reduce rare earth exports which looks likely to push up prices of these critical metals and mineral elements. Just look at how Rainbow Rare Earths has performed in recent months after receiving funding and which was another one of our picks.

With the stock currently sitting at 0.90p for a market cap of a shade over £5m, we are extremely pleased to be the company’s current largest shareholder holding just over 29%. Frankly, we are amazed given yesterday’s news that we are not closer to 2p than 1p with our own target price being 2.5p. We are working on a new note to conclude with the closure of the trailed investment which will open up of the “Aladdins cave” of tantalum, lithium and feldspar production at scale and anticipate a meaningful increase in this target price. Without a doubt, Kazera Global is our top pick for 2021. Buy now ahead of the expected meaningful re-rate.

RISK WARNING & DISCLAIMER

Kazera Global is a research client of Align Research. Align Research & a director of Align Research own shares in Kazera Global and are its largest shareholder who are bound to the company’s dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited