Align Research Top picks for 2023 – KZG, BMV, ECO

Well, it is fair to say that 2022 did not pan out for many people the way they had hoped. We were one of those. From being forced to get activist (again) to try and protect our equity investments to having (again) non delivery by many of our company holdings, we have become somewhat jaded with regards to the smaller cap arena in the UK. The last 7 years of operating Align have certainly been eye opening. Quality and trustworthy management are rare animals and in the small cap space this is absolutely paramount in terms of generating future returns. When market’s turn against investors as they have done this year, the availability of “speculative” capital dries up and the haircuts applied to fresh equity raisings is eye watering. We know, we have many of those T shirts…

This will be our last “New Year” picks. During 2023 Align is going to “hang up its boots” for many reasons. Principal one being that the passage of time makes one realise ever more acutely the utility of it – the older you become the more valuable the balance of it is. I personally have no desire to continue to engage in bruising battles in the City fighting a system loaded against investors. What we can say, unlike many other City houses, is that we truly have “eaten our own cooking” over the last 7 years – some major winners (ITM, ARB, EQT, SLN) & some serious flameouts (MYN, ICON/WDC, AAOG…) – small cap investing is not easy that’s for sure. One of the golden rules is when you have material gains ALWAYS de-risk – there are invariably bumps in the road that will hurt the stock price – just look at Telsa at time of writing… One of my favourite sayings is that “the stock market can make fools of geniuses and geniuses of fools. The trick is recognising which one you are at that point in time!”

So below are our 3 last ever New Year picks that amalgamte all the lessons and key items that we have learnt running Align since 2016 – management “align”ment with investors and by extension a desire for equity value preservation, management integrity (not a given sadly) and finally, real value uplift opportunities with very attractive risk/reward profiles by way of current price v risks. We believe the 3 companies below represent the very best of these.

KAZERA GLOBAL INVESTMENTS – Valuation anomoly post TVM sale at 1.05p

Investors looking for small cap resource action in the coming year should look no further than Kazera Global Investments. This is a mining investment company that has just days ago announced the sale of its Tantalite Valley Mine asset for a base $13m plus interest and royalties for the life of mine. See HERE our full write up in this regard and that should set a base price for the company at @ 1.2p per share. The company’s business model is to find undervalued early-stage assets where management can add value from a progression basis, circulating funding from other operations in pursuit of swift cash flow and returns. This is not some pipe dream as the sale of TVM has very succinctly demonstrated. Post this sale, we believe that all the pieces are now in place for 2023 to be the year Kazera really gains traction.

Pan Plant on site on the company’s concession near Alexander Bay. Source: Company

The original intended cash cow for Kazera’s big march forward has been the Alexander Bay Diamond Project (60%) in South Africa. Here, production is ongoing from an Inferred Resource of something like 208,000 carats at a bottom cut-off aperture size of 1.6mm at a grade of 6.0 carats per 100m². This operation has recently shifted up a gear or two with the arrival of a Pan Plant to process diamond gravel at 70t/hour. The result is lower costs and via an innovative deal, production costs are only paid out of the proceeds of diamonds sales. This all sounds good, but revenues from this SA diamond operation are about to be well and truly eclipsed by those from Heavy Mineral Sands (HMS) project. Indeed, such is the nature of mining the heavy minerals from these sands that the diamonds effectively become a by product of this process.

HMS production has now commenced in earnest at at the 60%-owned Walviskop Mine. This has a JORC compliant Indicated Mineral Resource of 3.11 million tonnes of valuable heavy minerals at a grade of 61.2% – one of the highest globally. In early 2023, the team will be targeting 6,000 tons per month which at current prices will generate an estimated gross profit of approx US$300,000 per month. At this monthly production rate, the project will achieve its planned 72,000tpa of high-grade HMS. This has all the makings of being a huge money spinner with the introduction of a separation facility in 2023 that is expected to triple profitability.

At Walviskop, the predominant Valuable Heavy Minerals are garnet (30.29% of Run of Mine (ROM)) and ilmenite (27.54% of ROM). The NPV here has been determined at around £150 million based on a swingeing 20% discount rate (and prevailing FX rates). Also present are zircon and rutile, which it is worth pointing out have not even been included in the economic modelling.

Given all this potential, it is no surprise that Whale Head Minerals (the Kazera subsidiary) is applying for Mining Permits over adjacent areas. That big NPV(20) valuation of £150m is just for Walviskop and there is a lot more here than simply that project. WHM is also in the process of applying for a Prospecting Right over an adjacent beach which apparently bears all the hallmarks of having similar characteristics to Walviskop – but is reckoned to be 34 times larger. Here we are talking about some big numbers as 34 x £150 million = £5.1 billion.

Current stock price (1.05p) offers Heavy Mineral Sands project for free

Given the poor sentiment in the small cap mining space this last 18 months, the stock market is presently offering up a very unique opportunity in Kazera. The see through net cash value from the payments for TVM is approx 1.2p per share PLUS the 2.5% royalty from TVM. Also, importantly, as of now all costs in relation to this division have passed to Hebei Xinjiang Construction and the risks associated with the mine. The HMS operations ARE now in production and, base case are likely to generate $2-3m net profit p.a to Kazera and, as 2023 progresses and the separation of the constituent HMS takes place, multiples of this in 2024 onwards. In simple terms, the stock market is effectively paying investors 0.15p to have these assets at the current share price. We point out tha this valuation anomoly also excludes the diamonds that should, finally, be a useful decent cash contributor of several hundred thousand dollars a year.

CEO Dennis Edmonds is a seasoned deal maker and at the age of 65 is now focused on driving value here over the next few years and making his options pot worth something – he takes a very tempered salary so the upside to him is in the creation of capital gains. We remain as largest shareholders and have aided the company materially on capital raising fronts this last 3 years to protect all equity holders. Dennis continues to have our support and we believe that 2023 will finally reflect value as the prodigious cash flow generation profile of the HMS operations shows its mettle.

BLUEBIRD MERCHANT VENTURES – 2023 finally the year of production catalysation – 1.7p

Bluebird Merchant Ventures is a South Korea focused resources company which is bringing old gold mines back to life. The rationale here is that it is far quicker and cheaper to rehabilitate old gold mines than it is to fund exploration. Production ceased at these mines a few decades ago due to a low gold price – below US$140 an ounce. The management team sees the production economics at the current gold price to be highly attractive and is fast tracking the reopening of its two 100%-owned two gold mines – Kochang and Gubong – which are located in a great pro-mining jurisdiction.

These two gold mines offer the potential for near term cash flow and resource expansion. Kochang has an estimated non-JORC mineral resource of c.200,000oz gold with an historical capex estimate of the existing infrastructure of US$5 million. The production target here will be 10-12,000 oz of gold per annum and should finally be catalysed in 2023. The team consider that Kochang is comparatively easy to re-open and has a higher historical grade, so this will be the first gold mine to be put back into production.

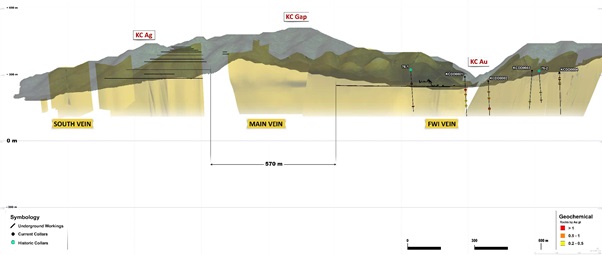

Kochang Deposit – long section. Source: Company

Gubong represents a far larger project with an estimated non-JORC mineral resource of c1.3 million ounces of gold. Historical capex of the existing shafts and tunnels has been put at in excess of US$20 million. The production target at Gubong is 60Koz of gold per annum. The longer term outlook is for more than 100,000 oz of gold per annum. The gold mineralisation is open at depth and along strike so there could be tremendous further potential to look forward to.

The company is on a highly compelling path to production in Korea. Currently, Bluebird is focused on proof-of-concept gold production at Kochang, once Temporary Mountain Use Permits (TMUP) are received. The latest news is that the TMUP application remains on track and is expected to be granted early in the New Year 2023. Proof-of-concept gold production will set the scene for rapid ramping up of the operation at Kochang before emulating the same strategy at Gubong. A swift trajectory to 100,000 oz per annum by 2028 would seem to be on the cards. With reasonably low operating and capital costs, these Korean projects could throw off a very substantial amount of cash.

The management of BMV headed by Colin Patersin are highly regarded as the team has decades of experience in rehabilitating old gold mines around the world. Colin Patterson (CEO) and Charles Barclay (COO) have developed a cracking business model honed over many years of hard graft. In 2010, the Apex Mine (Philippines) was acquired for US$7 million, reinvigorated by the team and 2 years later received an offer for US$180 million from a major. In our mind, Bluebird bears all the hallmarks of being Apex Mark II.

Batangas back from the dead in 2022

BMV has been led a merry old dance over the years in the Philippines concerning its 100% owned Batangas Gold Project. So much so that management had pretty much written off the project. However, improving sentiment towards the mining industry from the government over there has allowed the company to resurrect the potential of this project. It is not hard to see as Batangas spans two 25-year Mineral Production Sharing Agreements (MPSAs) covering a total of some 2,174-hectares with multiple targets and an established resource of 444,000 ounces of gold.

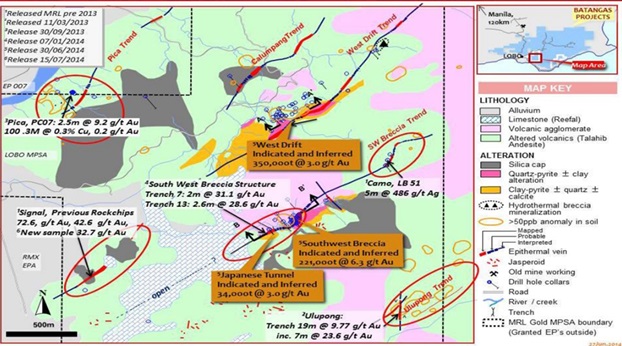

The plan is to prioritise the Lobo project area which has a current 36,000 oz gold Reserve (which could be mined in the first 18 months of operation) and an Indicated resource of 82,000 oz gold (which is thought could easily be converted into Reserve ounces) primarily in the South West Breccia (SWB) high grade zone.

Lobo remains highly prospective plus there is immediate exploration upside for further high-grade gold discoveries. Interestingly, the mineral resources are associated with a linear, steeply dipping, epithermal lode with high grade ‘shoots’ of mineralisation, similar to Medusa Mining’s Philippine projects. The Lobo licence area just seems to keep on giving as on top of the Reserve and Indicated resources, it hosts multiple epithermal and high-grade targets which look fair game for resource expansion.

Batangas is a high-grade exploration project that has a quantified resource. The company believes it is both exploitable and highly extendable. Source: Company

Bluebird has really whetted investors’ appetite in highlighting the sort of cracking grades that have been discovered at Lobo. Testing of the footwall lode at the SWB extension produced results including 2.1m @14.4g/t gold and 3m @12.1g/t. Meanwhile, the West Drift (which already has an Indicated and Inferred resource of 350,000t @ 3 g/t gold, along with high-grade surface trench intersections) yielded 8.35m @ 18.4 g/t gold, 2.6m @ 28.6 g/t gold and 3m @ 22.2 g/t gold.

There does look like there is a lot more to come as the five key targets identified within 15km strike on five parallel epithermal lode structures (which includes Camo) are described as being a major flexure “look-a-like” target to SWB. It does look as though the veil is just beginning to be lifted on the potential size of the prize here. However, BMV has yet to place any attributable value in its books for this project which has seen over US$20 million spent on exploration – so there is scope for tremendous upside here. In October 2022, BMV was granted a two-year licence extension, which allows them to complete the final studies required for a production decision.

Management has plenty of skin in the game

As relayed at the beginning of this piece, we have seen that in small cap resources stocks where management have a decent amount of “skin in the game” and are therefore motivated to make a success of the projects that this is almost always a 100% pre-requisite for ultimate equity value creation. In this respect, BMV scores extremely highly as between them the board has in invested more than US$2 million. On top of that, in order to conserve cash the management team have voluntarily taken equity instead – such is their belief in the projects – they own over 20% of the equity with Southern Gold and ourselves as the other major equity holders. Management’s stake speaks volumes based on our hard experiences.

By any yardstick we believe Bluebird to be seriously undervalued. Using a flat gold price of US$1775 per ounce, we have previously determined a Net Present Value using a 12% discount rate of US$302.56 million. To be more conservative to allow for project execution risk, we have discounted this NPV by 50%, resulting in a figure of US$151.28 million. This would now equate to 18.86p per share based on the number of shares currently in issue (652,115,042). On a fully diluted basis (c817 million shares) this gives a figure around the 15p mark.

In early December 2022 the company was also able to announce that the team had begun discussions with a streaming fund for the entire capital needed for the development of Kochang. Such a move would provide security of funding for Kochang without further equity dilution. At the current price of 1.825p BMV is another company that has suffered at the hands of poor sentiment in the small cap gold space. As an aside, we expect to, excuse the pun, really shine in 2023 with a price of $2,500 and potentially $3,000/oz not out of the question during the year. At these levels, the project metrics of BMV become even more compelling and make the current 1.70p price difficult to comprehend.

ECO (ATLANTIC) OIL & GAS – Multiple upside catalysts from some of the hottest O&G Exploration assets globally – 17.5p

Eco (Atlantic) Oil & Gas is an oil and gas exploration company focused on the offshore Atlantic Margins. The company teams up with oil majors and this really serves to reduce the risks in the search to unlock the huge potential of these prolific hydrocarbon provinces. Eco’s impressive acreage in Guyana, South Africa and Namibia has huge potential and the company has a good track record of being able to successfully negotiate farm out deals with majors to develop its projects. Eco is in good shape, we estimate circa $8m of cash (after paying its cash share of the Block 2B well), no debt and proven backing of major shareholders like C$1.23 billion market cap Africa Oil. We wouldn’t be surprised to see a decent cash component from a 3B/4B farm in either.

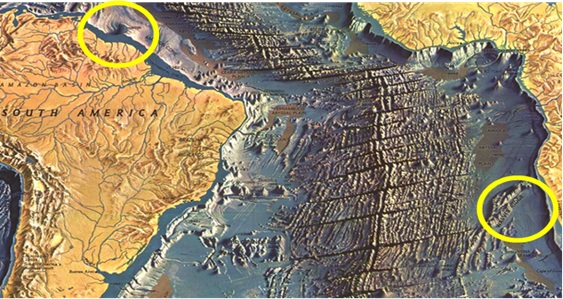

Opening of the central Atlantic Ocean by plate tectonics.

Note: Yellow circles highlight Eco Atlantic’s exploration projects in Suriname-Guyana basin, Guyana; Walvis basin, Namibia and Orange Basin, South Africa. Source: Company

The Atlantic Margin plays represent an extremely exciting recent development within the industry. The thinking behind this play revolves around the concept called Conjugate Margin Pair Basins. There is overwhelming evidence through plate reconstruction which shows that parts of South America and North America make a really good fit with Africa and Europe in the times before the plate split and the continents began drifting.

Eco looks well-placed to really benefit from its early adoption of this compelling concept which has pointed towards similar basins being developed on both sides of the Atlantic. The prize could be huge as ExxonMobil’s activities in the Guyana Basin have so far have led to more than twenty significant discoveries within the Stabroek Block and recoverable resources now exceed 10 billion boe.

The latest news is that Eco and its JV partners on the Orinduik Block, offshore Guyana, are currently drawing up plans to drill at least one well into light oil Cretaceous targets in the next Petroleum Agreement exploration phase which begins in 2023. It should be pointed out that the light oil Cretaceous has been the source of ExxonMobil’s huge success on the adjoining Stabroek Block where the 120,000 bopd Liza Field went into production in late 2019, following discovery in 2015. Liza Phase 2 is expected to see peak production in 2024 of 220,000 bopd.

Strong strategic position in Namibia

It is not hard to see that there are plenty of potential catalysts for wider regional success in Namibia and South Africa. Eco’s strong strategic positioning in Namibia should have become a lot more valuable following Shell discovering light oil at its Graff-1 exploration well. Namibia could become one of the hottest global plays – so a good time for Eco to up its interest by acquiring Azinam and which has just completed. This cracking deal also added two South African Orange Basin blocks, Block 3B/4B, that are directly correlated to Graff-1 and Block 2B, a shallow water block with previous light oil discovery.

In the wake of the recent significant hydrocarbon discoveries offshore Namibia, Eco is assessing its options for progressing exploration and commercial activity on its acreage. It is not surprising that the company has been able to report that there has been considerable interest in its licences in Namibia and is currently assessing options, including a potential farm-out.

There were high hopes for the Gazania-1 well on Block 2B, offshore South Africa, which was spudded in October 2022. Although this well its reached target depth of 2,360m, there was no evidence of commercial hydrocarbons. But Colin Kinley, Eco’s Co-Founder and COO was quick to point out that “…..Gases normally associated with light oil were encountered throughout the drilling of the Gazania-1 well. This, in our view, confirms the active hydrocarbon system, proven by the A-J1 discovery well in 1988, extends to the part of the basin where the Gazania-1 well is located. Further seismic interpretation will likely lead to the definition of viable areas for trapping downdip of Gazania-1 closer to the 1988 oil discovery A-J1….we remain optimistic for this basin ….”.

Whilst looking at developments in South Africa, reading between the lines we believe there could be a farm out deal in offing. Last heard, Eco was waiting for satisfaction of the conditions required to complete the acquisition of an additional 6.25% Participating Interest in Block 3B/4B, Orange Basin offshore South Africa, for a consideration of US$10 million. This would give the company a total 26.5% interest in the Block.

Growing interest in the entire Orange Basin

To us, all of this looks like the first step before the big boys of the oil and gas industry get involved given the proximity to recent discoveries. The acquisition announcement did mention that the board was seeing growing interest in the entire Orange Basin and in particular Block 3B/4B. We can guess that there are likely to be more than a handful of the biggest oil companies in the world itching to get involved in this play, which could serve to offer a big increase to Eco’s return.

A big oil company would need at least 40-50% interest in a block to show any real interest. The local player Riocure now has a 53.75% interest but in a farm out deal could not go lower than 20% due to Black Empowerment legislation in South Africa – which would only free up a 33% interest. What we see going on here is that Eco’s acquisition of the additional 6.25% interest could provide the balance. If the major wants a 50% stake, then Eco and its strategic alliance partner Africa Oil could demand a rich carry.

So, we clearly see that there is a farm out deal on Block3B/4B on the cards. Plus, there looks to be some developments afoot in Namibia, together with the likelihood that drill targets for Guyana could be announced.

Eco is exploring for oil and gas in some of global hotspots in todays’ hydrocarbon world – offshore Namibia and offshore South Africa, along with offshore Guyana. In January 2022 we updated our research coverage on Eco with a Conviction Buy stance and a target price of 114.65p, when the stock was trading at 23.75p. There is potentially a lot of excitement to be generated in this stock in 2023 so we are more than happy to confirm our stance at the current price of 17.5p and believe that the upside of the company’s block interests in oil hotspots is not remotely reflected in the current stock price.

RISK WARNING & DISCLOSURE – Align Research Ltd’s Director & related parties hold equity, warrant and debt interests in all of the companies mentioned in this piece and this cannot be considered to be impartial in relation to their outcomes. All companies are or have been research clients of Align Research. The Director is bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk. You should also assume, given that the majority of Align’s fees are received in stock, that for general corporate cash management purposes including taxation, that divestments of investments held will take place as and when, in Align’s sole discretion, it is deemed appropriate.

This financial promotion has been approved by Align Research Limited