Corcel – Market begins to reacts to transformation of business strategy

It is fair to say that there has been little good news for Corcel shareholders during 2022 – indeed to quote the late Queen, it has been an annus horibilus. In recent weeks however there been the stirrings of a potential re-appraisal of the Company’s prospects going forward and so the Corcel share price.

Over recent months Corcel has changed its spots and now dubs itself as a natural resources exploration and development company with primary interests in battery metals. It is fair to say the the FGS (Flexible Grid Solutions) endeavour did not play out as both we and management expected. As one of the largest shareholders in the company we have suffered most in this regard. Actions at the company this last few months have been based around reducing the debt burden in the company (of which we were a large provider in attempting to bridge the company to FGS news in 22 and progress in PNG and that sadly did not occur) and which is now materially lower and so de-risks the equity. This latter point is important as the company’s reinvention and consolidation looks to be at a major inflection point.

In mid-October 2022, investors got the first sniff that Corcel was reorganising its battery metal mining interests in Papua New Guinea (PNG). We learnt that offtake discussions with Shandong New Powder COSMO AM&T (NPC) had morphed into the formation of a new joint venture company with Corcel called Integrated Battery Metals (IBM), based in Singapore. This is being established in order to pursue an Asian focused battery metals strategy with direct links to offtake partners and end users of these critical battery metals.

NPC is a joint venture company of Shandong New Powder Co., Ltd and COSMO AM&T.CO., LTD. It is mainly engaged in the research and development, production and sales of lithium cobalt oxide, 5-series, 6-series, 8-series ternary materials and NCA as cathode materials for lithium-ion batteries.

The Shandong Group is a leading Chinese titanium dioxide manufacture with some impressive technology. Meanwhile, COSMO AM&T is the third largest cathode material manufacturer in Korea. The third shareholder in NPC is the Australian Sentient Mining Fund which has a scale of US$2.6 billion and is a global holding company of many energy and mining companies and heavily involved in the supply of raw materials. See HERE.

It seems that these 3 major players now see Corcel as their vehicle for development opportunities and so were happy to invest in recent days at a 95% premium to the then share price. Very few AIM companies attract these kinds of backers and so we think it now is time for the market to sit up and pay attention.

What is being created is a Singapore-based upstream Battery Metal joint venture which is planned to own CRCL’s positions in the Mambare (41%) and Wowo Gap (100%) projects alongside the Doncella lithium project in Argentina. Corcel will own 50% of the JV and benefit from a US$1.5 million carried interest, a 1.5% gross revenue royalty on Wowo Gap and be able to provide half of the board of the JV. Via this deal, the company is making the pie bigger as mining of these two substantial resources is much more likely now with these partners who need the nickel and cobalt for future production. Nobody doubts Corcel’s PNG assets are massive – the problem has been attracting the scale of capital without swamping current equity holders with dilution – this dynamic has now changed.

|

|

Mt |

Nickel % |

Cobalt % |

|

Indicated |

3.3 |

1.00% |

0.07% |

|

Inferred |

159.2 |

0.94% |

0.09% |

|

Total |

162.5 |

0.94% |

0.09% |

|

Contained metal (Kt) |

|

1,528 |

146.25 |

JORC-compliant MRE for Mambare Nickel/Cobalt Project June 2012. Source: Company

|

|

Mt |

Nickel % |

Cobalt % |

|

Indicated |

72 |

1.03% |

0.07% |

|

Inferred |

53 |

1.09% |

0.06% |

|

Total |

125 |

1.06% |

0.07% |

|

Contained metal (Kt) |

|

1,325 |

83 |

Wowo Gap MRE (JORC 2004) dated 2011. Source: Company

In the medium term, the partners plan to list the JV in Singapore. This would allow the market to award a proper valuation to these exciting and highly relevant battery metal interests – we suspect a figure closer to $15-20m is likely and even applying a large liquidity discount to Corcel’s 50% stake this gives a valuation over 3 times the current market cap. This move was accompanied by the introduction of a new cornerstone investor into Corcel and the appointment of Yan Zhao who will be joining the CRCL board and bringing with him his enviable network of Asian industrial contacts.

The Doncella lithium project is Hanacolla’s flagship project, located in the Arizaro Salar in the Salta province of NW Argentina. The project lies some 170km from Salta which is considered a prospective area within the “Lithium Triangle” that owes its name to the lithium available in lithium brine-based deposits.

The project consists of 725km² of lithium salt brine style mineral tenements located within the Salar de Arizaro Basin, which is the largest salar in Argentina and one of the most important inthe Puna Region – an area whch constitutes the southern end of the high platform of the Central Andes.

Further ambitions in PNG

There is little doubt that Corcel is seeking to capitalise on its existing PNG experience and expertise, along with providing a further broadening of the company’s mineral exploration portfolio. This was clearly demonstrated in late-October 2022 when Corcel announced that its 100%-owned subsidiary, Niugini Nickel Pty Ltd, had submitted an application over currently vacant ground in PNG which spans c.464km².

This area covers the Star Mountains project, a gold and copper exploration project which has seen a lot of work done by ex-ASX listed company Highlands Pacific. The mineralisation was discovered back in 1972 by Kennecott and Highlands Pacific reckoned that the region was one of the most exciting and productive exploration areas in the region. In 2018 it declared a maiden mineral resource at Star Mountain of 210Mt at 0.4% copper for 840,000t copper and 2.9Moz gold; based on data from 23 diamond drill core holes for a total of 8,949m. This is an obviously attractive area, and so it is little surprise that are a number of applications for these tenements.

New REE project next door to Lynas

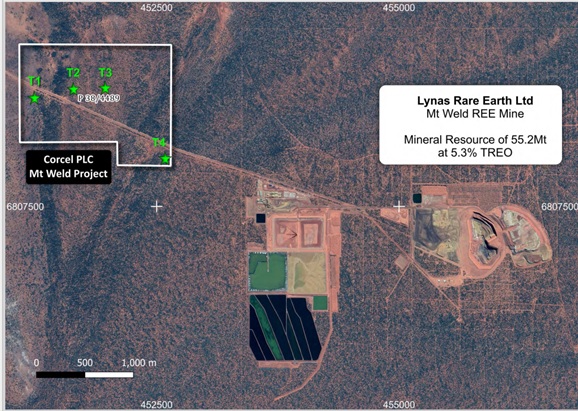

In early December 2022, Corcel increased its interest in the Mt Weld (P38/4489) Project to 100%. This is a granted mineral tenement which lies less than a mile away from Lynas Rare Earths’ (ASX: LYC) Mt. Weld REE Mine near Laverton in Western Australia. The project is 171 hectares in size where the underlying geology is obscured under recently transported sediments. T1, T2, T3 and T4 (shown in the map below) represent four discrete undrilled magnetite features potentially representing carbonatite intrusive complexes which would make for good immediate drill targets.

Corcel’s Mt Weld Project lies in very close proximity to Lynas Rare Earth’s Mt Weld REE Mine.

Source: Company

Early in 2023, there are plans to do a cheap and cheerful drilling programme of these highly attractive targets. With Lynas next door there is potentially a quick exit that could be achieved on the production of any decent results. Also, it looks like there are further REE opportunities where Corcel might look to get involved.

As we have relayed, the initial hopes surrounding the company’s flexible energy generation and storage projects and their capacity to be a cash cow for the company did not come to pass and given the poor sentiment this year for AIM minning minnows we believe the stock price has been sold down to unduly low levels now. As great as such plays are, funding institutions increasingly don’t want to have any involvement in gas fuelled electricity generation even if it does support the UK’s move to green energy. All of this left Corcel’s Tring Road 50MW gas peaking project difficult to finance and so it has been disposed of. However, we see this as the board clearing the decks in light of the ongoing transformation of the company’s business interests and we believe the improved focus now provides a new base for the renewed management team to push forward on.

Corcel continues to look to develop a cash generative arm. The focus now seems to be on developing a revenue stream based on the sort of technologies that its new big battery metal partners in Asia have at their disposal. These partners broadly give the company access to battery recycling technology as they are two large cathode producers. Possible future ventures might be involved in say recycling batteries or even recycling the waste from the production of batteries and electronics.

At the current price of 0.255p, Corcel is now capped at just under £2 million. The transformation of the business strategy means that our previous target price is clearly no longer valid. At this market cap and even adjusting for the remaining debt post the £466k placing, we believe that from a newsflow perspective – namely the forthcoming Singapore Battery Metals combine listing and the drill campaign in the new year at Mt Weld that the skew is to the upside. Aim mining minnows have been a basket case for 12 months but sentiment does turn – it is the nature of the cycle. With new management input & major cornerstone investors, a de geared balance sheet and a number of newsflow catalysts in the New Year we believe this provides once more an interesting opportunity for speculatively minded investors and so are comfortable resupporting the company at this stage.

RISK WARNING & DISCLAIMER

Corcel is a research client of Align Research. Align Research’s Director and related parties are collectively the second largest holders in the shares of CRCL and also hold a large volume of warrants over the company and so cannot be seen to be impartial in relation to the share price outcome. All employees and analysts are bound to the company’s dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk. You should also assume, given that the majority of Align’s fees are received in stock, that for general corporate cash management purposes including taxation, that divestments of investments held will take place as and when, in Align’s sole discretion, it is deemed appropriate.

This financial promotion has been approved by Align Research Limited