Metro Bank – speculation of Lloyds interest illustrates abject value in the stock

The sharp price movement in Metro Bank yesterday in response to the reported interest from multiple sources of a potential takeover by Lloyds Bank does not surprise. As per our article HERE we have believed for several weeks now that the end game for Metro shareholders is absorption by a larger bank or potentially a take private by ex Chairman Vernon Hill as reported by the Telegraph HERE.

We listened into the conference call that Metro held post their 3Q results last week and it was very interesting towards the end how CEO Craig Donaldson acted “cagey” with regards to the question posed about takeover interest. Of course he would not be able to say anything per regulations but the essence of his response seemed somewhat “prepped” in advance of this question.

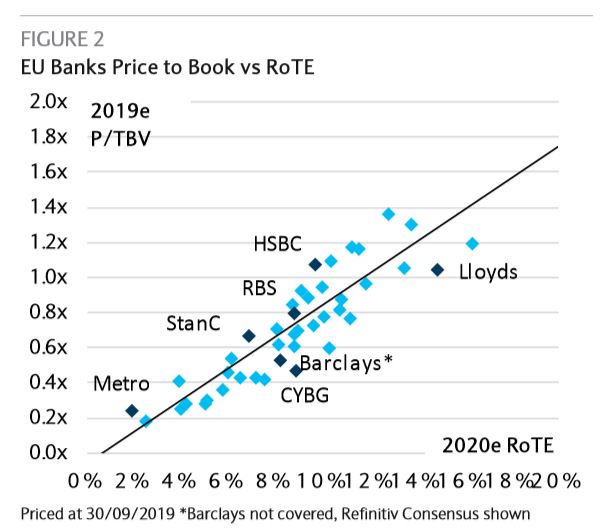

On the basis of their being “no smoke without fire” we decided to take a look at just what Lloyds could theoretically pay without diluting their earnings or book value. The good thing for Metro shareholders per the chart below is that the discount to book value at Metro is massive. As a consequence of this material value arbitrage, assuming any such offer uses Lloyds paper (and with a market capitalisation on Lloyds’ part of just over £40bn, such an acquisition really would be literally at the margin for them), we expect that Metro management would likely hold out for at least £5 per share which is the last capital raise price back in late May of this year.

As we relayed HERE post the 3Q results, there are in fact many issues going in Metro’s favour contrary to the shorts mantra, namely very low NPL’s (Non Performing Loans), the loans to deposit ratio trending back towards the key 100% level and a stabilised deposit book in the face of negative commentary aswell as continued customer growth and a very robust Tier 1 capital ratio. These are all attributes that a number of banks, not just Lloyds would find attractive.

An absorption of Metro’s book value through paper issuance by a predator which trades at a premium to book is frankly a “no brainer” for any banks management as long as they are secure in the quality of the loan book – the low NPL’s at Metro provide the big tick here. As we see it, Lloyds (or indeed a number of other banking majors) could simply close down the Metro stores and take the book value run off disparity between the price paid for the assets and the end realisation level and still make money.

On the income side, a larger banking group that has a lower cost of funding simply repeats the trick again here as with the book value – refinancing the onerous MREL rate of 9.5% and enjoying lower deposit acquisition costs. By our calculations, reducing the MREL rate by 50% and adjusted for management cost synergies, lower funding and deposit acquisition rates could produce incremental profits to a major of £30-40m p.a. Capitalising these at say 6 times (less than the banking sector PE and Lloyds’ own PE) and adding to a tangible book value acquisition discount of 50% results in a potential takeout price of £4.70. This figure seems a realistic level to us and coincidentally is close to the last £5 raise price. Of course should there be other interested parties then the discount to book level could diminish further. Another way to view it for a newer entrant into the Retail banking space in the UK, ie for Goldman Sachs with their Marcus offering, is that 1.9m customers acquired for say £450 per customer (a pretty low figure) results in a price near £4.50 a share – and this excludes the refinancing and book value arbitrage value uplift. Indeed, an end take out price approaching £7 would still be value enhancing for many larger players

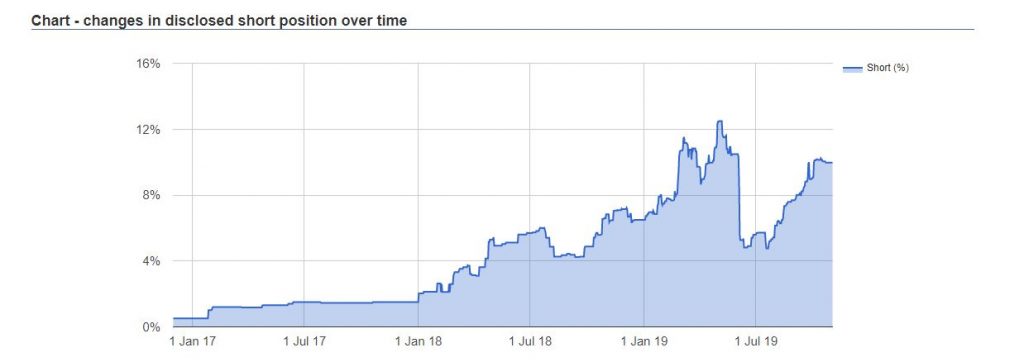

For the moment, the company still waits on the results of the FCA loan misclassification inquiry. Our own belief is that a manageable fine and new procedures in place to ensure the non recurrence of this is the most likely outcome. In other words, it would not change the premise of a takeover for a larger player. We have been bullish on Metro for some months now and belief, in unison with the bond market reappraising the value in Metro’s bonds in recent weeks, that the equity price still has some way to go to correct the valuation disparity, with or without a takeover. Married with the still near 10% short position as the chart below relays, to us, the risk/reward skew is still asymmetrically to the upside. The lesson following the financial crisis that many major banks learnt is that running off book value over time usually pays material dividends. Keep buying.

RISK WARNING & DISCLAIMER

Align Research & a director of Align Research own shares in Metro Bank and are bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited