Acasti Pharma – A View to a Krill

Made in the liver and found in some foods, cholesterol is a fatty substance, carried in the blood attached to proteins called lipoproteins, which is vital for the normal functioning of the human body. However, having an excessively high level of cholesterol in the blood can increase the risk of developing serious health conditions. Over time, cholesterol can build up in artery walls, restricting blood flow to the heart, brain and the rest of the body, thus increasing the risk of heart attacks, stroke and a range of other life changing conditions.

While a number of treatments currently exist for high cholesterol, one Canadian company is looking to develop a new, potentially more effective medication and with much reduced side effect, by taking advantage of a common crustacean.

Acasti Pharma (ACST) is a NASDAQ and TSX Venture Exchange listed biopharmaceutical company which is focussed on the research, development and commercialisation of prescription drugs using omega 3 fatty acids (OM3) derived from krill oil. A favourite snack of sea creatures such as whales and penguins, krill are an abundant crustacean found in all the world’s oceans and are harvested by humans for their rich source of protein and omega 3 fatty acids. Omega 3 fatty acids have been found to have a number of positive health benefits, with there being extensive clinical evidence of safety and efficacy in lowering triglycerides (TGs), a type of fat found in the blood.

Levels of triglycerides in the blood can act as a marker associated with the risk for heart disease and stroke. This is especially the case when an individual also has low levels of high-density lipoproteins (HDL), or so called “good” cholesterol – which carries cholesterol away from the cells and back to the liver, and elevated levels of low-density lipoprotein (LDL), or “bad” cholesterol – which can build up in the artery walls, leading to disease of the arteries.

Krill – potential life saver

Cutting cholesterol

Acasti Pharma’s lead product candidate is CaPre®, a highly purified omega 3 phospholipid derived from krill oil. The company is currently developing CaPre under an exclusive licence granted by 34% shareholder Neptune Technologies & Bioressources Inc. to use Neptune’s intellectual property portfolio related to cardiovascular pharmaceutical and medical food applications. The licence, granted in August 2008, confers “freedom-to-operate” to Acasti so it can develop and commercialise CaPre for the prescription drug and medical food markets.

CaPre is being developed initially for the treatment of severe hypertriglyceridemia (HTG), a condition characterised by high levels of TGs in the bloodstream. A “severe” condition is defined as one where patients have levels of TGs in the bloodstream amounting to 500 milligrams/decilitre (mg/dL) or higher. Multiple studies have suggested that patients with elevated TG levels (above 200 mg/dL) are at a greater risk of coronary artery disease and pancreatitis as compared to those with normal TG levels. HTG is also associated with conditions such as chronic renal failure, nephrotic syndrome and diabetes.

CaPre contains polyunsaturated fatty acids (PUFAs), primarily composed of the OM3 fatty acids eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), which are well known to be beneficial for human health.

According to numerous recent clinical studies, EPA and DHA may promote healthy heart, brain and visual function, and may also contribute to reducing inflammation and blood triglycerides. The company believes that EPA and DHA are more efficiently transported by phospholipids sourced from krill oil than those contained in fish oil that are transported either by TGs (as in dietary supplements) or as ethyl esters in other prescription OM3 drugs, which must then undergo additional digestion before they are ready for transport into the bloodstream.

Taken orally once or twice per day in capsule form, CaPre is intended to be used by patients as a therapy combined with positive lifestyle changes, such as a healthy diet and exercise, and can be administered either alone or with other drug treatment regimens such as statins (a class of drug used to reduce bad cholesterol).

Clinical trial progress

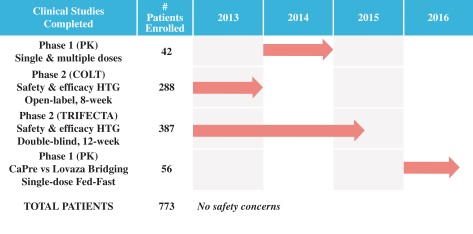

To date, four clinical Phase I and II trials have been conducted with CaPre, with a Phase III trial initiated in the US during the second half of 2017 and planned to start clinical site activation by the end of the year.

In both Phase II clinical trials, CaPre significantly lowered TGs in patients with mild to severe HTG. Critically, CaPre also demonstrated no deleterious effect on “bad” cholesterol (LDL-C) which accumulates in the walls of blood vessels, where it can cause blockages. This is in contrast to currently approved competitive products LOVAZA and EPANOVA which have been shown to significantly increase LDL-C in patients with severe HTG. The data also indicated that CaPre may reduce LDL-C. In the Phase II trials, CaPre also reduced non-HDL-C (all cholesterol contained in the bloodstream except HDL-C – “good” cholesterol), which is also considered to be a marker of cardiovascular disease.

A summary of the beneficial effects found from CaPre to date include:

– significant reduction of triglycerides and non-high-density lipoprotein cholesterol (non-HDL-C) levels in the blood of patients with mildly elevated to severe HTG.

– the potential to reduce low-density lipoprotein cholesterol – “bad” cholesterol.

– the potential to increase high-density lipoprotein cholesterol – “good” cholesterol.

– good absorption by the body, even under fasting conditions.

– minimal difference in absorption when taken with low-fat or high-fat meals.

– an overall safety profile similar to that demonstrated by currently marketed OM3s.

The company believes that these features could set CaPre apart from current FDA-approved OM3 treatment options, and could give a significant clinical and marketing advantage.

Chart: CaPre Phase 1 and Phase 2 Studies. Source: Company

Research commissioned by Acasti suggests there is a significant unmet medical need for an effective, safe and well-absorbing OM3 therapeutic that demonstrates a positive impact on the major blood lipids associated with cardiovascular disease risk. If supported by the Phase III program, the company believes that CaPre will address this need. There is also the potential to expand CaPre’s initial indication to patients with “high” TGs (200 to 499 mg/dL), although it is likely that at least one additional clinical trial would be required to do so.

Acasti believes that CaPre will be fully covered under its own issued and pending patents when the licence with Neptune expires in 2022, with the company having so far filed patent applications in 24 jurisdictions, including Europe, North America, Asia and Australia for its “Concentrated Therapeutic Phospholipid Composition” to treat HTG. It currently has 20 issued or allowed patents and 15 patent applications pending. As a result of a royalty pre-payment transaction Acasti is not required to pay any royalties to Neptune under the agreement during its term for the use of the licensed intellectual property

Business Plan

Acasti Pharma’s near-term strategy is focussed on completing the Phase III program for CaPre. In Phase III, the company will conduct two pivotal, double-blind, randomised, placebo-controlled studies to evaluate the safety and efficacy of CaPre in patients with severe hypertriglyceridemia. These 26 week studies will evaluate CaPre’s ability to lower TGs from baseline in approximately 500 patients randomised to either 4 grammes of CaPre daily or a placebo.

The primary endpoint of these studies is to determine the efficacy of CaPre at 4 grammes/day compared to placebo in lowering TGs in severe HTG patients, and to confirm safety. The programme will be overseen by Dr. Dariush Mozaffarian, M.D., Dr.P.H., a cardiologist and epidemiologist whose published research focuses on how lifestyle and diets, such as those rich in omega 3s, can influence cardiometabolic health.

Assuming positive results, the company then intends to file a new drug application (NDA) with the Food & Drug Administration, to obtain regulatory approval for CaPre in the United States. As discussed above, this will initially be for the treatment of severe HTG, with the potential to expand CaPre’s indication to the treatment of high TGs. The company’s current development timeline (see chart below) is guiding towards 2021 for initial product launch.

Chart: planned key milestones and development timeline. Source: Company

Acasti is targeting a large and growing market in the US for the treatment of HTG.

According to the American Heart Association (AMA), one-third of adults in the US have elevated levels of TGs (>150 mg/dL), with its prevalence rising and being driven by factors such as aging populations and increasing levels of obesity and diabetes. In the US the AMA estimates there are c.36 million people diagnosed with high TGs, and 3 to 4 million people diagnosed with severe HTG.

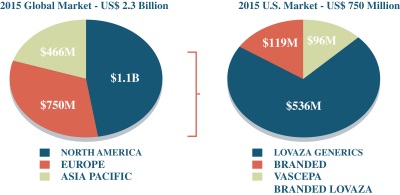

According to IMS NSP Audit data, CaPre’s US target market for severe HTG was worth c.$750 million in 2015, with c.5 million annual prescriptions written over the prior four years. Beyond the US, according to GOED Proprietary Research, the total global market was worth c.$2.3 billion. The US market is currently dominated by two FDA-approved and marketed branded competitors (GlaxoSmithKline’s LOVAZA and Amarin’s VASCEPA), with Astra Zeneca having an FDA-approved product, EPANOVA, which has not yet been launched.

Audited prescription data from IMS NSP Audit suggests that over 50% of OM3 prescriptions are written for branded products. Based on primary market research with pharmacy benefit managers and audited prescription reports, the average pricing of generics is currently approximately c.$190 per month, while pricing for branded products averages c.$250—$300 per month.

Chart: Estimated global and U.S. markets for HTG in 2015. Source: IMS NSP Audit data

While the current market opportunity is relatively large, there is significant room to expand the treatable market as all currently marketed OM3 products are approved by the FDA only for patients with severe HTG.

In the US there are currently two ongoing studies that are evaluating the long-term benefit of lowering TGs on cardiovascular risks with prescription drugs containing OM3 fatty acids. The REDUCE-IT trial, sponsored by Amarin, is expected to report in mid-2018 and the STRENGTH trial, sponsored by AstraZeneca, is due to report in 2019. Assuming favourable results, this could significantly expand the market to include the estimated 36 million people in the US with high TGs, although additional clinical trials would likely be required for CaPre to also expand its label claims to the high TGs segment.

Further highlighting the potential for the expansion of the market, a study by Ford et al carried out between 1999 and 2004 found that 18% of US adults (c.40 million people) had elevated TG levels equal to or greater than 200 mg/dL, but only 3.6% were treated specifically with TG-lowering medication.

Overseas market provides further opportunities

Outside of the US Acasti will be pursuing other opportunities, with the preferred strategy being regional or country-specific strategic partnerships, such as licensing or similar transactions. The company believes that that a late development-stage and differentiated drug candidate like CaPre could be attractive to various global, regional or specialty pharmaceutical companies, and is taking a targeted approach to partnering and licensing in various geographies.

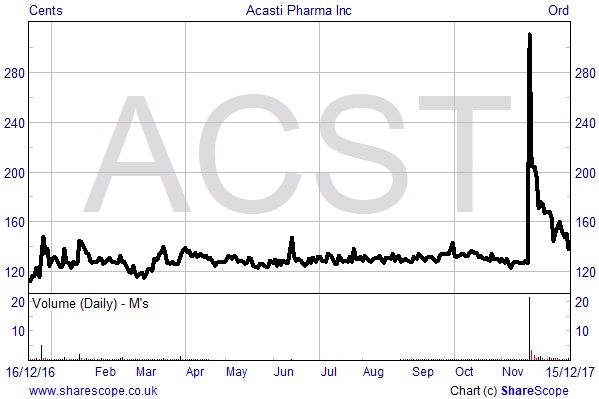

On that note, shares in Acasti surged by 144% on 20th December after the company confirmed it has entered into a non-binding term sheet with an un-named but “leading” China-based pharmaceutical company.

Completion of the transaction is subject to further negotiation and execution of a definitive agreement, which once signed would grant an exclusive licence to the Chinese pharmaceutical company to commercialise CaPre in certain Asian countries, including China. At this stage, the term sheet is preliminary and non-binding. However, if a definitive agreement is reached and signed, the term sheet contemplates that Acasti would receive an upfront payment of $8 million upon signing, plus potential additional regulatory and commercial milestone payments in excess of $125 million, and tiered double-digit royalties on net sales.

Funding

As at 30th September this year Acasti had cash and cash equivalents of CAN$5.33 million. In order to advance its growth strategy, the company recently announced that it is looking to raise further funds via the issue of 6.755 million new shares. While the price has not yet been set, if the funds are raised at the current share price of $1.37 the gross funds raised will amount to c.$9.25 million.

With each new share Acasti will also issue a warrant to purchase 0.9 of a common share, exercisable for five years at a price not less than the closing price on NASDAQ on the date the registration statement of the prospectus becomes effective. Assuming a price of $1.37 this could bring in an additional c.$8.33 million if all warrants are excercised.

The proceeds will be used for the further development of CaPre, including clinical site activation, progression of patient enrolment and production of clinical materials for the Phase III program; expansion of business development activities; working capital; and other general corporate purposes.

Assessment

Shares in Acasti Pharma currently trade at $1.37 each, to capitalise the company at just $20.27 million. Set against the proforma cash balance (assuming receipt of the Chinese $8 million initial payment) and adjusting for the new shares to be issued, the market seems to be ascribing an Enterprise Value of c.$10 million. By any stretch of the imagination, considering the stage the company is now at and the potential commercial milestone payments, should Phase III trials prove successful the stock is woefully undervalued.

As with any early stage biopharma company there are significant risks over the investment case, especially concerning funding requirements and success of clinical trials. On the funding side, the company made a loss of CAN$7.285 million in the six months to September this year, so given cash levels at the period end, added to assumed funds raised of $9.25 million from the current share offer, and assuming the $8 million is to come from the Chinese partner company, we estimate there should be enough on a current run-rate basis to last just in excess of 2 years given present CAN/USD exchange rates. Importantly, this takes Acasti to the threshold of hoped for commercialisation in 2021.

We do note however that Acasti’s prospects currently depend entirely on the success of CaPre. With the drug currently entering Phase III trials, significant risks remain over successfully passing through the remaining trials, achieving FDA approval and the eventual marketing and sale of the product but, at the current stock price, we believe these risk more than adequately discounted, and some.

With the Phase II study data being positive, and considering the potential market size in the US, along with the term sheet signed in China offering the company potential income worth many multiples of its current market cap, we consider Acasti to be an attractive prospect on a risk/reward basis for those with capacity for a real potential “blue sky” stock in their portfolio. If CaPre is successful in Phase III there is a very real likelihood of a buyout, likely at a triple digit dollar market cap figure.

Acasti Pharma one year share price performance

RISK WARNING & DISCLAIMER

A director of Align Research own shares in Acasti Pharma. Full details of our Company & Personal Account Dealing Policy can be found on our website http://www.alignresearch.co.uk/legal/

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.