MetalNRG – back to work full time on the corporate strategy.

By Dr. Michael Green

MetalNRG has been given a bit of a rough ride and now sits at what we believe is an absurdly low market cap of just £800,000. It has not been helped by the continued mud-slinging by an ex-director for many months, even though he has lost every single court case involving the company.

The best way of course to respond is by actions, and which speak louder than words. CEO Rolf Gerritsen has what we believe to be a cohesive plan for the next 12 months which ought to see the company get money out of its EQTEC Italy investment. This can be used to fund exploration and drilling at MNRG’s 100% Gold Ridge project in the US.

In a nutshell, MNRG invested a total of €700,000 into EQTEC Italy, where €13,333 was for equity, gaining them a 12.9% holding and the remaining €686,667 was a shareholder loan. This plant is now up and running, hooked up to the grid and selling electricity on a pre-determined tariff for the first 5 years of operation.

Waiting in the wings are two additional revenue streams. Firstly, the opportunity to sell heat generated to a neighbouring factory. Secondly, there is a by-product called biochar which can be sold for something like €500-800/t for use for soil improvement and remediation in agriculture. The material needs to be certified and that is going on at the moment. Then the quality of this by product will be known and the actual price accurately determined.

The great news is that MetalNRG might not have to wait long to get some money out of this project. The backers. along with MNRG. are seeking to refinance the plant, a move which could see a repayment of part of the shareholder loans. We are hopeful of an update on this front in the near term.

No dilution required

Such offers involve a process which is a bit akin to buying a house, refurbishing it, and then selling a piece of it and maintaining some equity position. MNRG would retain its 12.9% stake and get money out to invest in Gold Ridge. Actually, the company might use some of the funds liberated (only a limited amount) to up its equity position in EQTEC Italy to 25% to keep the bank happy. But there would be a substantial amount of cash returned to MNRG.

The second potential avenue likely will only happen once the plant has been in operation for a while longer. This could involve the forward selling of the revenue stream over the next 10 years to a bank or finance house and reasonable numbers are likely in this scenario. Going forward, 75% of the revenue stream could go to pay off this loan and the reminder would be retained by shareholders.

All of this means that there is a high probability of the avoidance of a placing and the dreaded dilution at this lowly market cap. The funds out of EQTEC Italy will be recycled and the company would retain or increase its equity position. This is good news as when we first looked at this project it was suggested that MNRG could be in line for a €200,000 dividend, that was with a 12.9% stake. But that €200,000 figure does not include selling heat or biocharge, although that might require extra investment.

£1 million coming into the kitty

When MNRG entered into the development of this electricity generation project, the management was budgeting on buying in the fuel (woodchips) for €75/t. Having cunningly installed a drier, the plant can new buy wetter woodchips which are less processed and cheaper coming at something like €50-55/t. This all would suggest a substantial reduction in operating costs.

At the moment, Rolf is just trying to educate the market about the concept. We are promised some proper numbers at the end of next month which will really put the icing on the cake. But the main message management are trying to parlay is that MNRG does not need to raise money now. MNRG won all its recent legal cases and is owed a material sum still and which should be coming in soon. The board believes that over the next few months they could well end up with £1 million in the kitty. Remember, the current market cap is just £800,000.

That’s ahead of getting a significant part of its shareholder loan of €686,667 back from EQTEC Italy. There is also what looks like could be an enhanced dividend going forward from that operation, which could well pay a lot of the company’s overheads.

The future is Gold Ridge

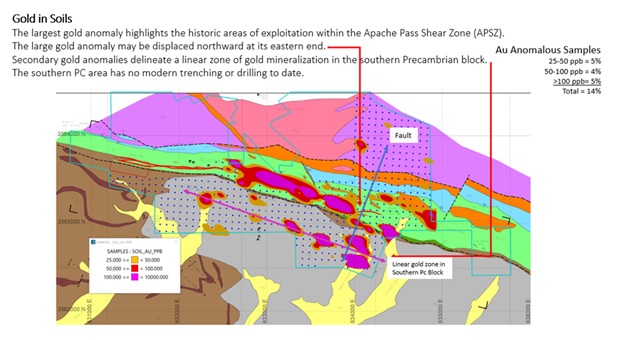

Great strides have been made at the Gold Ridge Gold Mine. Very encouraging results from geochemical sampling pave a pathway to further exploration work to be focussed and planned. Highlights included soil geochemistry providing evidence for multiple geologic events, including the offset of Apache Pass Shear Zone (APSZ) at eastern termination of historic mining. This offset also implied that historically mined gold mineralisation is transposed northwards where no exploration drilling has occurred.

On top of that, a new linear gold anomaly has been defined in the Southern PC block which parallels the APSZ as a multi-element geochemical anomaly, while a new significant multi-element geochemical anomaly occurs 1km west of the Dives Mine. That’s not to mention copper anomalies in volcanic rocks show strong evidence for radial fracturing, a common feature of porphyry deposits.

Gold in soils results slide from the presentation of the Gold Ridge soil sampling programme. Source: Company

Gold in soils results slide from the presentation of the Gold Ridge soil sampling programme. Source: Company

It was pointed out that the findings of the geochemical programme encourage the company to conclude that the area may host a larger mineralisation system controlling all the surface mines and showings. The company’s Senior Geologist reckoned that this is a real possibility of a larger un-discovered gold/base metal system at Gold Ridge. High praise indeed.

MetalNRG has completed just under 600 (Phase I) of the 1,000 geochemical samples planned. The largest gold anomalies were found in historical areas mined for gold. However, a secondary zone of gold anomalies was found in an area previously unexplored and delineates a new linear zone of gold mineralisation in the Southern Precambrian block – an area which has seen no modern trenching or drilling to date. To show just how good these results look to be, of all the sample results to date apparently 14% have gold above 25ppb, 38% silver above 0.3ppm, 47% lead above 35ppm, 40% copper above 35 ppm and 33% zinc above 115ppm.

By way of a bit of background, the Gold Ridge Gold Project lies 85 miles east of Tucson in Dos Cabezas Mining District, Cochise County in Arizona. MetalNRG has a 100% interest in this project which covers an area of 9.3km². This is a brownfield gold exploration play where there are ample opportunities for development as this area remains underexplored for the past 35 years and looks to have plenty of potential for making new gold discoveries.

The Gold Ridge Project spans a large area which includes three historical underground gold mines called Gold Prince, Gold Ridge and Dives. They were each mined over various intervals between discovery in 1877 and 1996. Historical production at the Gold Prince Mine through to 1996 saw a total of around 22,000 ounces of gold mined above the #6 level. This mine was operated from 1984 to 1996 by Phelps Dodge, Queenstake Resources and lastly Western States Mining Corp.

These three historic mines cover a 1.8km strike length that lies within a prospective 5km long vein swarm. The geology of the area suggests that steeply dipping high-grade gold bearing, quartz-sulphide veins are hosted within the 32km long, Apache Pass shear zone, which lies adjacent to a Tertiary plutonic-volcanic centre. The historic Dos Cadezas Mine was located in the nearby plutonic rocks which were magma that cooled below surface.

MetalNRG has been focused on gaining a complete understanding of the rock types, structures, soil geochemistry and mineralisation of the mine area. With such knowledge, the team is seeking to develop Mineral Resources and Mineral Reserves to support recommencing mining.

Far larger potential

Consolidating nearby previously producing mines in the area looks as though it could become interesting. Initially, the team looked at waste dumps with gold and then gained some impressive assays when sampling the pillars underground. However, the geologists have now taken a step back and are looking at the much bigger picture. SRK reckons that there are much larger opportunities to these three small mines, which are not that far apart.

Moving forward, new gold anomalies in a new unexplored area are begging attention and really showing the true possibility for a possible open pit operation. There is a new southern area which has seen no trenching or drilling to date. Plus, those new gold anomalies that no one knew about are being uncovered. Reassuringly, the more they explore the more their geologists discover. It is plain to see that no one has before looked at the overall geology and structure. Now that is happening it does seem that the true potential might start to begin to be unveiled.

Soon, MetalNRG should stop being a litigation play and it will be back to work full time on the corporate strategy. Soon the legals which has bedevilled the company should finally be over, the appeals processes should be completed by April/May. It has to be pointed out that MNRG won the legal issues both in London and Scotland. Judges pretty well concluded that the plaintiffs did not have a leg to stand on. With the stock now sitting at the 0.065p mark, we believe there is latent value within the company of multiples of the current beaten down price and now presents a fantastic, albeit speculative, buying opportunity.

RISK WARNING & DISCLAIMER

MetalNRG is a research client of Align Research and owns shares in MetalNRG. A related company Catalyse Capital also holds a susbtantial interest in MetalNRG and cannot be seen to be impartial in relation to the share price outcome. Full details of our Company & Personal Account Dealing Policy can be found on our website http://www.alignresearch.co.uk/legal/

This is a marketing communication and cannot be considered independent research nor is it subject to any prohibition on dealing ahead of its dissemination. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk

This financial promotion has been approved by Align Research Limited