Anglo African Oil & Gas update – news ref SNPC provides catalyst for potential price target upgrades

There was some cracking news from Anglo African Oil & Gas (AAOG) on Friday afternoon with an update on well TLP-103C, along with details of cost reimbursements from its partner Société Nationale des Pétroles du Congo (SNPC).

The TLP-103C well targeted a number of horizons including the Djeno, which is a prolific producer in the neighbouring licences with individual wells recording 5,000 bopd and upwards production numbers. Drilling operations were completed on the 26 January 2019 having successfully encountered oil shows, not only in all the targeted horizons, but also in some additional areas.

Since that time, the TLP-103C well has been left to stabilise for 45 days. To release pressure that had been building up in the tubing the well was opened and oil produced. A sample of this oil was analysed by the Congolese state refinery which has been able to confirm that the oil collected had an API of 43° and came from the Djeno reservoir.

Certainly, this serves to confirm Schlumberger’s earlier computer-processed interpretation (CPI) calculations which in January 2019 led the consultants to conclude that the TLP-103C well had encountered oil in the Djeno reservoir. We have viewed a successful discovery in the Djeno as being potentially able to deliver a transformational increase in production.

Facts we can glean are as follows:- oil from the Djeno came to the surface under its own pressure, this is despite a concrete plug having been inserted below the Mengo horizon. Such pressure is another characteristic of the Djeno reservoir where it seems that the TLP-103C well was in the end drilled in an excellent location. With such results, the engineers are re-investigating the merits of producing from a side-track of the TLP-103C as a better option to the planned co-mingling production from the R2/Mengo horizons.

Just to recap. AAOG is an AIM-listed independent oil and gas development company which is focused on increasing production from its existing assets in the Republic of the Congo. The company has a 56% stake in Tilapia, which a producing field in the Lower Congo Basin adjacent to 1 billion-barrel fields. AAOG’s partner in this licence is the Congolese national oil company SNPC which has a 44% interest in this project.

For some time now AAOG has been funding SNPC’s share of costs and the amount currently owed stands at around US$9.5 million mark, which largely relates to SNPC’s share of the costs of drilling TLP-103C. In mid-February 2019, SNPC agreed to make monthly instalments of US$600,000. The intriguing latest news is that SNPC now wants to re-open negotiations to exchange part of its equity stake in Tilapia for the forgiveness of that debt.

This is just what the company had been hoping for, but obviously SNPC also sees the potential upside in Tilapia. AAOG has agreed to such talks with SNPC provided the monthly payments are made while the negotiations persist. At the time of this latest announcement David Sefton, Executive Chairman of AAOG was quick to point out that SNPC were “…excellent partners for their technical abilities and deep knowledge of assets across the Republic of the Congo…”.

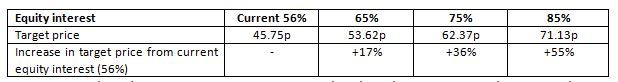

At this stage it is worth investigating how resolving the underlying issue of the size of SNPC’s equity interest could affect our target price. On 18 February 2019, we upped our target price which now stands at 45.75p, after adjusting for the current FX rate and post the payment of the cost of drilling etc associated with TLP-103C out of the placing proceeds. Below we set out the target prices that would result from the company gaining an increased equity stake in the project. Congolese regulations do dictate that the maximum stake that AAOG could hold would be 85%.

Target prices based on varying equity interests in the Tilapia licence. Source: Align Research

The currnet negotiations need to resolve the SNPC equity issue once and for all. With the capital expenditure required to ramp up production from the Djeno, SNPC could soon find themselves in an identical position unless its stake is slimmed down to a level which they can adequately fund on an ongoing basis. It is thus not beyond the realms of possibility that AAOG could end up with an 80% or 85% stake in Tilapia plus some cash. It seems inconceivable to us given the drill results that the market would not reward such an outcome from the negotiations with a significant uplift in the equity price..

Undoubtedly, a healthy news flow looks to be on the cards whilst these negotiations with SNPC proceed. It was clear in last Friday’s announcement that the board has received a report by a reservoir engineering group who were asked to work on a production plan for the TLP-103C well and the company intends to update the market on these plans once the report has been reviewed.

In addition, information from the analysis of the oil at surface will be included in the CPR which is planned to see the light of day in April. That’s not to mention the new licence. The team should soon see the terms against which to negotiate the new licence – we believe that there is plenty of scope to improve on the previous one that is more tailored to AAOG’s plan to massively ramp up production from the Djeno.

It does look as the market’s attention is likely to be strongly focussed on AAOG over the next few weeks/months as the potential at Tilapia becomes better understood. Accordingly, we reconfirm our Conviction Buy stance and our target price of 45.75p.

RISK WARNING & DISCLAIMER

Anglo African Oil & Gas is a research client of Align Research. Align Research & a Director of Align Research own shares in Anglo African Oil & Gas and are bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.