Align Research Top 7 Conviction calls for 2021

Well, its that time of year again and, like many, we are certainly very pleased to see the back of 2020. From a recommendations viewpoint we had some stellar success with Eqtec, Argo Blockchain & Gaming Realms, each of which multi-bagged to varying measures and exceeded our price targets. This year we tried to narrow our highest conviction calls down to 5 but simply could not. Each of the recommendations below warrant an inclusion and so we hope it is a “lucky 7” for us and those that follow our lead, and our money. We make the point that the calls are offered up below not in any particular order. It can be seen HERE also that we have major stakes in a number of them. We continue to believe that we are unique in truly “putting our money where our mouth is”.

We thus wish all our readers and followers a healthy, Covid free(!) and prosperous 2021.

1 – ECO (ATLANTIC) OIL & GAS – current price 22p

The share price of Eco (Atlantic) Oil & Gas has, frustratingly for existing shareholders, seemed to mark time for most of 2020. However, it does look as though the stage is now set for a bit of overdue price action over the coming months. Eco is building on its Atlantic margin focused business with offshore plays in Guyana and Namibia. Importantly, in both of these locations, the company has highly prospective licences which are being developed in partnership with majors, and which really serves to reduce the risks.

Eco started trading on the TSX-V in 2011 with Namibian oil interests. 2016 saw the company teaming up with Tullow to acquire a licence in Guyana to explore similar basins in the margins on the other side of the Atlantic Ocean, ahead of becoming dual-listed in 2017. The shares climbed to over 190p in 2019 following the drilling of two discovery wells in Guyana which confirmed the prospectivity of the upper and lower Tertiary fairways. However, the stock price fell by two thirds in a matter of days on news that the wells contained sour heavy oil, which clearly disappointed the market.

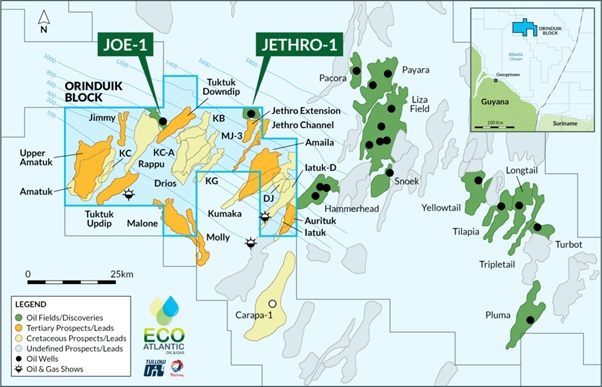

2019 was always going to be hard year to follow, as during that period Eco was able to report two cracking discoveries in offshore Guyana which encountered high quality reservoirs containing mobile heavy crude. Here the company has a 15% WI in the 1,800km² Orinduik Block where it has partnered up with the operator Tullow Oil (60%) and Total 25%. Orinduik lies next door to Exxon’s recent string of drilling successes where more than 9 billion barrels recoverable has been discovered with a 90% hit rate. There is extensive seismic coverage within Eco’s prospects of approx 3.9 billion barrels. The second successful discovery was the Joe-1 well which was completed September 2019, a play-opening well in the Upper Tertiary which very neatly serves to de-risk further identified prospects. The appraisal of Exxon’s Hammerhead discovery has apparently revealed an extension into Orinduik. One could say that it is all starting to look most interesting….

Eco’s acreage in relations to other discoveries in offshore Guyana. Source: Company

The market however has seemingly lost interest given the oil that Eco found was heavy but, it has to be pointed out, that it is pretty similar to other commercial heavy crudes that are in production around the world. There are plenty of reasons to really believe in the considerable upside potential the Orinduik licence possesses, especially in the Cretaceous horizon which has shown to bear light sweet oil in the neighbouring Stabroek and Kanuku Blocks. Over the past 12 months, the company has been working with its joint venture partners to make sense of these discoveries in offshore Guyana and also in relation to other discoveries which are close by in order to delineate drill targets for 2021. Given all this potential, Eco wants to resume drilling on Orinduik as soon as possible.

Enviable position in offshore Namibia

In offshore Namibia, the company has the second largest footprint after ExxonMobil. Late in 2020, investors learnt that the company had successfully negotiated for all its four licences in the Walvis Basin in offshore Namibia to be re-issued. Four new Petroleum Exploration Licenses (PELs) have been awarded on Eco’s existing offshore blocks, which results in a large expansion of the company’s acreage position. In all, these new PELs cover something like 28,593 km², with more than 2.362 billion BOE of prospective P50 resources. This can be seen as a bit of a reward for the company’s big investment in these offshore blocks in the Walvis Basin.

|

Licence |

Acreage km² |

Block reference |

Licence ownership |

Controlling interest |

|

Cooper |

5,788 |

Block 2012A |

54.3% WI |

Operator |

|

Sharon |

5,700 |

Block 2213 |

56.7% WI |

Operator |

|

Guy |

11,457 |

Blocks 2111B & 2211A |

47.2% WI |

Majority partner |

|

Tamar |

5,648 |

Blocks 2211B & 2311A |

85% WI |

Operator |

Eco’s acreage offshore Namibia. Source: Company

Offshore Namibia oil exploration has become highly attractive for IOCs and oil majors over recent years. It has to be said that with the likes of proven oil finders such as ExxonMobil, Total, Qatar Petroleum and Shell arriving on the scene, it looks fairly certain that more discoveries could now be on the cards. Eco looks very well-placed to benefit tremendously from any successes in the forthcoming drilling campaigns of Total, Shell, M&P, and ExxonMobil.

The next 12 months looks as though there will be a lot going on at Eco and which we believe now represents a really compelling play with its prolific hydrocarbon provinces where the company teams up with majors. Today, the company is in good shape, with US$17 million in the bank and being fully funded for further drilling in Guyana. We initiated research coverage of Eco in November 2020 with a Conviction Buy stance and target price of 123.54p and have not changed our view.

2 – KAZERA GLOBAL INVESTMENTS – current price 1.475p

Upfront disclosure – we are the largest shareholders here. Second blunt statement, are very happy indeed to sit in this position.

In late 2020, the Kazera story really started coming together quite rapidly and we now believe that company is poised at the dawn of a new era which should usher in the generation of substantial value for equity holders. What’s even better is that the shares remain “under the radar” unlike many of the smaller miners with dubious prospects that have been heavily promoted and their valuations are well out of sync with underlying fundamentals. We believe the polar opposite applies here at Kazera and expect that the stock is likely to be one of the star performers of 2021 in the junior mining sphere.

In our opinion, the stock has only just begun its move up from what was, to all intents and purposes a shell valuation as the market lost faith in the likelihood of the Tantalite Valley Mine ever being put into production. At the heart of the Kazera story lies its 100%-owned world-class tantalum mine which boasts blue-sky potential. Even better, this stuff is high-grade, low radioactive (very important for offtakers) and there is also quite a bit of lithium – the rare earth du jour given the global move towards increased “electrification” and away from fossil fuels.

Tantalum is one of the rarest elements on the planet and Kazera’s partners are large US electrical equipment companies – no names mentioned. The stock market seems yet to wake up to the fact that along with the rare earth elements, on the list of critical metals are also manganese and tantalum.

Tantalum on the critical list

The US relies on tantalum to build basic circuitry in guidance control systems in smart bombs as well as on-board navigation system in drones. In addition, tantalum is also an important component in US anti-tank systems, robots and most of its weapon systems. It’s all down to the metal’s high thermal conductivity which results in something like two-thirds of world production going into electronic capacitors. Without it, smart phones and all sorts of modern technology just cannot function.

|

Country |

Mine production |

Reserves |

||||

|

2015A |

2016A |

2017A |

2018A |

2019E |

||

|

Congo (Kinshasa) |

350 |

370 |

760 |

740 |

740 |

n/a |

|

Rwanda |

410 |

350 |

441 |

500 |

370 |

n/a |

|

Nigeria |

na |

192 |

153 |

200 |

210 |

n/a |

|

China |

60 |

94 |

110 |

90 |

100 |

n/a |

|

Brazil |

115 |

103 |

110 |

250 |

250 |

34,000 |

|

Australia |

na |

na |

83 |

23 |

20 |

55,000¹ |

|

Ethiopia |

na |

63 |

65 |

70 |

40 |

n/a |

|

US |

– |

– |

– |

– |

– |

n/a² |

|

Other |

117 |

45 |

83 |

101 |

109 |

n/a |

|

World total |

1,100 |

1,220 |

1,810 |

1,890 |

1,800 |

>90,000 |

¹ – JORC compliant reserves of 14,000 tons.

²- The US has about 55,000 tons of tantalum resources in identified deposits, most of which were considered uneconomic at 2019 prices.

World mined tantalum production and reserves (tons).

Source: US Geological Survey, Mineral Summaries Annual Reviews

A recurring theme last year has been China’s stranglehold on rare earths and so, the US has been in the process of attempting to reduce its reliance on the Chinese for its supply of critical metals. Truth is that the US needs to rapidly establish alternative sources of supply. For tantalum there are few places to go as so little of this critical metal is produced and where it is, there is usually a high radioactivity content. It is for these twin reasons that tantalum plays like Kazera are extremely rare.

Mineral processing of tantalum at Kazera’s 100% owned mine. Source: Company

So far so good. However, the stumbling block to commercial production has been a lack of water. Boreholes in the area just could not supply the needs of the processing plant (which like the mine is already in place). The solution is a 13km pipeline from the Orange River which would solve this problem, coupled with some plant upgrades, which will cost US$3-5 million.

Transformation

To address this funding requirement, 2020 saw Kazera transformed into a diversified resources company where its fortunes will no longer be dependent on a single asset in a single jurisdiction where a shortage of water had stymied production. The company has now moved into alluvial diamond production at a secured & untouched mining block in the intertidal beach zone at the long-established Alexkor diamond operation in South Africa.

The resultant cash flow has been earmarked to fund production of heavy mineral sands (HMS) also on the beach near Alexander Bay and further the development of Kazera’s tantalum mine. In a nutshell this is a pathway to near term cash flow generation, enabling each project to be funded internally. Best of all there is a clear intention of strictly limiting equity dilution moving ahead.

The impressive progress on the ground in South Africa seems to be now, finally, matched with developments in Namibia. The prospect of growing cash flow from the new diamond and HMS operations is poised to have a transformational effect on the company and its share price. Such improving fundamentals ought to attract the spotlight to firmly shine on Kazera and with the announcement on the 21st December in which management veritably telegraphed that there is a signed subscription agreement “at a price in excess of the current share price (then 1.25p)” it looks as if the first few weeks of 2021 will cement this.

Without the water problem, this tantalum mine could make several million dollars a year as it stands without upgrading the plant. With the cash from the new Namibian investors, there should be nothing holding the tantalum project back as it has the plant, mine and ore resources in place.

The interesting thing that we have seen in the markets time and again is that as soon as a company starts generating cash flow, belief starts to return and its effect can be transformational. With the investors having been on site and successfully completed their due diligence investigations, the subscription price is said to be reflective of NAV and that we estimate to be between 1.5 – 2p. As the largest shareholders we await the conclusion of this with eager anticipation and expect the investment level will set a new base for the stock.

Having initiated coverage on Kazera with a Conviction Buy stance in early August 20202 at 0.70p we set an initial target price of 2.50p. Now with the stock currently sitting at 1.475p and news flow to come on many fronts through 2021 we are more than happy to reconfirm our highly positive recommendation and plan to, post the concluded investment, update our model and note extensively. With, in 2021/2 hopefully a fully fledged HMS operation, tantalum and lithium production, the trading arm and diamond mining generating useful cash we are hard pressed to find another listed mining entity in London on the cusp of so many near term cash flow generative events.

3 – IRONVELD – current price 0.52p

Time looks as though it has stood still at Ironveld for the last three or four years and thus it is little surprise that the stock market fell out of love with the company and the share price fell to uncharted depths as 2020 drew to a close. The end result was that the company raised £1 million at, what was to all intents and purposes, a shell company type valuation of £3 million in November 2020, despite there being tremendous potential. These funds have now cleared the decks of accruals and given the board a year to do a deal. This time around there looks like a real desire to do a deal. Truth is there will not be many more chances.

Ironveld actually has a hugely exciting & world class asset. The company sits on a unique project located on the Northern Limb of South Africa’s Bushveld Complex. This project has a JORC-compliant resource of 56.3Mt grading at 68.6% Fe2O3, 14.7% TiO2 and 1.12% V2O5. When in operation, this should attract a lot of attention as it would be the first project in South Africa that is capable of producing high purity iron (HPI), vanadium and titanium. Given all that, it is little surprise to find that globally recognised offtake partners are already in place for all three products. Ironveld’s project has huge potential that is ready to be unlocked by near term financing.

The company did have a deal with Inclusive Investment Group (IIG) to find the necessary finance to progress their SA resource but has now let it lapse. Now free from IIG’s clutches, this has certainly put the company back in play and we expect other interested parties to begin knocking on their door. The form of any possible deals could be another strategic partner taking a stake and securing finance, traditional project finance, or investment equity at the asset level into the project.

High purity iron, vanadium and titanium mineralisation outcropping at Ironveld’s project in the Bushveld. Source: Company

Big competitive advance

Ironveld is blessed with a tremendous competitive advantage when it comes down to HPI production, and which is used in 3D printing. There are only a handful of major HPI producers, and most do not have their own mines but instead use scrap stainless steel which accounts for up to 70% of production costs. The company’s big advantage is that not only is it cheaper to mine rather than grinding up stainless steel, but also Ironveld’s HPI does not have the impurities that exist in stainless steel as it has not been processed. The compelling combination of having its own mine together with by-product credits represents a huge competitive advantage. All of this firmly places Ironveld in the lowest quartile of the HPI cost curve. When you consider by-product credits, the company may well be the world’s lowest cost producer.

Middleburg 7.5MW smelter. Source: Company

There are near, mid and long-term opportunities here. Phase 1 is the near-term opportunity provided by the pending acquisition of an existing 7.5MW smelter, where a purchase deal has been agreed. To start the mine and buy the smelter will require R300 million (£15 million). Ironveld’s resource in the Bushveld in Phase 1 mining at 40,000tpa would take 25 years to mine 1Mt of the 56Mt, incredibly still leaving 98% of the resource intact. It is crying out for a far larger project that could really begin to make the most of this cracking potential and that’s where Phase 2 and Phase 3 come in. Given the delays, it is important that the company just gets started.

Although the purchase of the Middelburg smelter is still the prime strategy, there is a growing opportunity for even earlier cash flow at this project. Magnetite ore could be simply dug up, crushed and without any further processing be used in dense media separation (DMS) for coal washing. Such a move could generate some handy cash flow which would give the company more breathing space to do a more commercial big deal. A joint venture could lead to the rapid start of a simple mining and crushing operation of the magnetite ore for coal washing where it is the most commonly used material.

As we have seen with our other top pick, Kazera Global, it’s amazing how the investment profile of a stock changes when cash flow starts – suddenly the stock market begins to believe in you again. There is all this potential with Ironveld, along with a highly experienced board and senior management team based in South Africa and the UK who are no strangers to pushing projects rapidly up the valuation curve.

We are in the midst of undertaking the analysis for a full in-depth research report on Ironveld. Although we don’t want to spoil it for our readers, it’s fair to say that we are a bit bullish.

4 – TECTONIC GOLD – Current price 1.65p

It looks as though 2021, will see Tectonic Gold come of age. The company has a really impressive, highly focused, high-grade gold portfolio in Australia with multi-million-ounce potential projects which are planned to be joint ventured or sold to majors. At this stage, all signs are that the majors are watching as Rio Tinto has already pegged acreage next door to Tectonic’s flagship project, which we believe speaks volumes for its potential.

The back story here is that Tectonic Gold became Aquis listed in 2018 following the RTO of an Australia based gold explorer called Signature Gold. This brought into the company impressive R&D, big data and exploration methodology which has been developed in Australia on other Intrusive Related Gold Systems (IRGS) regions around the world. So, Tectonic is focused on the huge global opportunity in large-scale high-grade IRGS projects which investors are likely to increasingly learn more about over the coming years. This is a true competitive advantage.

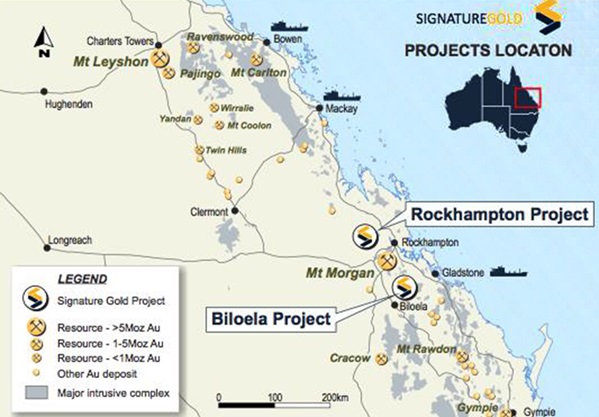

Tectonic Gold’s projects held through its 100%-owned subsidiary Signature Gold.

Source: Company

IRGS represent a new frontier in the discovery of significant, large gold deposits. This is a relatively recent development as there was little comprehensive research into the actual genesis of gold deposits up until the 1980s. Developments since then seem to have re-written the rule book, with a number of well-known big gold deposits and large gold mines now being reclassified as IRGS deposits. Tectonic has a tremendous skill set to seek out such opportunities by looking for the tell-tale signatures of these potentially rich mineralisation systems. It has put its knowledge to good work at its large Biloela Project, which includes Specimen Hill and Last Chance.

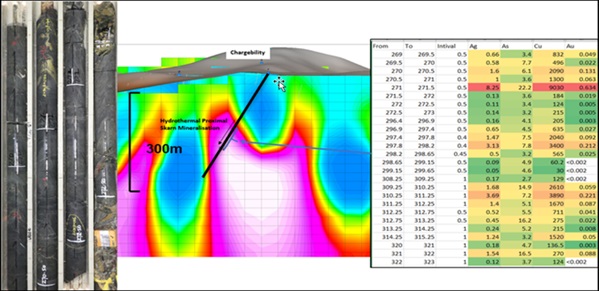

Investors should really start to get excited by the fact that in the Specimen Hill Area there is more than one deposit/style consisting of Au/Ag and Cu/Au systems resulting from multi-phase hydrothermal events. The team reckon that the architecture of the Main Gold sheet system extension is similar to the Kupol mine in the Okhotsk-Chukotka volcanogenic belt in Russia which is owned by Kinross Gold. Well, with all that going on, the company’s attention seems to be focused on the following three aspects. Firstly, evaluation of geological (mineralisation) architecture and devolving hydrothermal system to locate economic mineral traps. Secondly, evaluating Main Lodes extensions to Cameron’s Look Out deposit (800m extension of veins to main lodes). Thirdly, infill drilling to confirm continuity of gold grade and geology so a resource shell can be defined around the high-grade gold veins.

Sample drill results and gold bearing core from the 2019 drilling programme. Source: Company

Tectonic’s project pipeline has an extensive database of past exploration, production and drilling. This, combined with the current state-of-the-art technology, means that IRGS deposits can now be identified at low cost. Truth is that the team already discovered the structure at Specimen Hill from high resolution magnetic surveys and 3D IP (pictured) and, in combination with past drilling records and historic mining, they knew there was gold in the system before it was drilled. A nice situation to be in.

There is no doubt that Tectonic is imminently well positioned to provide the majors with replacement projects. The company has two large, advanced projects – one of which could be a Mt Morgan (8 million ounces (Moz) gold) lookalike – in a highly prolific gold belt. More than 3Moz is being targeted at each project now that the gold bearing systems have already been identified. Investors benefit from a past £7.5m spend which has resulted in compelling discoveries and multiple drill ready targets. All the signs are that the company has identified and proven gold bearing systems in a highly prolific area.

The flagship Specimen Hill project seems to be shaping up to have impressive potential. Early in the New Year, investors should expect to see the publication of the remaining assay results from the latest drilling programme. Already we know that gold/copper/silver mineralisation has been logged – it’s just a question of grade. All of this data is planned to be used to define a maiden JORC resource with hopes for an upgraded resource and feasibility studies where the economic value of the gold mining project based on the defined resource will be determined later on in the year. This should result in a sustained news flow over Q1/Q2 2021 which could culminate in the very real prospect of a corporate deal on Specimen Hill before the end of 2021.

We updated our coverage of Tectonic in September 2020 with a Conviction Buy stance and a target price of 5.54p with the shares then standing at 0.35p. We were dead right. Now with the stock trading at 1.35p, we see more to come.

5 – KORE POTASH – Current price 0.775p

Our 2021 recommendations had to include Kore Potash, where almost all the pieces are now in place to allow the company to commence a dramatic growth trajectory. It remains to be seen whether the majors of the potash world will be prepared to concede market share to them or buy them up. Perhaps in the coming twelve months we will get an answer.

Almost every company seems to claim that its operations are in the lowest cost quartile. However, Kore is able to go one stage better as its project has all the makings of being the lowest cost potash supplier to the giant Brazilian market from its globally significant deposits in the Republic of the Congo (RoC). If that wasn’t enough, Kore has the shortest shipping route to the Brazilian market, along with the fast-growing African market.

District scale development potential

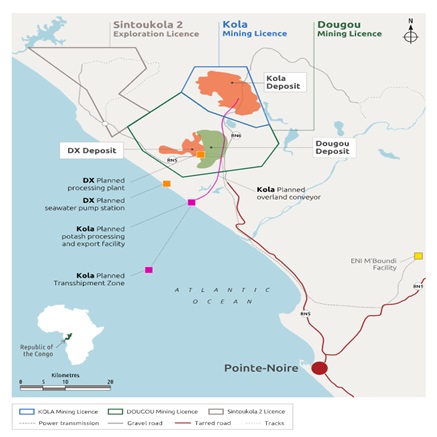

Kore has been developing its vast Sintoukola potash basin in the Republic of the Congo since 2010. The company is certainly well-blessed as it has district scale development with 6 billion tonnes of potash which is just 12km from the coast. There is no shortage of technical data and existing feasibility studies as something like US$150 million has already been spent here to date.

Kore is developing its global significant potash deposits in the RoC. Source: Company

Such is the enormous scale of this potash basin that eventually a big project will be required to really do this globally significant potash resource justice. It will also need a big budget. Its flagship 2.2Mtpa Kola project came through DFS with flying colours but, with an estimated US$2.1 billion capex. Great, but this sort of financing just isn’t available for a lowly capped junior miner for a new project in the RoC.

Small starter DX project

New blood in the boardroom led to a really sensible move to devise the smaller starter DX project, one which would mark the initial stage in the district wide development of the Sintoukola potash basin. The 400,000tpa DX project is rapidly going through feasibility studies and there is no reason that this shouldn’t be in production by Q4 2023. The PFS was announced in May 2020 and allowed the team to commence work on the DFS in September 2020.

Progress on various elements for the DFS allowed an Updated PFS to be announced in mid-November 2020, materially enhancing the results of the PFS. Basically, the Ore Reserve estimate for the DX remained unchanged. However, an improved understanding allowed the production schedule for this Updated PFS to include 2.43Mt of Muriate of Potash (MoP) from Indicated Mineral Resources and 2.31Mt MoP from Inferred Mineral Resources. The end result is a far longer mine life and higher NPV.

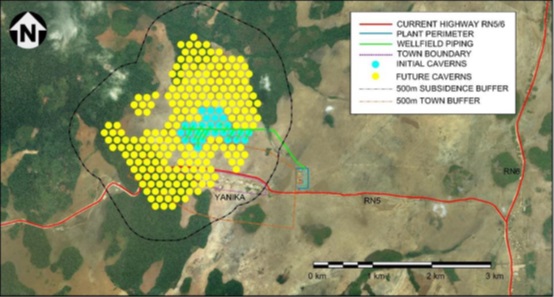

Wellfield and process plant location planned for DX. Source: Company

As it stands, the Updated Production Target gives a 30-year project life at 400,000 ktpa MOP. The Updated PFS determined an attributed NPV 10 of US$412 million and 23.4% IRR on a real post tax basis at life of project average granular MoP price of US$422/t (which is the Argus Media’s price forecast CFR for DX Project’s target markets), with a post-tax payback period of just over four years.

All the signs are that DX can rapidly come on stream with capex under US$300 million, making it financially possible for a greenfield operation in the Republic of the Congo. DX is a scalable solution mine which is low risk as there are many such successful potash projects around the world. Getting DX into production is a game changer as it will make the financing of Kola possible and begin to unlock the tremendous value here.

All this is being played out against a background of rising potash demand as the world will need to grow 50% more food by 2050. Arable land per person is sharply declining and farmers are increasingly using more fertiliser to feed an anticipated population of 9 billion people by this time. Kore will produce MOP which is the cheapest and most important source of potassium for agriculture, so there is no risk of substitution.

Our view is that Kore will either be allowed to grow or be acquired. DX and Kola put Kore on a real journey with its 6 billion tonnes of potash. Not only are the company’s production costs very cheap but also Kore has the shortest shipping route to the African markets and Brazil. Moving ahead, the development of the Sintoukola Potash District will basically be serving to replace potash from the Northern Hemisphere.

There looks to be substantial potential value to be created at Kore for the benefit of all shareholders over the coming years. We initiated coverage on Kore Potash with a Conviction Buy stance in June 2020 when the price was sitting at 0.85p with a target price of 6.51p. Now with the shares trading at 0.80p, we are more than content to reiterate our stance.

6 – YOURGENE HEALTH – Current price 15.5p

Despite the turbulence seen in the markets over the past 12 months, 2020 has actually been a good year for small caps. As we write, the AIM All Share index stands at just over 1,100, up by 15% over the year as a whole and by 86% since the depths of the market sell off in mid-March. Unsurprisingly, leading the way have been a number of healthcare stocks, including Novacyt, up an astounding 6,000% in 2020, with Synairgen also seeing a four digit gain of 2,370%.

But one healthcare stock which seems to have been largely ignored by the markets is Manchester based Yourgene Health. Yourgene is an international molecular diagnostics group which is operating in a global market worth an estimated $8.3 billion in 2019 and forecast to grow at a CAGR of 9% up to 2026. Yourgene itself has been growing strongly under this backdrop, with revenues up by a CAGR of 61.3% between FY2016 and FY2020 and maiden profits at the EBITDA level posted last year.

The company’s flagship product is the IONA® test, a non-invasive pre-natal testing (NIPT) product used to determine the risk that a pregnant woman’s fetus is affected with Down’s Syndrome or other serious genetic diseases. An updated test, the IONA® Nx, was launched in H2 this year and is expected to drive strong growth in 2021 and beyond.

Meanwhile, under CEO Lyn Rees, appointed in summer 2018 and well respected in the markets, the company has been growing its portfolio of products, both organically and via acquisition. The business was significantly expanded in April 2019 when Yourgene completed the £9.2 million acquisition of Manchester based neighbour Delta Diagnostics (trading as Elucigene), a molecular diagnostics manufacturer and developer. The deal brought with it a complementary suite of in vitro diagnostic CE (CE-IVD) marked products focused on reproductive health and oncology, including leading products for cystic fibrosis testing and invasive prenatal aneuploidy screening.

Attracting the attention of investors amidst the global pandemic, Yourgene announced the launch of a number of COVID-19 related products and services during the course of 2020. These included the signing of a contract manufacturing services agreement to support the production of COVID-19 diagnostic tests, the launch of a CE-IVD marked diagnostic test to detect the SARS-CoV-2 virus and the expansion of its laboratory capabilities to support the NHS & private users in a COVID-19 laboratory service testing.

Clarigene™ SARS-CoV-2 test. Source: Company

Also in 2020, Yourgene bought Coastal Genomics, Inc. a sample preparation technology company based in Canada. The acquisition is for up to US$13.5 million, with a £15 million (net) fundraising completed to part finance the deal. Coastal Genomics is a Vancouver-based sample preparation technology company which has developed the proprietary Ranger® Technology. The deal will help to accelerate Yourgene’s diversification into the oncology market and provide access to the DNA sample preparation market. Also, a number of commercial synergies have been identified including cross selling and margin improvements through vertical integration.

Interim results (to 30th September 2020) announced in mid-December were a bit muted, with strong UK and European growth offsetting the impact of the pandemic on some of the company’s international markets. That saw revenues from the core NIPT segment down by 13% at £4.3 million. However, overall revenues were up by a modest 5% to £8.2 million, with an EBITDA loss of £0.2 million posted after an increase in admin costs and investment. However, the balance sheet remained strong with £11.9 million of net cash.

Despite the challenging first half, we believe that investors should really be looking at the company’s track record here, along with its upbeat outlook for H2 2020 and FY2021. Recent comments from the firm have suggested that core laboratory customers are now returning to more normal patterns of testing which, if sustained, will restore growth trends seen in the in NIPT, reproductive health, oncology and research markets. More noteworthy, the UK COVID-19 testing offering made revenues of £0.5 million in H1 from a standing start and are said to have exceeded that in the first two months of H2 alone, with the company operating at full capacity of 10,000 tests per month from October. Capacity is being further expanded to 20,000 tests per month, due to come on stream in the third quarter, and this will increase COVID-19 testing revenue potential to c.£1 million per month with potential for further expansion in line with anticipated demand. These kind of figures are highly significant given that the business as a whole made revenues of £16.6 million in the whole of its last financial year.

We initiated coverage of Yourgene in August, with our DCF valuation of the company suggesting a target price of 26.63p per share. With the shares currently trading at just under 15p, we therefore see material upside potential. More significantly, our target price did not account for any revenues from the COVID products & services, thus suggesting significant further upside to our target price in the medium to long-term. To illustrate the potential COVID testing upside, we made some assumptions on revenues and margins, along with a 10,000 a month testing capacity. This analysis added an additional 13.04p to our target price, but as we have seen this could well be a conservative figure given that capacity is currently being doubled to 20,000 a month. With COVID testing likely to see continuing strong demand next year and perhaps beyond, Yourgene Health is our top pick in the small cap healthcare sector.

7 – CORO ENERGY – Current price 0.42p

Growth in electricity demand in South East Asia is amongst the fastest in the world and a compelling play on this enormous opportunity is Coro Energy, a company which has rapidly developing interests in both renewables and gas.

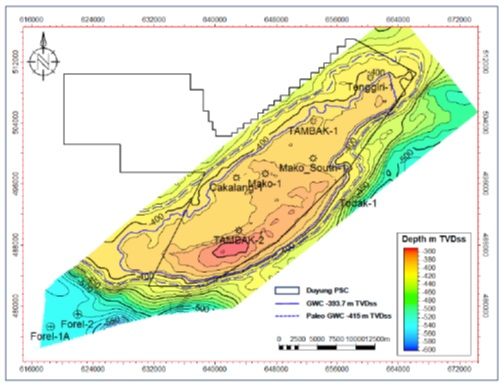

Duyung PSC’s Mako Gas Field is one of the largest gas fields ever discovered in the West Natuna Basin, offshore Indonesia, where production could start in 2024. It represents a tremendous gas asset which is reasonably close to Singapore and linked by a pipeline which all makes for it being a highly marketable asset. This is a shallow single tank deposit that is well understood and technically low risk.

A highly successful appraisal drilling programme in 2019 dramatically increased the gas resource which has led to the Mako plan of development needing to be upgraded which also ushers in a profile of much better returns. Leasing the processing facilities could allow the capex to be trimmed to US$265 million. Plus, there is even cheaper alternative of piping the gas to an existing platform which has already has compression facilities. With some other projects in the area in decline, Duyung would be able to use the spare capacity in the pipeline to Singapore where premium prices are paid. Obviously, the gas price is the key, but this is a very bankable project even at relatively low gas prices.

The large areal extent of the Mako Gas Field, Duyung PSC, offshore Indonesia showing all the wells drilled on the structure. Source: Company

Coro could fund its share of the development of the Duyung PSC in many ways. Operator Conrad Petroleum may seek to reduce its 76.5% holding stake with a farm out deal. If Coro tagged along and if the development was project financed on a 40% equity and 60% debit basis – the sort of investment required by the company would most likely be in the region of US$10 – 15 million and not US$20 – 40 million. Obviously, this is all dependent on the development concepts and the market will get a lot more clarity over the coming 6-9 months.

Recent move into renewables

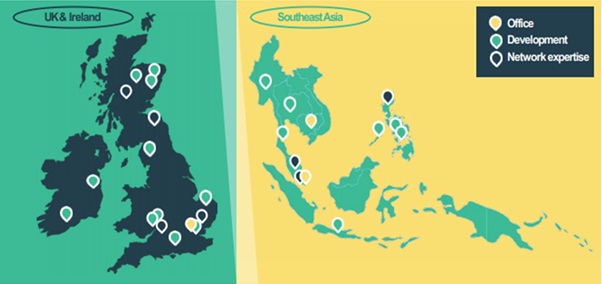

In recent months, Coro’s board has recommitted itself to South East Asia and now has a broader corporate strategy of hydrocarbons and lower carbon technology. The company has big plans for energy storage backing highly cash generative projects. The first move has been to take a 20.3% stake in ion Ventures, a firm which has 250+Mw of battery storage projects with consent in SE Asia and UK/Ireland. Coro has first right of refusal to fund each of ion’s clean energy projects.

200MW of shovel ready grid connected assets – 50MW of grid connected and off-grid solutions

ion Ventures’ project pipeline. Source: Company

The substantial pipeline of battery storage projects that ion has amassed is now being rapidly matured towards financing and project execution. Coro is getting involved in the pre-development /pre-construction stage where there is a higher risk by where a decent return look to be on the cards from a meaningful but relatively small investment

The message that is coming through loud and clear is that there are big opportunities and investors should not fear the level of financing required. The share price of Coro has cratered over recent years, down from 4p to a derisory level at which the stock offers tremendous value in our view. Investors might have been put off by debt and a lack of obvious progress with little news. It has to be pointed out that James Parsons has a proven track record in renegotiating such debt and anyway the company’s €22 million Eurobond issue (raised to pay for its stake in the Duyung PSC) is in friendly hands.

Moving ahead, the news flow looks to be good. The revised Plan of Development and the signature on the Gas Sales Agreement (GSA) could trigger a strong re-rating of the stock. Certainly, a GSA with a favourable gas price from the gas market moving up is a value catalyst that we believe is not even remotely priced in. At the same time, all this is happening as the scale of the opportunities from the company’s first move into South East Asian renewables and battery storage become apparent. Coro seems to be in the right place at the right time given the sentiment tailwind in this space in recent months. With the shares springing to life in the dying days of 2020 t looks as though other investors are beginning to cotton on and the future could be very bright.

Given all this pending excitement, we very recently initiated coverage on Coro Energy with a Conviction Buy stance and a target price of 1.50p when the shares were trading at 0.275p. Our view remains unchanged. Buy.

One final point, our specialisation is analysis and investment in small cap companies, in particular in the mining and oil & gas sphere. Each of these companies are, by their nature, at the higher end of the risk spectrum and do not, generally, have the same degree of liquidity as mid and large cap listed Plc’s. You should thus only invest money that you can afford to take such a commensurate risk with.

CLEAR DISCLOSURE – Align Research Limited & a Director of Align Research hold interests in all the companies mentioned in this piece with disclosable interests in both Kazera Global and Ironveld. The Director is bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited