Eco (Atlantic) Oil & Gas – acquisition of Azinam Group firmly heading towards completion

By Dr. Michael Green

There seems no end of good news for Eco (Atlantic) Oil & Gas at the moment which we believe looks poised to push the share price higher. This morning investors learnt that the acquisition of a 100% interest in the Azinam Group Limited is firmly heading towards completion. The latest news is that the final definitive Sale and Purchase Agreement (SPA) has been signed, after which closing is pretty well a formality, with completion expected within three weeks.

This deal comes with incredible timing, just as Shell has unveiled a huge discovery offshore Namibia. This is seen as a game changer for the country as it is Namibia’s first ever oil discovery. To put this into perspective, it is also thought to be Shell’s largest commercial find in Sub-Saharan Africa for more than 25 years since the Bonga deepwater offshore Nigeria discovery back in 1996.

Eco has a strong strategic position in Namibia which looks set to be improved by the acquisition of Azinam. Through this deal the company gains additional WI in its current oil blocks and so ends up with an 85% stake in PELs #97, #98 and #99. This is the same sized WI as Eco has at PEL #100, with the company being the operator on all four PELs.

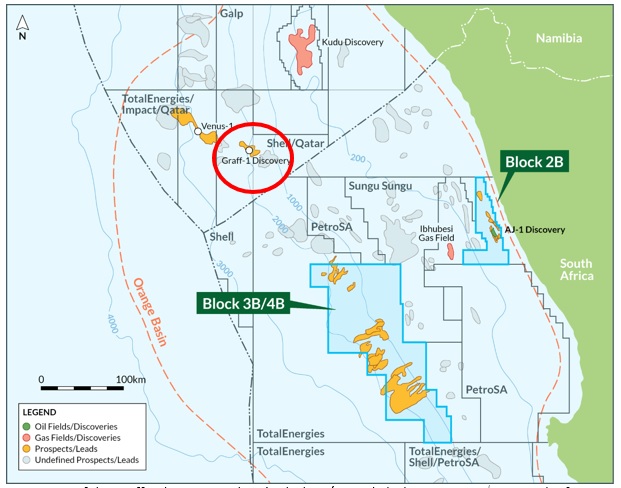

The acquisition of Azinam also takes Eco into the frontier region of South Africa as the deal added interests in two Orange Basin blocks. Block 3B/4B is directly correlated to the Graff 1 prospect and Block 2B which is a shallow water block with a previous light oil discovery.

Eco is acquiring Azinam’s entire offshore asset portfolio in a non-cash deal which involves the granting of a 16.65% equity stake in the enlarged company on completion. This was worth the equivalent of US$11 million at Eco’s share price of 20p when the deal was first announced. In addition, the vendor will also be issued warrants in Eco which are only exercisable on a producible commercial discovery. There are 20 million warrants at C$1.00 per share and 20 million warrants at C$1.50 per share.

Last Friday, the Namibian government was able to announce that Shell (45%) and its partners Qatar Energy (45%) and NAMCOR (10%) had made a significant light oil discovery. The Grafff-1 well had been drilled to a total depth of 5,376m in 1,900m of water in the Orange sub-basin in Namibia and encountered oil in two Cretaceous targets.

Shell and its partners are working to assess how much oil may be recovered. However, well-respected energy consultant Wood Mackenzie believe that the well has met its pre-drill estimate of between 500 million and 1 billion barrels; and they have assumed that 700 million barrels is recoverable. Apparently, the rig is expected to immediately drill a second well in order to prove up volumes.

The discovery of the presence of a working system with light oil in offshore Namibia looks to be a truly transformational event for the region. A comment by NAMCOR’s MD Immanuel Mulunga really said it all – “…We hope that this discovery puts to rest doubts about the hydrocarbon potential of Namibia and opens a new dawn in the country’s future prosperity…”

This is tremendous news for Eco with its strong licence position in Namibia. Global oil and gas hotspots do not recognize national borders and from a geological perspective Eco’s new offshore South African licences can be seen as being next door to Graff-1. In fact, Block 3B/4B is directly correlated to the Graff-1 prospect whilst Block 2B is a shallow water block with a previous light oil discovery. The Gazania-1 exploration well is expected to be drilled in H2 2022 on Block 2B. So, the Azinam acquisition introduces a potentially material short-term drilling catalyst. Block 2B looks to be highly prospective, with the Gazania prospect estimated to contain some 350mmbo sitting in shallow water less than 200m deep. Gazania lies updip of the 1988 AJ-10 oil discovery that was estimated to contain 39mmbbl of 39° API oil.

Location of the Graff-1 discovery and Eco’s Block 3B/4B and Block 2B Orange Basin, South Africa. Source: Company

A reasonable discovery on Block 2B in shallow seas close to the coast would represent the country’s first major offshore oil production. South Africa has some of the most attractive fiscal terms on the continent and a large energy deficit and already companies such as Total, Shell, Eni and Qatar Energy are actively exploring. The country’s well-known shortage of energy leads to frequent power shedding and so there would be a ready market for any gas that was discovered, a refreshing change from the situation found in some other African countries.

Truth is that Eco is exploring for oil and gas in some global hotspots in todays’ hydrocarbon world – offshore Namibia and offshore South Africa, along with offshore Guyana. This latest news comes just days after CGX Energy and Frontera Energy Corporation announced that the Kawa-1 well in offshore Guyana encountered the 177 feet of hydrocarbon-bearing reservoirs within the Maastrichtian, Campanian and Santonian horizons.

CGX and Frontera were quick to point out that these intervals are similar in age and can be correlated using regional seismic data to recent successes in Block 58 in Suriname and Stabroek Block in Guyana. The Kawa-1 well was drilled to a depth of 21,578 feet (6,578m) and targeted the easternmost Campanian and Santonian channel/lobe complex on the northern section of the Corentyne block. All of this does show a growing success story unfolding in offshore Guyana as the country emerges as a global oil and gas exploration hotspot.

We recently updated our research coverage on Eco with a Conviction Buy stance and a target price of 114.65p. At the current price of 28p, we are more than happy to conform our stance.

RISK WARNING & DISCLAIMER

Eco (Atlantic) Oil & Gas is a research client of Align Research. Align Research holds an interest in the shares of Eco. Full details of our Company & Personal Account Dealing Policy can be found on our website http://www.alignresearch.co.uk/legal/

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor. Align Research is bound to the company’s dealing policy, ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited