Eco (Atlantic) Oil & Gas – Tremendous read across for Eco from the latest offshore Guyana discoveries

By Dr. Michael Green

There was big news yesterday from leading global independent energy company Hess Corporation which was able to announce two new discoveries at the Seabob-1 and Kiru-Kiru-1 wells on the Stabroek Block offshore Guyana. We believe this has a tremendous read across for Eco (Atlantic) Oil & Gas.

Stabroek Block is the block that just seems to keep on giving – ExxonMobil is operator and holds a 45% interest and Hess has a 30% stake. To put these latest discoveries into perspective, these are the sixth and seventh made in 2022 alone. It looks as though they will serve to add recoverable reserves to the block’s previously announced gross discovered recoverable resource estimate of c.11 billion boe. At the time John Hess, CEO of Hess Corporation, was quick to point out that “….we continue to see multibillion barrels of future exploration potential remaining. ….. “. On this block, the Liza Unity and Liza Destiny FPSOs have already reached their combined design capacity of more than 360,000 gross barrels of oil per day.

The Seabob-1 well encountered approximately 131ft (40m) of high-quality oil-bearing sandstone reservoirs. The well was drilled in 4,660ft (1,421m) of water by the Stena Carron and is located approximately 12 miles southeast of the Yellowtail Field. Meanwhile, the Kiru-Kiru-1 well encountered approximately 98ft (30m) of high-quality hydrocarbon bearing sandstone reservoirs. The well was drilled in 5,760ft (1,756m) of water by the Stena DrillMAX and is located approximately 3 miles southeast of the Cataback-1 discovery. Apparently, drilling operations at Kiru-Kiru are ongoing.

ExxonMobil and its co-venture partners have currently four sanctioned developments in the 6.6-million-acre Stabroek Block. Firstly, the Liza Phase 1 development which started producing in December 2019 and reached its new production capacity of more than 140,000 gross bopd in the Q2 2022 following production optimisation work on the Liza Destiny floating production, storage and offloading vessel (FPSO). Secondly, there’s the Liza Phase 2 development, which achieved first oil in February 2022 using the Liza Unity FPSO and went on to reach its production capacity of around 220,000 gross bopd earlier this month. Third, is the development at Payara which has all the makings of coming online in late 2023 using the Prosperity FPSO with a production capacity of 220,000 gross bopd.

The fourth development in the Stabroek Block is at Yellowtail. This will be the biggest development so far and is scheduled to come online in 2025. Using the ONE GUYANA FPSO it has a production capacity of 250,000 gross bopd. Yesterday, co-venture partner Hess reckoned that there were at least six FPSOs with a production capacity of more than 1 million gross bopd which are expected to be online on the Stabroek Block in 2027, plus the potential for up to 10 FPSOs to develop gross discovered recoverable resources.

All this tremendous news reinforces the fact that the Guyana-Suriname Basin is a world class frontier hydrocarbon basin, where we know that, so far, more than 11 billion boe have been discovered.

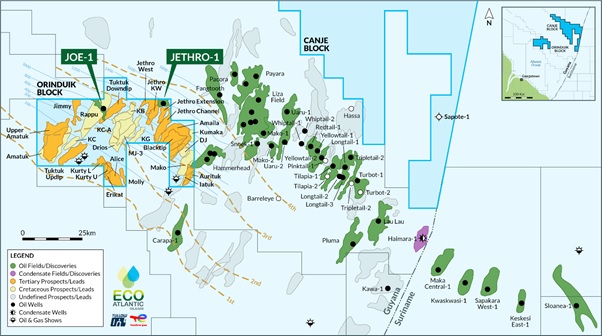

Eco has held a direct WI in the Orinduik Block since 2015. This block lies 170km offshore Guyana and covers 1,800km² and importantly lies updip of the Stabroek Block. Eco holds a 15% WI along side TOQAP. The TotalEnergies/Qatar Energy JV (25%) and Tullow Oil (60%-Operator). Independent CPR indicates Gross Prospective Resource P50 (Best) 5,141MMBOE and P50 prospective resource of 771MMBOE net to Eco. So far on the Orinduik Block 22 prospects have been identified, with 11 leads in the Upper Cretaceous horizon.

If that wasn’t enough, Eco also has an indirect WI in the Canje Block (via a stake it holds JHI Associates), held since 2021. Eco has a 6.4% interest in JHI with an option to increase to 10%. Canje is some 180km offshore Guyana covering an area of 4,800km² and lies directly Northeast (outboard) of the prolific Stabroek Block. The Canje Block has seen multiple significant prospects including the source rock trap centred over main kitchen within the basin feeding 11 billion boe discovered in Stabroek.

Importantly, it should be noted that these latest discoveries are on trend with the light oil targets on the southeast corner with Eco’s block. Each discovery made in the Stabroek Block is extremely positive and helps Eco better target its next drilling campaign.

Map of the offshore Guyana where the Orinduik and Canje Blocks (where ECO has an interest) lie adjacent to Exxon Mobil’s highly prolific Stabroek Block. Source: Company

Two tertiary discoveries were made on the Orinduik Block in 2019. In 2022, progress is being made on Cretaceous drilling target selection. The partners in the block are now entering the next phase of exploration decision making in Q3 2022 as drill commitment is planned to be sent to the government by the end of the quarter. At the same time, the next drilling alternatives are being evaluated for the Canje Block.

At the moment it is a very exciting time for the company. In late-June 2022, at the time when Eco successfully raised US$12.3 million at 30p, Gil Holzman, Co-Founder and CEO of Eco was able to highlight that, “…we are in a very strong financial position to fund all our current planned exploration needs in both South Africa, Namibia and Guyana including the drilling of the Gazania-1 well in September and additional near-term wells on Guyana Orinduik Block and in Block 3B/4B.” Eco, through its 100% owned subsidiary Azinam, operates and holds a 50% WI in Block 2B and plans to spud the Gazania-1 well, 25km offshore the Northern Cape in South Africa in September 2022.

Investors can now look forward to a well being spudded on 1st September, with rig immobilisation probably being announced in 2-3 weeks’ time. Plus, a farm out deal on Block3B/4B is clearly on the cards – given our reading between the lines on the latest developments over there. In addition, of course it looks likely that drill targets for Guyana could be announced.

There is no doubt that Eco is exploring for oil and gas in some global hotspots of todays’ hydrocarbon world – offshore Namibia and offshore South Africa, along with offshore Guyana. In January 2022 we updated our research coverage on Eco with a Conviction Buy stance and a target price of 114.65p, when the stock was trading at 23.75p. To put it mildly, there looks as though there is potentially a lot of excitement to be generated in this stock over the coming months and we are more than happy to conform our stance at the current price of 26.70p.

RISK WARNING & DISCLAIMER

Eco (Atlantic) Oil & Gas is a research client of Align Research. Align Research holds an interest in the shares of Eco and cannot be seen to be impartial in relation to the share price outcome. All employees and analysts are bound to the company’s dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk. You should also assume, given that the majority of Align’s fees are received in stock, that for general corporate cash management purposes including taxation, that divestments of investments held will take place as and when, in Align’s sole discretion, it is deemed appropriate.

This financial promotion has been approved by Align Research Limited