Five new Mid Cap Buy calls – TEVA (US), ENDP (US), KIE, MTRO & INTU

By Richard Jennings

Clear warning upfront – each of these companies carry risk. They are unloved, oversold and resolutely out of favour! This very situation in investment is however the backdrop that creates extreme value – the fundamental tenet of risk v reward remains as true today as it ever was. Precisely because of these opposing scales we believe that each of the companies detailed below offers up potentially material returns.

Kier Group – current price 101p

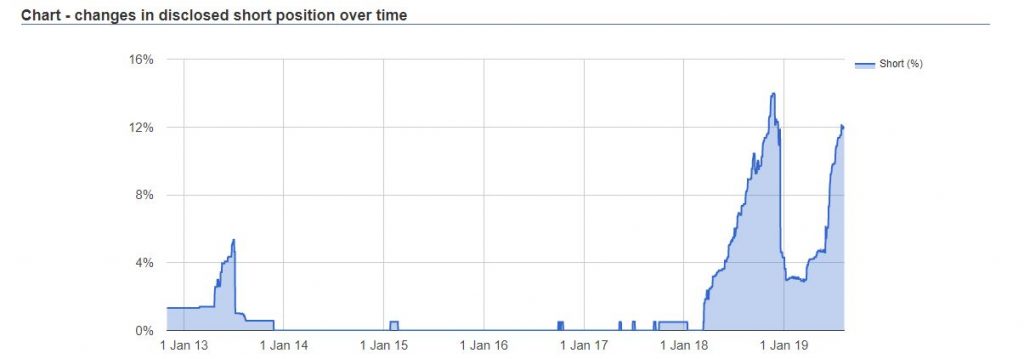

First company up is the supposed “new Carillion” – Kier Group. A number of the so called “smart money” hedge funds including Marshall Wace and Black Rock hold short positions in the stock (and it’s fair to say they have made good money and been right over the last several months) as the chart below relays.

In recent days however following the “Post Close Update” on the 1st August the stock has quietly risen by a material amount. From a low of just under 60p the shares had clambered back above £1 at yesterday’s close. What is interesting to us is that this sharp rise has risen whilst still over 10% of the company remains out short. This is equivalent to nearly 30m shares – probably 10-15 average trading days volume.

With a new CFO and relatively reassuring words on the debt position the risk/reward equation for a short is now becoming very dangerous we believe. Indeed, it was flagged within the 1 Aug RNS that “significant interest” had been seen with regards to the sale of Kier Living – the company’s house building division. We expect a premium to book value being achieved in the event of a successful conclusion to the sale process – a price between £140-170m looks realistic to us. This will make a material dent in the company’s debt position aswell as off balance sheet liabilities.

The sale of Kier Living could be announced any time and we rather suspect that this would be the primary catalyst on the horizon that would prompt a wholesale short covering episode.

What is also interesting to us is that one of the largest shareholders – Woodford Investment Management that is presently under siege on many fronts actually increased their holding in the Company in recent weeks when many had been expecting continued sales. It is debateable whether anyone should be taking a lead from Mr Woodford in this regards given the mess he has gotten himself and his investors in but it does strike me as a particularly “ballsy” call the he can ill afford to get wrong with the spotlight on him.

In short, if trading continues to stablilise at Kier and there is a successful conclusion to the sale of Kier Living that reduces debt the likely pro forma profits for 2020 could be in the range of £80-100m from what we can see from publicly disclosed guidance. A dividend return in 2020 is also not out of the question. Capitalising this even at the low point of this band at just 6 times earnings produces a price of @ 220p per share.

At the current price of 101p for the reasons we relayed here we believe the shares offer compelling value and would not be surprised to see them trade closer to £1.50 once the short cover commences in earnest.

Metro Bank – current price 298p

Now this one really does illustrate the schizophrenic nature of investors as a herd. Only just over 2 months ago investors were clamouring over themselves to buy shares in a placing at 500p per share (that was itself upsized such was the demand). In the end, a gross £375m was raised. Set this against the current market cap of just over £500m and stock price of less than £3 and it seems that “Mr Market” now believes that the ex cap raising operations of the bank are now worth just £125m. Nonsense we say.

The book value of the bank is approx £1.7bn and thus as at Friday’s close one can now buy these assets for less than 0.3 times book value. These types of valuations are generally seen in the teeth of a major recession where bad and non performing loans run to 10-15% of the book. Metro’s current position is far, far removed from this. Indeed, NPL’s at the half year stage were just 0.17% – one of the lowest ratios of all the listed banks. In fact, the most recent results per HERE painted a pretty robust picture going forward with intended expansion into the Northern heartlands of England and reaffirmation of medium term guidance.

Some commentators have lamented the absence of recent Directors buying yet ignore the large participation by the BoD at 500p in May including a £2.5m ticket from Chairman Vernon Hill. At this price and with a gilded shareholder register that includes such eponymous billionaires as Steve Cohen and Michael Bloomberg I cannot believe that they are not seriously looking at the metrics of taking this private. I certainly would be in their shoes if I had their pocket depth.

The current year PE we also argue is a misnomer given write downs on the loan book. With deposits once again on the growth tack we see continued lending expansion and that 2020 profits will make this years’ PE seem anomalous.

The bank’s Tier (1) ratio at 15.8% is extremely robust and following the recent capital raise illustrates to us that Metro is more than able to withstand any Brexit No Deal turbulence (which, by the way we see as being completely overblown – akin to the Y2K worries that proved a non event at the turn of the millennium). With the likes of Crispin Odey short here, during the summer doldrums the short pack have been able to make hay. We expect this period is now coming to and end (as with the real hay making period!) as the swing to the value end of the spectrum has become extreme. Our first target here is 500p back to the placing price and as with the price move in late May post the placing that took the stock up to near 900p from the mid 4’s in the preceding weeks, we expect the rally to be extremely sharp. Buy.

Intu Properties – current price 37p

This one really is a perplexer. The stock has taken one hell of a drubbing this last couple of years falling from around 300p per share to approx just a tenth of this at last week’s end close. With property veteran John Whittaker the largest shareholder here holding via his Peel Group just under 30% (the bid threshold) and having aborted a bid approach in at 210p just last December he is king maker and perhaps a renewed potential acquirer if he can find the partners to have another go at the company given the valuation collapse. Indeed, there has been recent commentary that Whittaker has had to shore up loans taken out against his Peel Holdings stake in Intu. This has been one of the central theses by the shorters in driving the stock down to what is now approaching a near 90% discount to NAV. That’s right, near 90%. As with Metro, we believe the pendulum has swung completely to the extreme (and some) reference the value now offered in this stock.

We do not discount or diminish the travails seen on the high street and the large shopping centres that make up the backbone of the Intu portfolio nor the impact on Intu with many retailers now using the CVA route to reduce rents. But again, at a near 90% discount to NAV, we argue that this is more than priced in.

It is noticeable in recent days that a slate of Board Directors have been trying to send a signal to the market through on market purchases. This is important on a few counts, firstly there cannot be an imminent capital raising due as they would have been restricted from purchasing if so. Secondly the collective nature of their purchases (and which includes the CFO) is, historically, a good lead indicator of price growth in a stock.

With the company committed to asset disposals to reduce the Group’s LTV ratio and looking to sweat their portfolio further through the construction of residential homes and hotels close to their shopping centres, we believe the market is not giving even optionality value to these two catalysts for a sentiment reappraisal. Our money is on a renewed bid approach by Whittaker and a consortia that looks to carry out the necessary surgery out of the public eye and media scrutiny. Any approach will need Whittaker’s buy in and at 37p we see serious asymmetric risk/reward skew here. Buy.

Endo Pharmaceuticals & Teva Pharmaceuticals (US) – current prices $2.45 & $7.06

This is a dual recommendation as the issues facing both of them that have driven valuations down to levels that I have rarely seen in my career are the same – potential opioid liabilities through litigation settlements in the US and debt burdens.

Taking the debt burden element first and discounting the opioid issue for a moment, both companies reported last week and it was abundantly clear that they are more than capable of managing their debt profiles from an interest payment and repayment perspective (2022 being the year when Endo’s first major debt repayment/refinancing falls due). Endo has circa $8bn in debt and Teva approx $27bn.

Endo’s results last week were in fact better than expected with a Q2 EPS figure (adjusted) of 52c per share and they reiterated full year guidance at $2-$2.25. You’ll be forgiven for doing a double take here. No we have not got the decimal place wrong, the stock really is trading at approx ONE times earnings (albeit adjusted) and yes they can service their debt load. Further, the 2 key divisions Branded drugs and Injectable are growth areas with additional serious upside from their cellulite treatment – CCH.

Teva also reported last week and, as with Endo, the market reacted badly but, as the week progressed, investors began to see sense with sharp rallies off the lows on Thursday. Teva’s debt profile is more acute in terms of near term refinancing relative to Endo, but as revealed in last week’s results, the shares now trade at a little over TWO times likely 2019 FY results.

So what’s the rub in these seeming too good to be true valuations? US litigation from various States in regards to Opioid deaths.

We find this article to be particularly interesting as to just how the likes of TEVA and Endo may be able to shield shareholders from an Armageddon scenario – https://www.cnbc.com/2019/07/22/one-opioid-drugmakers-solution-to-potential-liabilities-spin-them-out.html

In essence the splitting out of the potential liability encumbered divisions is a pretty interesting proposition. We however take a different tack and with extensive experience in litigation realise that the pushing of another party to the brink where they simply cannot pay is a futile exercise for the proponent of the litigation. We believe that there will be a collective settlement with liabilities that are much less than the market is presently discounting in these complete give away valuations. The tobacco industry blazed the trail here with payouts over many years and the global settlement thereof being much less than originally feared. We all know what happened to tobacco company share prices in the ensuing years…

It is interesting also to us that Endo’s CEO has gone on record to state that such is their belief in their position in the opioid issue that absent a “reasonable” global settlement that they will fight, believing that they have a better chance to win on appeals in court. For now, all eyes are on the key JnJ case in which the Oklahama State is pressing for a $17bn settlement against JnJ. HERE is a good background article on the issue. We believe that should JnJ win the case that the likes of Endo could double or treble on the day and Teva see a 50-100% uplift. If JnJ do not win and there is a negotiated settlement, then at these valuations it is too, to our eyes, more than in the price.

Reverting to the point above re litigation, Endo in particular is priced for bankruptcy. If a negotiated settlement that bankrupts them and peers results then nobody will get anything – and that strikes us in the land where money is God (U.S.) to be a result nobody wants. At $2.45 & $7.06 respectively we see multi-bag returns potential over the next 12 months here. Buy.

DISCLAIMER & RISK WARNING

Align Research & a director of Align Research holds exposure to each of the company’s mentioned here and are bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.