Align Research Recommendations update

As equity markets globally continue to push on in the face of historically extreme valuations whilst seemingly ignoring recession risk in the US and increasing geo-political tensions, we believe that caution is very much warranted now and indeed it is time to actively raise cash and take advantage of the distribution opportunities that the buoyant markets currently present. Indeed, in recent weeks we have been doing precisely this.

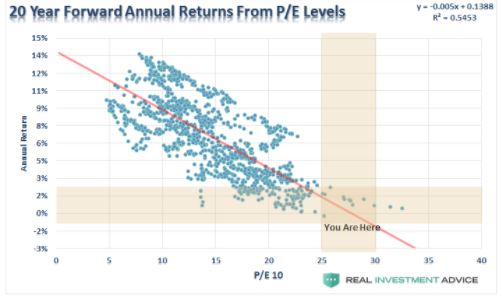

We bring 2 important charts to your attention below and explain how this concurs with the Align approach:

What this distribution log illustrates very clearly is that going back over multi-decades, whenever PE’s have been in the late 20’s, the prospective 20 year (yes that is 20 years not months) has been nominal or even negative. Of course, history is no guarantee as to what will happen in future but it does certainly give us food for thought. Our own perspective is that when looking at the valuation of the so called FAANG stocks in the States is that buyers at these levels have zero safety margin for a whole multitude of scenarios. As an investor with hopefully many years of future life remaining that strikes us as not a great position to be in.

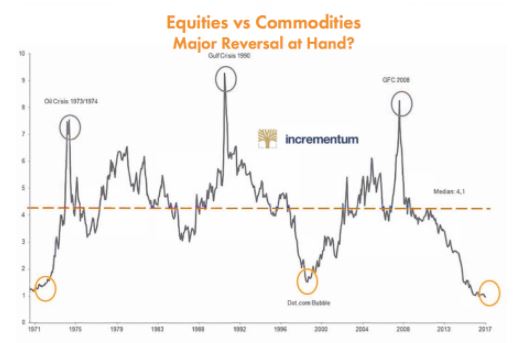

The 2nd chart we would like to bring to your attention is per below:

This is a near 50 year chart of the relative valuations between commodities (as a basket) and equities. Again, the same caveat applies re history being no guide to the future but what it also spells out to us is that our own anecdotal evidence of value (being value biased investors) is largely being presented in the commodities arena – in particular smaller cap stocks where there is a dearth of research. Choose these stocks well and they largely move independently of the wider equity market class. This is precisely what we attempt to do here at Align Research.

With the above in mind below is an update of our current call stances:

| Company/Asset | Date | Price | Current | % Gain/loss | Notes | |

| Vectors Junior Gold Miners | 04/01/2016 | 1598.25 | 2956.5 | 84.98% | HOLD | |

| Randgold Resources | 13/01/2016 | 4253 | 7915 | 86.10% | TAKE PROFITS | |

| Antofagasta | 13/01/2016 | 368.8 | 1018 | 176.03% | SELL | |

| Fresnillo | 13/02/2016 | 692 | 1621 | 134.25% | SELL | |

| Providence Resources | 24/02/2016 | 15.25 | 8.5 | -44.26% | HOLD | |

| Barclays | 02/03/2016 | 158.1 | 190.25 | 20.34% | HOLD | |

| GBP/AUD | 06/03/2016 | 1.9264 | 1.6239 | -15.70% | ADD | |

| GRIT | 17/04/2016 | 5.125 | 11.75 | 129.27% | HOLD | |

| Valeant Pharmaceuticals | 12/06/2016 | 2400 | 1423 | -40.71% | ADD | |

| Genel Energy | 28/07/2016 | 90 | 155.25 | 72.50% | HOLD | |

| Strat Aero | 27/06/2017 | 0.105 | 0.0825 | -22.50% | ADD | |

| London Capital Group | 12/10/2016 | 3.3875 | 2.25 | -33.58% | HOLD | |

| VIX (to rise) | 28/10/2016 | 11 | 12.04 | 9.45% | ADD | |

| Gulf Keystone equity | 11/11/2016 | 121 | 120 | -0.83% | BUY | |

| Zanaga Iron | 13/11/2016 | 3.5 | 5 | 42.86% | HOLD | |

| CMC Markets | 11/12/2016 | 100 | 146.5 | 46.50% | SELL | |

| IG Index | 11/12/2016 | 457 | 666 | 45.73% | SELL | |

| Plus 500 | 11/12/2016 | 375 | 912 | 143.20% | SELL | |

| Dryships | 28/01/2017 | 1950.2 | 309 | -84.16% | SELL | |

| Short NASDAQ | 19/02/2017 | 5324 | 5838 | -9.65% | ADD TO SHORT | |

| Silence Therapeutics | 11/03/2017 | 89 | 180 | 102.25% | HOLD | |

| Stanley Gibbons | 06/06/2017 | 13 | 8.5 | -34.62% | ADD | |

| Gold | 01/01/2017 | 1130 | 1317.4 | 16.58% | ADD | |

| Gulfsands Petroleum | 21/01/2016 | 2.875 | 5.75 | 100.00% | HOLD | |

| LGC Capital | 07/04/2016 | 4.6575 | 13.5 | 189.00% | SELL RECOMM 4 SEP 2017 | |

| Space & People | 25/01/2016 | 38.75 | 34.5 | -10.97% | HOLD | |

| ITM Power | 11/08/2016 | 17 | 36.4 | 114.12% | SELL RECOMM 23 AUG 2017 | |

| Mgmnt Res Solutions | 13/09/2016 | 12.5 | 3.5 | -72.00% | ADD | |

| Zenith Energy | 06/10/2016 | 6 | 12 | 100.00% | HOLD | |

| Milestone | 24/01/2017 | 0.37 | 0.245 | -33.78% | HOLD | |

| Obtala | 10/05/2017 | 18 | 18 | 0.00% | HOLD | |

| Short Bluejay Mining | 11/07/2017 | 13 | 17.75 | -36.53% | REITERATE SELL STANCE | |

| Powerhouse Energy | 26/07/2017 | 1 | 1.32 | 32.00% | HOLD | |

| Arian Silver | 12/05/2017 | 0.85 | 0.525 | -38.24% | HOLD | |

| Greenfields Petroleum | 17/08/2017 | 0.2 | 0.18 | -10.00% | ADD | |

| Total | 1157.63% | |||||

| AVERAGE | 33.07% |

NOTE – Prices based on closing levels as at 1 Sep 2017 and local currency prices used.

We are pleased to report a simple average return of 33.07% on the aggregate of our recommendations.

DISCLOSURE & RISK WARNING

Align Research Ltd and a Director of Align Research holds positions in many of the individual companies and instruments listed here.

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.