Align Research Top 5 Conviction Picks for 2020

This year we have concentrated our coverage into those top 5 picks where we have the most conviction in price v fundamental reality rather than 10 in previous years. The lesson we have learnt over the last 4 years of operation as one of the most innovative research houses in the UK is that management is EVERYTHING in small/micro cap companies. If there is even a sniff of management integrity and capability being compromised or in question the cure is simple – sell. Do not hang about hoping it comes good – it doesn’t. Bad management does not ever become good. Just take a look at the companies where we have cessated coverage and see what has happened to their stock prices following that cessation point – in all instances material declines ensued.

The other lesson we have learnt and that we STRONGLY recommend to all our followers is that when you have a meaningful gain on a position in the order of 50%+ ALWAYS, ALWAYS derisk. The ideal position to be in is one where you are playing with “house money”. Small caps ARE high risk – this comes from reduced liquidity, absence of larger balance sheets, management concentration/risk and a greater susceptibility to jurisdictional risk, in particular companies operating in overseas regions. We repeat, the primary focus should be on trading these companies rather than sitting in them forever and a day. Almost all our picks usually provide the opportunity for a trading gain – use this to your advantage.

In no particular order here are our 5 picks that we have the most confidence in returning material gains to both ourselves (as large equity holders) and our followers:

Metro Bank – 206p

Metro has been covered extensively HERE by us and is unique amongst our picks in (a) being of a larger market cap than usual and (b) the only one where we are presently underwater.

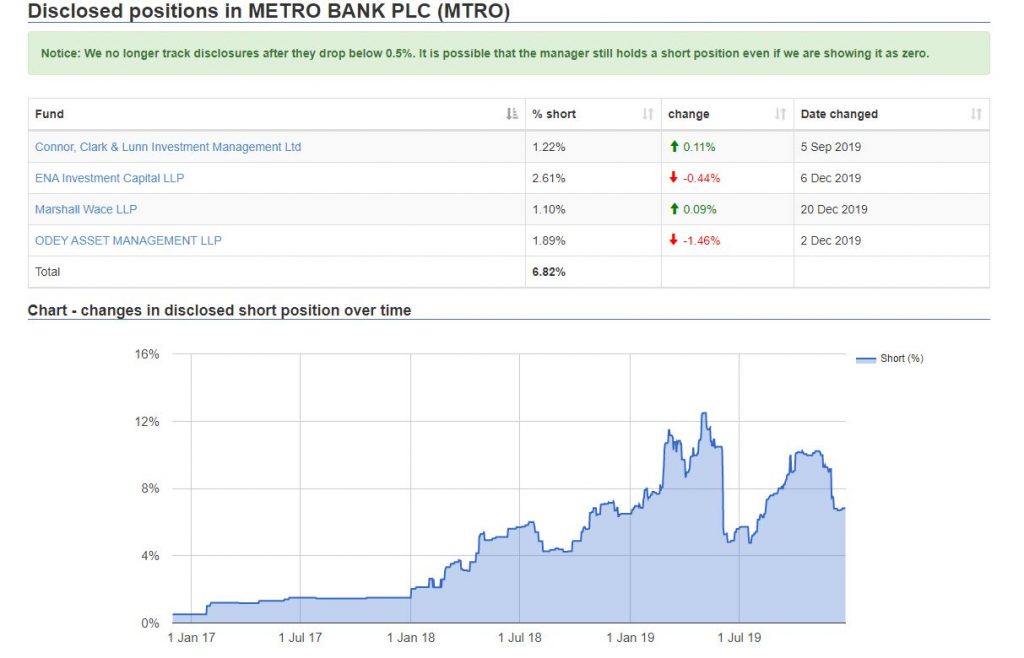

The woes of Metro bank have been well rehearsed by many other commentators, namely the onerous MREL terms, impending FCA investigation announcement, reduction in management growth plans, BoD resignations etc. What has not been rehearsed during the last several weeks are the following: rising bond prices (the smart money) back towards one year highs (see HERE), a meaningful reduction in the short position with the major player here – Odey – reducing massively (see below)

The BoD has been purged in recent months, in particular with the departure of high profile founder and former Chairman Vernon Hill aswell as his right hand man Craig Donaldson the former CEO. We expect a heavyweight CEO appointment to replace interim man Dan Frumkin in the 1st quarter of 2020 or, equally likely and linking to our central thesis below ref a potential takeover of the bank, that an offer will be tabled early in 2020 from one of a whole coterie of potential acquirers whilst the BoD remains open to a sale.

Our central tenet ref our decent stake holding is that with tangible book approaching £8 per share set against the current price of just over £2 that this disjoint will not have gone unnoticed by other banking corporates. indeed it has not as evidenced by the large purchases in recent months by a number of US funds and Colombian billionaire Jamie Gilinski Bacal who have collectively taken a stake of just under 15% at prices seemingly from just over 300p down to where we presently reside. Given that the cash raised in May of last year was around the current stock price it is as plain as day that they see the latent value here with the banking licence, goodwill, banking infrastructure and near £1.4bn all in for free at this price. Our guess is a bid pitched at 350-400p would win the day and, if a larger bank, get the FCA’s blessing.

Underlying metrics at the bank such as loans to deposit ratio, new deposit growth etc are all supportive of a recovery in fortunes being on track for next year and most importantly, NPLs (Non Performing Loans) are one of the lowest in the industry. In short, the present stock price does not match operational reality in our eyes.

As we can see in the chart below, the stock has in fact been making higher lows this last few months whilst sentiment remains deeply negative, in particular given the testing of retail investors patience with the seemingly daily occurrence of a morning rise being pushed/manipulated down again by the larger players. The RSI has been also steadily rising since early October and is now back above the key 50 line. The formation over the last 3 months looks like a classic saucer bottom to us and provides the early clues, together with the large stake building by US players & the coincident short covering, that sentiment is turning and price is about to follow.

To conclude, we expect post the conclusion of the FCA investigation into the loan misclassification and the appointment of a new CEO that with the more stable domestic backdrop post the general election that the shares will be trading north of 300p in the near term and that there is a better than evens chance of an outright takeover. Indeed a number of parties have been in the frame from the mainstream press including Vernon Hill taking private, Lloyds, Virgin Money, CYBG etc. The volume and regularity of that speculation coupled with comments on the post results conf call by Craig Donaldson in October of last year in answer to a question re approaches make it an almost cert that there are moves behind the scenes. At 206p this is one of the biggest value opportunities we can see today and we have accordingly placed our capital where our mouth is. Buy.

Gaming Realms – 8.9p

2020 is set to be a good year for Gaming Realms (GMR), the creator and licensor of real money and social games. During 2019 the company completed a restructuring of the business, moving towards a highly profitable licensing based business model, moving it away from the tough UK consumer gambling market. This was done by selling off its remaining real money gaming (RMG) business in July to River iGaming for £11.5 million on a cash-free, debt-free basis. Gaming Realms is now purely an operator, a model which we believe will deliver gross margins in the 90% region in the long-term.

Recent results for the six months to June 2019 highlighted that the decision has been a good one, with total group revenues from the continuing operations (excluding real money gaming and affiliates) rising by 18% to £3.2 million. More notably, revenues from the Licensing segment soared by 167% to £1.6 million. The division delivered an adjusted EBITDA profit of £0.723 million for the half for a margin of 44%, a figure we expect to rise markedly as further deals go live with partners and economies of scale are realised.

Growth was driven by increased distribution of games across partner sites and an expanded games portfolio. The company saw the 13 partners that went live through 2018 contribute to growth and also went live with tier 1 operator William Hill. It released four new games into the market and, key for growth in 2020, signed worldwide distribution deals with key industry operators Relax Gaming and Scientific Games.

On the balance sheet, cash at the period end was £0.28 million but as at the date of the results the cash position was c.£4 million following completion of the RMG deal and receipt of funds, settlement of certain liabilities connected to the B2C RMG assets and deal expenses, and further investment in operations.

Good bet

Many metrics point to a good year for Gaming Realms in 2020. In the interims, Licensing revenues were said to have grown by an impressive 88% in the 9 weeks since the period end. The company has gone live with 3 new operators since the end of June, taking the total to 37, including News International and Betsson, which could add up to a further 33 new sites, covering UK and Nordics. Three new games have been released, including Monopoly Slingo, with more releases scheduled for the remainder of the year.

What’s more, the completion of the RMG disposal has allowed Gaming Realms to reduce headcount by 45 and reduce annual costs by £2 million. Overall, the company is looking for the Licensing division to become cashflow positive by the end of 2020, with the non-core Social business said to be in the latter stages of being rationalised.

Our discounted peer based EV/EBITDA valuation suggests a target price of 26.79p for the shares. With the current price being just 8.9p our valuation implies approx 200% upside potential. We also note recent director buying of the shares, with Michael Buckley, Non-Executive Chairman, buying 2 million shares at 5p in October and Mark Blandford, Non-Executive Director, buying a not inconsiderable 5 million shares at 8p in December. As the chart relays below, the shares are now in a sustained uptrend with next level of resistance around 12p. Conviction Buy.

Argo Blockchain – 5.6p

It was an eventful year for cryptocurrency miner Argo Blockchain (ARB), which experienced everything from boardroom troubles to Bitcoin doubles. Back in February the company, which listed on the Main Market in summer 2018, decided to halt its Mining as a Service business model in order to mine cryptocurrencies (mainly Bitcoin) for its own book. Despite concerns from some shareholders, the strategy paid off as the BTC price rocketed from lows of c.$3,300 in February before peaking at a touch below $14,000 in June. Combined with significant investment in mining hardware and the company’s expertise in configuring the machines, the operations quickly became highly profitable.

The latest news from Argo is that 7,000 mining machines are now chugging away in its Canadian data centre, with plans to significantly increase that number in the coming weeks. A total production base of c.17,000 machines is expected by the end of the first quarter of 2020, with the additional machines currently on order and in the process of being delivered. When delivered, this will make Argo the largest publicly listed miner next year.

With mining margins (crypto value less electricity and hosting costs) recently reported at around 73% Argo is also one of, if not the most, efficient miners in the world. While the Bitcoin price is highly volatile, and it is the main risk Argo is exposed to, our financial model suggests that Argo breaks even at a BTC price of around $2,300. With Bitcoin prices currently around $7,400, the business model remains highly profitable.

As well as watching out for the new machine deliveries in 2020 there is a major expected crypto event which we believe Argo will benefit from. Around June next year Bitcoin block rewards are expected to fall from 12.5 to 6.25 per block mined. We believe that this halving will exclude most of the inefficient miners from the market (those with high power costs and older, less powerful hardware) which is currently estimated to represent over 50% of the total network hashrate. These miners turning off their mining operations, as they become unprofitable would be favourable for efficient miners like Argo as the difficulty rate would be expected to fall. If the BTC price increases significantly until the halving, everyone keeps mining and it is more profitable for Argo. Conversely, if the BTC price does not increase significantly until the halving the inefficient miners will have to turn their machines off and Argo will mine more BTC. It seems that Argo management have positioned the company through the large expansion in machine orders leading up to this event in a “heads we win, tails you lose” situation relative to their peers.

Coining it in

Our model shows that Argo (at 5.65p) now trades on an earnings multiple of just 3.3 times 2020 forecasts. More pertinently however the earnings multiple, incredibly, turns negative on an ex-liquid assets basis as we forecast cash + crypto to exceed the current market cap by the year end. This is an almost unprecedented observation in many years in the markets ref a value opportunity. It is highly unlikely to have gone unnoticed by other industry players and barring a bitcoin collapse to sub $2,000 is the singular reason that we believe the shares will likely attract takeover interest in 2020.

Taking into account the risks involved, Argo’s growth profile and efficient operations, we remain of the belief that a multiple of 8 times earnings would be a reasonable value to place on the shares. On our 2020 forecasts for c.1.83p of earnings, that equates to a value of 14.62p per share. Adding in the value of forecast cash, hardware and cryptocurrency on the balance sheet adds another 8.71p per share for a total value of 23.33p per share.

Assuming our forecasts are met then Argo should have significant distributable reserves available very early in 2020 a point the market appears to be ignoring/missing. Reasonably assuming a 30% payout ratio then investors are looking at a potential dividend of c.0.55p per share for the year, an event which should be a major catalyst for the shares. Given the cash generative nature of the business discussed above we believe that the payout ratio has the potential to be much higher – with a 50% payout ratio and with an assumed yield application by the market of 6% this results in a value of 15.23p per share. As we can also see from the chart below the stock looks poised to break up from the falling wedge formation that has been in play since early August and a clear break of 6-6.5p targets 10p . The rising RSI adds extra credence to this technical position too. Conviction Buy.

BigDish – 1.2p

Investors in restaurant yield management platform BigDish (DISH) had a rollercoaster year, with the shares starting 2019 at around 1.7p before soaring to over 9p in June. Fast forward six months and we are now down to just 1.2p per share, for a market cap of just £4.2 million, a valuation which looks unfair in our view set against net cash of slightly in excess of £1m.

Big Dish is an early stage technology company which owns and operates a yield management platform for the restaurant industry. This helps restaurant owners maximise sales during quiet trading periods by offering discounts to customers. Big Dish earns money by restaurants paying a fixed fee per diner seated, with the strategic focus currently being upon signing up restaurants to the platform, on a region by region basis, in order to build up critical mass.

For most of 2019 BigDish used a “boots on the ground” approach to restaurant acquisition but the focus is now on telesales, an approach which is proven to be much more effective in getting the numbers up and is also lower cost. There were 177 restaurants live on the BigDish platform in early November and the primary focus for the next 12 months is restaurant acquisition and accelerating the growth of restaurant numbers.

The growth plan has been tasked to new CEO Tom Sumner who joined in early December. Sumner has worked in the restaurant discount industry for the past six years. From 2013 to 2016 he was National Partnership Manager at Gourmet Society and Tastecard, the largest diner membership clubs in the UK. Notably, in 2016 he joined TableNow, a dining discount app that enables diners to book discounted restaurant seats in the UK, rising to the level of Managing Director. Following a rebrand in April 2019 he grew the platform, with a 10 person telesales team, from 250 to 3,000 restaurants across the UK over a six month period. At Big Dish, the objective is to rapidly build up a telesales team of approximately 10 persons.

In terms of cash, following a £2.1 million placing in June, as at 30th September 2019 cash stood at £1.29 million. The new strategy is expected to result in substantial cost savings well in excess of £250,000 per annum and on that basis Big Dish believes it has sufficient funding until the period of the third quarter of 2020. This has been estimated using purely a cash burn assumption – the most pessimistic scenario.

Big Dosh

With early stage technology companies it is difficult to accurately place a valuation on the shares given uncertainty surrounding future cashflows. However, there are plenty of transactions in the wider food technology industry which reflect the kind of valuation Big Dish could command should it successfully execute its strategy.

To take one example, yield management and restaurant reservation platform Eatigo completed a Series B fundraise in October 2016 at which point it reportedly had grown to 700 partner restaurants, with media sources suggesting that c.$10 million was invested by travel and restaurant website owner TripAdvisor. Siddhanta Kothari, Chief Financial Officer of Eatigo, suggested the business had a valuation of $70 million following the funding round, which we believe could be applied as a potential benchmark to BigDish as 700 restaurants look like an achievable goal in 2020, in our view. At current exchange rates that equates to a valuation of £54 million, some 13 times the current market cap. This valuation disparity with some of its private peers also poses the scenario where the company could be used as a merger/reverse vehicle – something the market clearly has not ascribed any probability to at this price.

Big Dish has been very active on the newsflow front since its IPO in August 2018, with the market often reacting positively to good news. With a new CEO in place and focussed expansion strategy, we believe that 2020 could see the shares rise markedly from their currently lows if further positive updates are made. Full update note to come from us in late January but at just 1.2p the shares look oversold and ripe for a material rebound pending newsflow in Q1 2020.

Eco Atlantic Oil & Gas – 54p

Eco is a relatively new addition to our investment book, our taking a position following the Tullow Oil “heavy oil” debacle of early November that cratered the shares by nearly two thirds in just 3 days. The basis of our purchasing the stock is simple – yes, heavy sour oil is more difficult and costly to process to sell as was revealed from their Jethro/Joe well interest but it does not mean that the value of this discovery is nil – there is a ready and wide market for heavy crudes.

Secondly, at the current market cap of just under £100m and adjusted for current cash of approx $20m, by any measure of renewed risking to the NAV, the shares look dramatically underpriced especially given that the key Cretaceous drilling program is to commence in 2020 and where the main prize is as opposed to the present Tertiary discoveries.

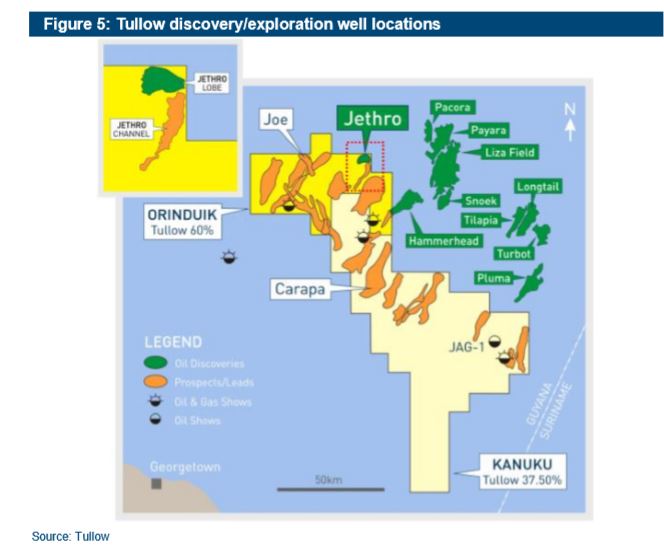

All is to play this New year for where we would argue that the potential results from the Cretaceous targets have been de-risked dramatically following the Jethro well drills – oil is clearly there. Results are also due any day now from Repsol’s Carapa well and which neighbours ECO’s Orinduik block and this could further provide a sentiment boost to ECO (assuming it is positive of course) – see diagram below showing the proximity of the two blocks..

Recall that in March last year ECO revealed their updated CPR (Competent Persons Report) for Orinduik wil revealed a potential oil resource of upto 4bn boe. There are 15 leads here and management plan to reveal in January which of these will be drilled first, likely in the Cretaceous regions. Jethro is also expected to be re-entered and further testing carried out next year with a side-track into the Jethro Channel extension that could further add to resource estimates.

We note a number of fellow research house estimates of adjusted NAV being centred around 120p with the lowest just below a pound. For those of a more risk orientated leaning, buying ahead of the neighbouring Carapa well result could yield significant returns should they be positive. In contrast, those of a more conservative nature should wait for the Carapa well release before entering a position. At just 54p per share, we believe the stock to be at least 50% undervalued and accordingly remain long.

That concludes our 5 high confidence picks for 2020. Remember our opening comments, should any of these stock prices return meaningful gains relative to your inception point, that it is ALWAYS prudent to derisk and take gains along the way – it is a strategy we have learnt over many years and serves us well.

CLEAR DISCLOSURE – Align Research Limited & a Director of Align hold interests in all the companies mentioned in this piece and are bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited