Gulfsands Petroleum – establishing fair value in a post Syrian conflict environment

By Richard Jennings, CFA

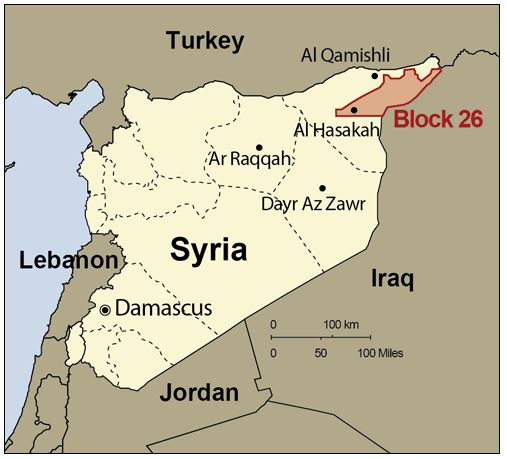

We initially covered Syrian focused Gulfsands Petroleum (GPX.l) at the beginning of this year, highlighting the embedded value in the company’s key Block 26 field in the North East of Syria. At a price then of just under 3p we believed the stock to be materially undervalued should the tragic and devastating civil war that has dogged Syria for nearly 8 years now, finally see an end. Not even we could have envisaged the geo-political backdrop however that allowed the Assad regime to regain the upper hand and, in recent days, almost recapture the key city of Aleppo and which will be in all probability the turning point in the war. The catalysts behind these events were the involvement of Russia in aerial bombardments of the rebels and (at the turn of the year – highly improbable) prospect of a Trump presidency.

Fast forward to December 2016 and it looks ever more likely that the war will come to an end in the final closing days of this year and that there will be renewed diplomatic efforts for a lasting peace which will, in all probability, leave Assad in office. For GPX holders then the question is what will be fair value for the stock in the event of Block 26 pumping again?

We attempt to establish this here via two methods – comparisons on an EV/2P basis to its regional peers Genel Energy and Gulf Keystone Petroleum and in the second approach by taking the pre-war value and applying an appropriate discount.

By way of background, the company has represented that the Block 26 fields are ready for pumping at just weeks’ notice and remain in good condition, and so unlike many other small cap E&P plays, cash flows to the company will accrue very quickly in the event of their operation again. Through the involvement of financier Richard Griffiths and Russian oil veteran Michael Kroupeev via his Waterford company, the debt legacy of the old management has been nullified through their taking on of the convertible loan that GPX owed Awarak International and then financing an issue of Ord shares to repay this. Net effect of this was to give them effective control of the company and there have been further management changes this year with Alistair Beardsall – a long time lieutenant of Kroupeev departing midsummer and John Bell taking the reins. Following a further modest fund raising in August of £1.5m, together with Syrian tycoon Ayman Asfari (via his ME Investments vehicle) who purchased stock at 5p earlier in 2016, the trio now hold 82.76% of the company. The free float, adjusted for the institutions on the list is thus very small and which is evident in the sharp price movements seen in recent days and also back in March of this year.

On an EV/2P comparable basis, Genel’s core reserves are valued (at the current stock price) around $2/bbl and GKP at approx 60c/bbl. GPX hold just under 81.7m barrels of equivalent oil (excluding the gas reserves of 33.4 bcf) and which will be most likely reclassified as 2P reserves in their main fields at Block 26 from 2C if the sanctions are removed. If we take a simple average of GENL & GKP’s EV/2P values of $1.30c/bbl and apply this to GPX we derive a value of $117m which, at the current FX rate of $1.26 = 16.2p per share (we make the point that we see GKP & GENL as materially undervalued at these stock price levels however). These figures do not take into account GPX’s interests in Morrocco, Tunisia and Colombia though (to which we currently ascribe nominal value) and more importantly, there is no value in this figure for back payments due from their partner in Block 26 – Sinochem that has been estimated at several tens of millions of dollars.

In the second method, the company’s reserves were valued by various analysts at just under half a billion dollars before the sanctions were imposed on the Company. Further upside was seen on a “risked” basis in the company’s Syrian exploration assets. However, the oil price began with a 1 and had 2 digits after it back then. We take a rough and ready approach and halve this figure and also apply a further 50% “political” discount which is likely to remain in the aftermath of the war to arrive at a realistic figure of @ $125m for the reserves in Block 26 and which equates to approx 19p per share. Again, however there is no value attributable to the back payments they have been unable to receive due to the sanctions when the fields were operating via their partners Sinochem and the Syrian GPC.

We also note that in looking back at the company’s results between 2009 & 2011 where most of the revenues came from Block (26) that net profits of between $28m and $55m were produced. At the current oil price we estimate (as best we can) that if the field production was pushed back upto 10k bopd that net profits of approx $30m p.a. would be made. Even applying a lowly 6 times multiple to this would result in a stock price approaching 30p per share ex the reserves (risked and unrisked) values.

To conclude, if, like us, you see the writing on the wall re the end of the Syrian war, the stock price continues to offer potential multi-bag upside under almost all production scenarios and we see base value between 20 and 30p per share.

CLEAR DISCLOSURE – The author, who is a Director of Align Research Ltd, holds an interest in the equity of Gulfsands Petroluem and is bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”)