Bonus re-iteration recommendation for 2022 – Kore Potash

Adding to our top ten tips for 2022 we present an additional bonus…

KORE POTASH – Current price 0.825p

The potash price curve is starting to look like the Bitcoin chart, which as yet hasn’t been reflected in the share price of Kore Potash. There’s little doubt in our minds that the company’s Tier 1 potash play in the Republic of the Congo (RoC) looks set to become the lowest cost potash supplier to the giant Brazilian market.

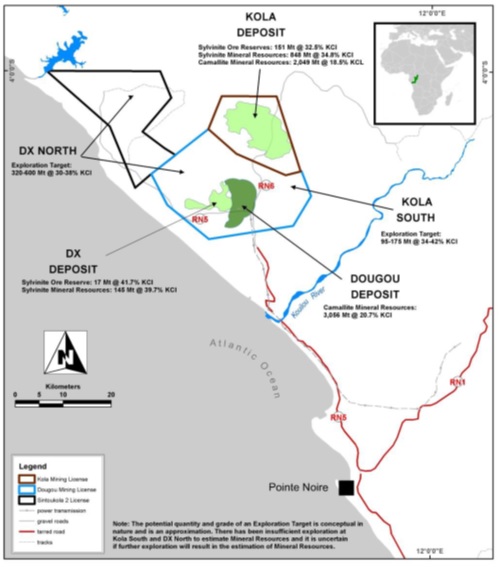

Kore represents a large fertiliser play. The company has been developing the Sintoukola potash basin in the RoC since 2010. Here, Kore has a district scale development with 6 billion tonnes of potash, just 15km from the coast and US$230 million has been spent on it so far. The flagship 2.2Mtpa Kola project came through the DFS with flying colours but needs US$2.1 billion of capex, not easy for Kore to raise for a greenfield project in such a jurisdiction. Just as the team began rapidly advancing the smaller DX project, potential investors came knocking with the promise of a fully financing Kola.

Sintoukola Potash District. Source: Company

There is a very sizeable growth opportunity in developing the large Kola project. Early in April 2021, Kore announced a non-binding MoU with Summit to arrange the total financing for Kola, with the company retaining its 90% stake. The MoU sets out a roadmap to optimise, fully finance and construct Kola via a mix of debt and royalty financing, based on the understanding that the company will retain a 90% stake in Kola. Waiting in the wings is the smaller DX project which is also being progressed in parallel as it provides good backstop if anything should go wrong with the negotiations concerning Kola.

The financing process with Summit has kicked off, with the consortium moving to complete an Optimisation Study and if successful then provide Engineering, Procurement and Construction (EPC) contract proposals together with a potential royalty and debt financing to cover the full constriction costs.

The Kola Optimisation Study is being undertaken by the key engineering and construction partner of the Consortium, SEPCO Electric Power Construction Corporation. The target is to get that capex under US$1.65 billion and shrink the construction timetable down to 40 months. These are seen to be aspirational targets but so far Summit looks on course to achieve them in this study which is on track to be completed in Q1 2022.

If Kore gets 90% of that cash flow and even after deducting royalty finance costs once in production, even on modest multipliers we believe Kore could deserve to have a market capitalisation well in excess of US$2 billion. A successful close of this financing on the terms proposed will allow Kore to retain 90% ownership of this world class asset without Kore shareholders having to inject the equity up front to construct the project. Very neatly, what would have been equity from Kore shareholders is now proposed to be replaced with royalty financing. All of this could set the scene for potentially dramatic share price growth.

Truth is that Kore is positioned to replace potash supply from the northern hemisphere. Not only are the company’s production costs enviably low, but Kore is also blessed with having the shortest shipping route to the giant Brazilian market and the fast-growing African market. All the pieces are now almost in place to allow Kore to commence a dramatic growth trajectory.

As we mentioned earlier on, the potash price curve is starting to look like the Bitcoin chart. When Kore completed the DFS in early 2019, the potash price CFR Brazil was around US$360/t. With the start of the Covid-19 pandemic, this fell to US$250, but is c.US$820 as we write. Meanwhile, the potash price in SE Asia was US$600 plus and FOB Vancouver US$700 plus. The feeling is that the potash price will remain strong over the long-term and sit within a band. The potash market is currently controlled by a handful of large companies that have temporarily lost control of the price but will be making moves to regain control. So, the US$800/t price might not be sustainable, but moving ahead it looks as though it is going to be significantly higher than it has been in the past.

It has to be pointed out that Kore’s dramatic opportunity is gaining momentum against a background of rising potash demand as the world needs to grow 50% more food by 2050. It has to be highlighted here that arable land per person is sharply declining and farmers are increasingly using more fertiliser to feed an anticipated population of 9 billion people by 2050. Actually, it is worse than this because as global temperatures rise, crop yields drop. This means more intensive farming is required which calls for a higher use of fertiliser.

In May 2021, we updated our analysis on Kore Potash with a conservative price target of 11.2p and a Conviction Buy stance when the stock was trading at 1.175p. Now with the shares standing at 0.825p, we are more than happy to reiterate our view.

RISK WARNING & DISCLAIMER

Kore Potash (KP2) is a research client of Align Research. Align Research holds a position in Kore Potash. Full details of our Company & Personal Account Dealing Policy can be found on our website http://www.alignresearch.co.uk/legal/

This is a marketing communication and cannot be considered independent research nor is it subject to any prohibition on dealing ahead of its dissemination. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk

This financial promotion has been approved by Align Research Limited