Mayan Energy – Align update

By Dr Michael Green

The latest update from Mayan Energy last week concerning its rising oil production was unequivocal good news for investors. The RNS seems to suggest that the 300 – 500 bopd production target is now firmly in sight. In addition, we provide some color on the valuation of Deloro Energy in anticipation of a capital raising within that entity as it moves towards the 1000 bopd production trigger.

The board of Mayan was able to announce that the Gilbreath #15 well at Forest Hill Field had come on production with 51 barrels of crude oil in the first twenty-four hours. Importantly, this level of production is ahead of the company applying any of its proprietary production enhancement techniques which we expect will boost these initial rates. Mayan plans to produce Gilbreach #15 for a couple of weeks to establish baseline production before attempting to further stimulate the well. The Gilbreath #15 was the fourth in an eight well programme, where the necessary permits have been granted to complete and produce from the first six well. Permits for the remaining two in this field are expected next week. This eight well programme at Forest Hill Field is targeting 35-50 bopd per well.

This news follows the announcement concerning the initiation of production at two other wells earlier on in the week. Production was initiated at Gilbreath #19 and Forest Hill Field (Mayan 70% WI, 52.5% NRI) and the Morris #1 well in Stockdale Field (Mayan 60% WI, 45% NRI). Mayan was also able to report the successful workover of the Collins well in Forest Hill Field. Gilbreath #19 was brought on line with 55 barrels of oil produced during the initial 254 hours and rates since have not disappointed whilst at the Morris #1 well, this was put on production at a rate of 24-26 bopd from the Upper Anacacho and has continued to consistently produce at this rate.

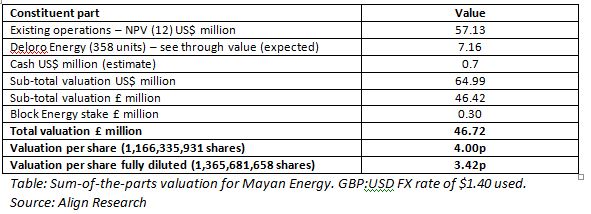

As part of our analysis on Mayan Energy we have run the numbers of Deloro LLC in recent days and have accordingly updated our SOTP’s valuation.

Deloro of course holds a 49% interest in the Asphalt Ridge oil sands project. We have determined a Net Present Value using a conservative 12% discount rate to a current derived value for the project and which comes out US$355.34 million. We make the point that we have also been highly conservative in this see through analysis in employing a flat WTI oil price of UIS$60 per barrel even though management have stated that they in fact anticipate obtaining a premium to WTI and the average so far this year has been in excess of $60 a barrel. Deloro’s 49% interest thus equates to US$174.12 million, and which we additionally risk by a further 25% to account for the risks associated in moving from 1,000bopd to a far larger name plate capacity. The resultant value is thus US$130.59m.

In revisiting the value in Mayan Energy following this valuation we are expecting Deloro to raise circa US$7.5 million from new investors in the near term. Management are thus expecting a valuation on this entity in the range of $35-50m. Currently there are 2,030 units in issue in Deloro and taking the expected weighted average mid-point in this raise (likely in 2 tranches) produces a unit valuation approaching $20,000. This suggests that Mayan’s holding of 358 units at this still early development stage (and if the raise is successful, validating the value by third party investors) will be valued at circa $7m at this stage (a four-fold uplift). Considering that the company paid $4,300 per unit only 4 months ago this would illustrate two things. Firstly, what a cracking deal the Deloro acquisition and Asphalt Ridge project is (contrary to misinformed or biased other analysts/commentators postulations on this) and secondly, that the continued speculation of a capital raise within Mayan in the near term os completely ill-founded and without a fundamental base.

Incorporating the expected see through valuation of Deloro reveals that approx. 0.43p of the current stock price is underpinned by this stake alone. Valuing circa 300-500 Bopd at a rump £3.5m illustrates starkly just how the market continues to apply, in our opinion, a completely wrong valuation on the stock. As management moves further towards the key 500 bopd production level and, assuming Deloro receives the third party valuation validation at the $35-50m level, we expect the market will finally re-rate the stock towards our near term price target of 2.1p.

At the current price of 0.68p we thus remain highly positive as evidenced by our increased holding in recent weeks and reiterate our Conviction Buy stance.

DISCLOSURE & RISK WARNING

A Director of Align Research Ltd & the Company hold positions in Mayan Energy and are bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.