Metro Bank – following departure of CEO all eyes now on Lloyds & other mooted bidders

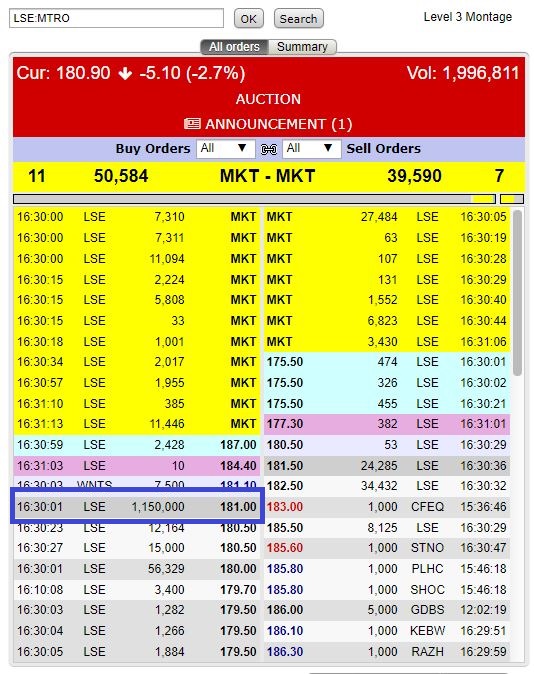

News at the close of play (and, interestingly or coincidentally, a size bidder of over 1m shares in the auction – see screenshot below and perhaps one for the FCA?) from Metro Bank relaying the departure at the years end of CEO Craig Donaldson looks to us as the final clearing of the top guard ahead of a sale of the bank.

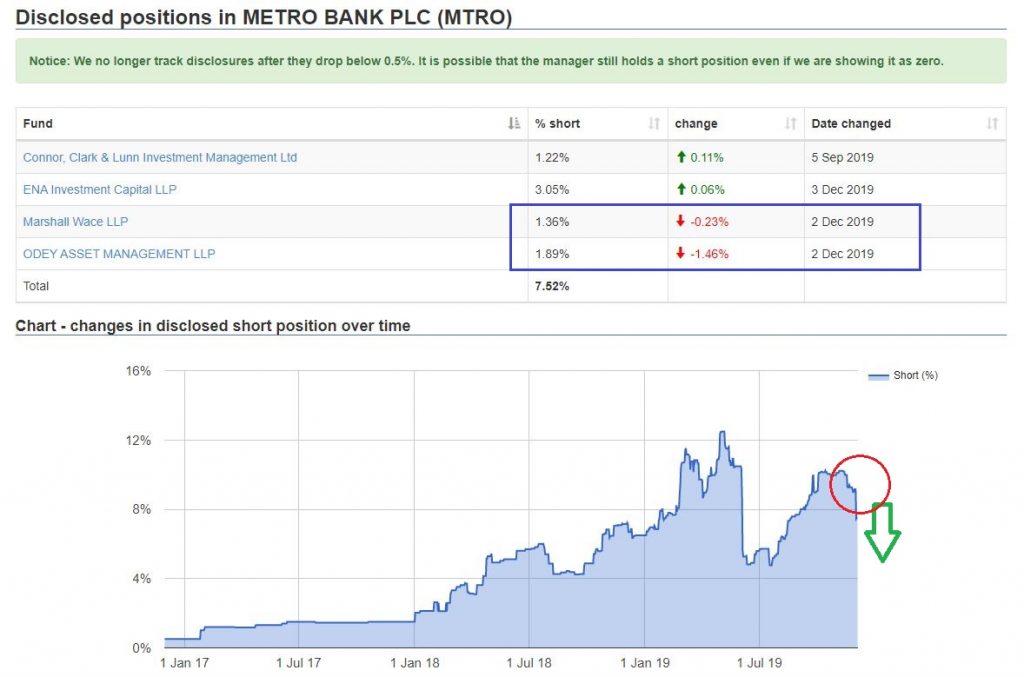

With founder and former Chairman Vernon Hill departing a couple of months ago and now Donaldson, our experience of such top brass departures from a major Plc is usually a precursor to a takeover. There is a material amount of credence to this view too with stories again emanating this evening of Lloyds Bank interest aswell as Virgin and CYBG and Vernon Hill supposedly lining up a pop at the bank too. With the short position in the stock decreasing in recent weeks with Odey Asset Management in the vanguard (see below) aswell as the arrival of a few new size holders of the stock on the register including banking specialist and Colombian billionaire Glinksi Bacal there has been decent turnover in the stock in recent weeks with the transfer from the non believers to those who see the real value and opportunity here. There has even been talk of Elliot Advisers the activist investors looking to get involved. In short, the status quo that has pressed the stock back down to less than 30% of TANGIBLE book value is likely to change imminently

We have noticed in recent days that at the close of play the volume on the day has picked up materially with the price firming aswell as size buyers in the opening and closing auctions that we have highlighted on our twitter feed. Sadly, the City is not a level playing field and the keeping a lid on inside info is more a pipe dream than reality. We suspect that this trading activity is linked to today’s news and that the shorts realise that RNS risk rises by the day re either a confirmed bid or resolution of the FCA investigation in the loans misclassification earlier this year.

Even the arch bears at Goodbody stockbrokers have realised in the last week that being short/negative here in the face of such latent value is fraught with risk. We are long in the mid 200’s and in the last 3 weeks have had daily egg put on our face ref advocating the bull tack. However, the management sweep, oversold status, shorts closing, massive discount to book, takeover rumours (none of which have been denied) and trading activity as highlighted here in the last few days leads us to believe that the long awaited re-rate is now upon us. Buy.

RISK WARNING & DISCLAIMER

Align Research & a director of Align Research own shares in Metro Bank and are bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited