Tekcapital Update – new CEO for investee company and shares now trade at large discount to NAV

By Richard Gill, CFA

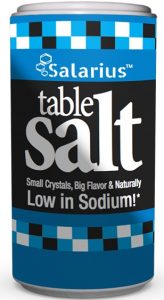

UK intellectual property group Tekcapital (TEK) has announced that investee company Salarius Limited has hired Victor H. Manzanilla as its CEO as part of its drive to build a global low-sodium salt brand. Manzanilla has significant business management experience, having previously served as Marketing Director for Office Depot and holding several positions at Procter & Gamble including Home Care Marketing Innovation Manager and Brand Manager for Global New Business Development for Febreze.

Along with the appointment, Manzanilla has purchased a 2.5% stake in Salarius through his consulting firm VHM Global Research for $50,000, with Tekcapital owning the remaining 97.5%. We note that this implies a valuation for the business of $2 million, compared to a balance sheet valuation of just $15,128 as at 30th November 2017.

Victor H. Manzanilla

Salarius is the developer and producer of Microsalt, a low-sodium salt product which has the potential to enable the commercialisation of a 1:1 replacement for regular salt in a variety of applications including table top, dry snacks such as chips and crisps, popcorn, cereals, and other dry surface applications that have salt in spice mixes. The Salarius product has up to c.67% less sodium by weight than standard table salt due to its smaller size, claiming to be the world’s smallest salt crystal. The product meets a growing need for the reduction of sodium in salt containing products, driven by negative health effects that excess sodium consumption can cause. Salarius is currently looking to out license its patented product while exploring the potential launch of a healthier snack food brand.

This is a large market to be involved in, with a recent report from analysts at Future Market Insights titled, “Sodium Reduction Ingredient Market: Global Industry Analysis and Opportunity Assessment, 2015 – 2025”, suggesting that the global sodium reduction ingredient market will grow at a CAGR of 11.7% during the forecast period to a vlaue of $1.758 billion. The snacks segment (which Salarius is targetting) is estimated to account for 26.9% of the global sodium reduction ingredient market and to grow at a CAGR of 11% over the forecast period.

Shares in Tekcapital currently trade at 10.5p, to capitalise the company at £4.48 million. For the year to 30th November 2017 net assets were up 240% to $10,675,961, with NAV per share up from 9 cents to 25 cents. At current exchange rates that means historic NAV is 19.05p per share. So with Tekcapital currently trading at a discount of 45% discount to NAV we see an excellent buying opportunity at current levels.

In addition, we note that c.82% of Tekcapital’s current portfolio value (as at 30th November 2017) was derived from one investment – the augmented reality glasses developer, Lucyd. The remaining value comes from eight other portfolio companies, all of which apart from Belluscura are conservatively valued at cost of the acquired intellectual property plus associated expenses. Therefore, an uplift in the valuation of any one additional portfolio company, driven by a fundraising or other value event, could have a significant impact on the balance sheet and increase NAV further.

We retain our stance of Conviction Buy.

DISCLOSURE & RISK WARNING

Tekcapital is a research client of Align Research.

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited