US Generic pharma plays – Teva, Endo & Valeant – an abject lesson in capitulation

By Richard Jennings

Everybody dreams of buying a stock at the low and selling at the high. When looking at a historic chart this always seems so simple in hindsight. Reality is somewhat different. Indeed, many stock commentators will tell you that it is foolish to try and pick a bottom (“brown fingers and all that!”) and that on the upside you should trail a stop. Problem with both these approaches is that you (a) on the “bottom” front miss most likely a big proportion of the gains to be had in a particular stock in waiting for the uptrend to be confirmed and (b) with the trailing stop, given the increasing prevalence of so called “algos” operating in the markets these days you will almost certainly be shaken out.

To us, the key to protecting downside is to take a leaf out of the sage of Omaha’s book, namely his comment “price is what you pay, value is what you get”. With collectively on our analyst team near 100 years of experience in the markets, we have some experience of spotting bottoms, and in particular capitulation. Followers of Align know that we veritably “eat our own cooking” and are not afraid of making “ballsy” contrarian calls. With this in mind we are calling the point of capitulation in the US generic pharma plays, namely TEVA Pharma, Endo Pharma & Valeant Pharma.

To make this call looking at the stock prices today (down between near 10 & 20%) would have many rub their eyes and question our sanity. Our response is that the self same stance could have been applied to us here when we called the floor on the commodity cycle at the beginning of 2016 almost to the day. The only difference is the sector is different and indeed, we believe, the value seen in these 3 stocks is even more compelling than was evident in our brave call to buy the commodity stocks in Jan 2016. The same eye rubbing most likely was applied to the case with our call to buy the spreadbet firms per here approx 12 months ago and also per our call on Genel here. In short, we know a thing or two about stock capitulation and the common theme is glaring value set against seeming incessant price destruction that shakes the faith of the most resolute bulls.

We have written indepth about Valeant here and here and just this week about Endo Pharma here – right ahead of a near 20% rally. So far it seems we are wrong on Valeant but as ever we would argue that patience is key. Put simply, Valeant looks to be trading on less than 3 times earnings, Endo less than, incredibly 2 times and TEVA, post the results today, also less than 3 times (note these are GAAP adjusted). By any measure for billion dollar companies this is frankly unprecedented. Such is the distorted basis of the markets today that you have tech giants like Amazon selling on PE’s in the triple digits and other so called FAANG stocks on eye watering multiples and yet we have these companies whose products are not going away selling for free cash flow yields (even with all the debt fears and post interest payments) of almost 60% in Endo’s case on a pro forma basis.

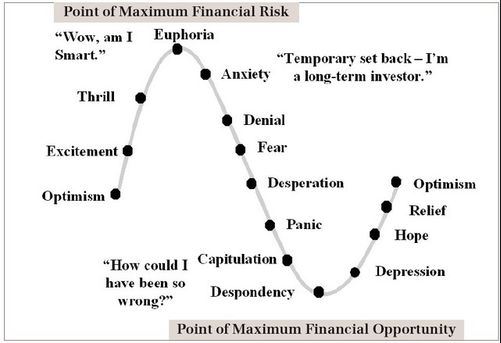

Below is the classic investor sentiment chart.

The characteristics we see in this sector today are extreme negative sentiment, analyst’s throwing in the towel, capitulation by investors, massive volume (just look at TEVA’s volume today and ENDO this last week where 30% of the full share count has turned over), all news seemingly bad news and oversold statuses that are as extreme as any seen in my career. Marrying this background against the current multiples as detailed in our links above – market caps around book value, price to sales the lowest they have ever been etc etc then it is remiss on our parts as value biased investors to (a) not invest on our own account (which we have) and (b) not bring this to our readers attention.

We thus believe we are at the “capitulation/despondency” stage in the sentiment cycle. Indeed, given earnings guidance from TEVA today, re-iteration by ENDO on Monday this week and in Valeant’s case, the continued pay down of debt, we are not sure how much more pain the market can inflict on these stocks – push them to prices where they sell at 1 times earnings and FCF yields over 60,70%? That would be something to witness that’s for sure…

To conclude, as is the way at Align, we are not afraid to go out on a limb and in the face of current perceived wisdom call the bottom in this sector but we caution that we will not, most likely, get the timing of this call to the day and so leverage must be tempered. Also, bottoms can be violent and are frequently scary and that, to us, the safest way to play this call is to buy all three companies. We sign off with the point that we would be amazed if private equity and the larger players like Novartis are not running their slide rules over potential acquisitions at these once in a generation cycle prices.

At $11.06 (Valeant), $11.26 (TEVA) & $5.95 (Endo) we are outright buyers.

DISCLOSURE & RISK WARNING

A Director of Align Research Ltd holds a personal position in Endo Pharmaceuticals, Valeant & TEVA Pharmaceuticals and is bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.